Beating the Market With Demographics

Regular readers of this letter know that I rely on long term demographic trends to predict the direction of global financial markets. Let me approach this topic from a different angle, measuring the number of retirees a population must support versus the anticipated burden in 20 years, and its implications.

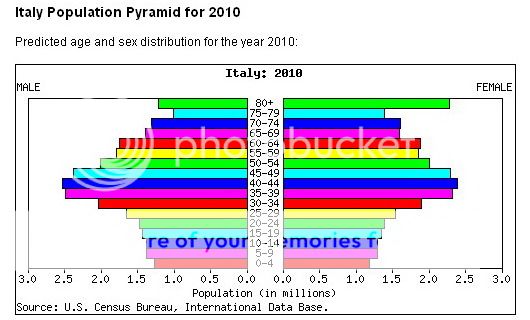

I start with the basket cases. Japan?s problems on this front are well known, with a retiree population of 30% today growing to 56% by 2030. That means every worker will be saddled with the costs of maintaining a senior citizen. Italy is worse, with the retiree load soaring from 30% to 60%. The rest of developed Europe is posting similar numbers. This is why you rarely hear me issuing ?BUY? recommendations on European companies, especially in the retail sector.

The US is stuck in the middle. Some 21% of our 310 million souls are retired today, and that is growing to 48% in 20 years. If you think our social security funding problems are bad now, just wait. On our current trajectory, bankruptcy is assured. Our saving grace is the large number of young immigrants who are continuously entering the country, legal and otherwise.

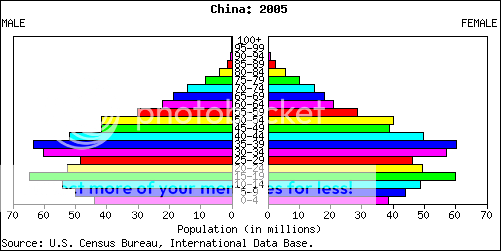

China is in a unique situation because of its ?one child? policy, which has reduced population growth by 400 million over the last 30 years. This guarantees that the country will undergoing a slow ?Japanization? that raises its ratio of retirees from 14% today to 42% by 2020. You can count on the Chinese economic miracle to hit a wall in about five years as a vast share of resources have to be redirected to supporting long lived senior citizens, who live on a healthier diet than your or I.

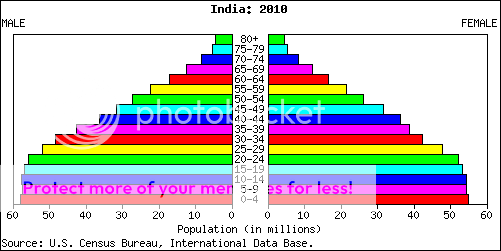

Other emerging markets are in a far healthier position. Only 8% of India?s 1.2 billion are retirees today, and that will only reach 20% in 20 years. Vietnam, Brazil, Mexico, Indonesia, and Malaysia are looking at the same numbers. One of the reasons that these countries don?t have to suffer the crushing expense of western style social safety nets is that they don?t need them. This is the basis for my constant table pounding that this is where you need to be overweighting your equity exposure.

I?ll be going into this subject in more depth next week, when I explain why demographics is so important. Until then your homework assignment is to read the excellent book, Boom, Bust, and Echo by David K. Foot, which you can buy by click here.

The bottom line message here is to be nice to your cleaning lady. She may be supporting you someday.

The ?Japanization? of China

They?re Not Making Italians Anymore

This is Where You Want to Put Your Money