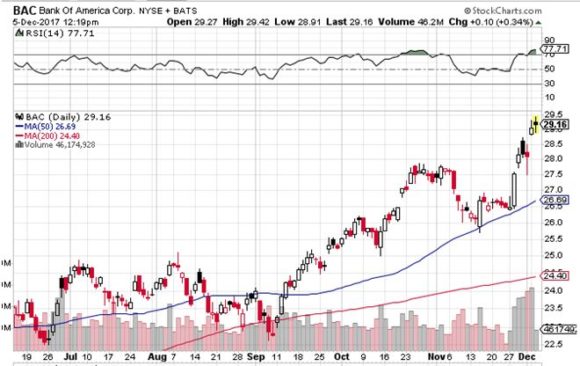

Bank of America is Breaking Out All Over

The prospect of the signing of a new tax bill has been like waving a red flag in front of a bull for Bank of America (BAC) shares.

What did the stock do? It rocketed by 11.32% in a week, along with the rest of the market, hitting $29.50. The shares appear to be taking a run at yet another new multi-year high.

The latest Q3 earnings report was stellar, beating expectations handily on both the top and the bottom lines. Expenses are in free-fall, and the company's cost of funds are plummeting, as lower cost deposit surge.

Analysts were blown away when they saw revenues of $22.079 billion, producing a fully diluted earnings per share of $0.47. The company returned billions to shareholders in the form of dividends and an aggressive share buyback program.

Loans we up 6% YOY. Net interest income rose to $11.33 billion.

Every major business segment showed big year on year improvements, including consumer and business banking. Global wealth and investment management knocked the cover off the ball.

Only bond trading was off 22%, given the miserable trading volumes and volatility seen this year, and is consistent with the results seen at other banks. That should rebound smartly in 2018 when the bond market finally collapses.

Deposits from mobile banking jumped. Average deposits are up 4%. Subterranean interest rates kept income there flat.

Given the bank's tremendous upside leverage, many analysts are now pegging the stock with a long term $50 handle.

There is another play here. (BAC) is highly geared to raising interest rates, which will enable them to lend money out at higher interest rates, increasing their spread. Think of it as long dated put option on the iShares Barclays 20+ Treasury Bond ETF (TLT).

That is not a bad position to have on board, given that we probably put in a multigenerational spike in bond prices in 2015.

Because of the bank's long and well-publicized problems with regulators dating back to before the 2008 financial crisis, (BAC) became toxic waste for many portfolio managers.

The end result of that has been to make the best-run banks in the industry and also the cheapest.

I have a feeling that I will be visiting the trough here often, and generously.

Time to Visit the ATM Again