Bitcoin Gets Dropkicked

The proof is in the pudding, and this is yet more evidence that it’s impossible to extinguish a forest fire with a bottle of water.

That’s the analogy I would like to trot out as another white-hot inflation number pierces the hearts of team transitory.

Inflation staying at 8.3% year over year is highly negative for the price of Bitcoin, cryptos, and risk assets in general.

Crypto was supposed to be the savior of inflation, but at the time of this writing, the price of Bitcoin (BTC) is down 6% this morning and underperforming the broader Nasdaq market by two times.

Everyone knew that inflation would still come in high, but the 8.3% is highly disappointing as the inflation naysayers had already started to spread the deflation narrative or that inflation has “peaked.”

We are currently stuck in a vicious feedback loop where elevated inflation cannot be contained with the current Central Bank policies.

A low Fed Funds rate of 2.5% cannot crack inflation over 8% and it’s killing the price of crypto and literally destroying the digital coin industry.

At these accommodative rates, the job market is holding up quite well which is what the Fed doesn’t want. Job seekers who lately have gotten cut from technology firms are reappearing with higher paying jobs and better benefits in different parts of the economy.

There is no hope for Bitcoin until the US Central Bank finally tames inflation.

The consumer price index (CPI) rose 8.3% in August from a year earlier, a mild slowdown from the 8.5% reported for July.

Gas prices came down, but other sectors offset those price decreases and caused overall inflation to remain elevated. Health insurance, for example, rose a blistering 24.3% year-over-year, the largest increase ever.

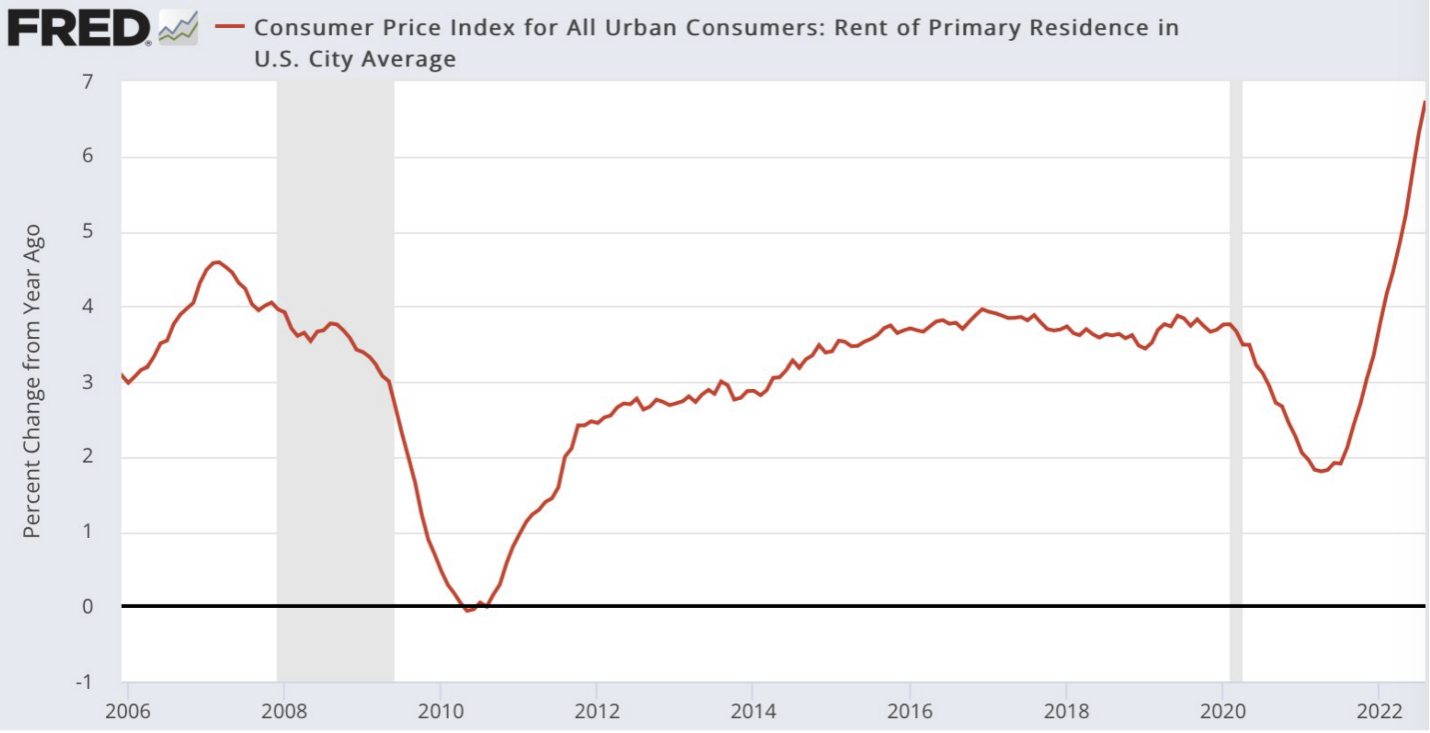

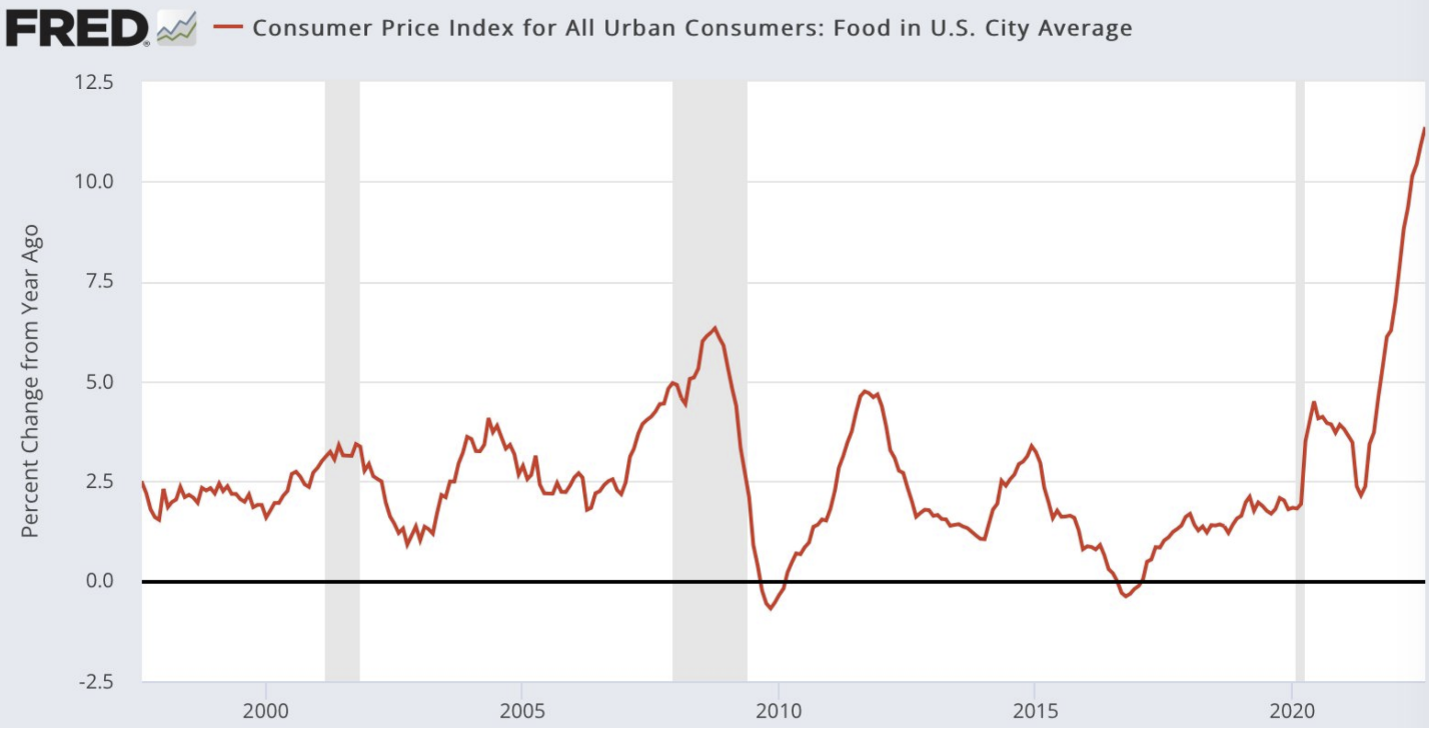

Food at home and rent prices were also one of the main drivers this month, up 13.5% and 15.8%, and services inflation rose above 6%.

The result of all this is that a Bitcoin reversal will be delayed as crypto investors wait for inflation to decrease.

I can’t imagine Bitcoin getting over the $25,000 per coin hump until there is more progress on the inflation front.

This is also negative for crypto infrastructure that is holding on for dear life until the next bull market comes.

Anything bullish in crypto has been effectively pushed back.

The inflation report means that US consumers will deal with a cost-of-living crisis longer than expected which will supersede any crisis in terms of what currency they want to store wealth in.

The larger risk is that the US Central Bank risks losing control of inflation completely as the negative feedback loop can accelerate to the downside which might force the Fed to raise rates to unprecedented levels.

It sure appears that this is morphing into a whack-a-mole phenomenon.

It’s clear that the Fed is being way too generous to equity holders by casually increasing rates at a pedestrian pace. If they lose control of inflation, Bitcoin could go to $10,000 per coin.

The fact is that the US Federal government is the biggest beneficiary of low-interest debt which is now about to touch $31 trillion.

The Fed is doing everything it can to not raise rates more than is needed because it makes servicing the debt and those interest payments too onerous.

The Fed will need to raise rates to keep the Federal government solvent if the risk of hyperinflation increases.

Ultimately, this new inflation report means that inflation will persist longer than expected which will cause the Fed to raise short-term rates faster and higher than expected.

Today was a sucker punch to Bitcoin – the digital is down and out for the time being.