Bitcoin Hoarders Aren't Selling

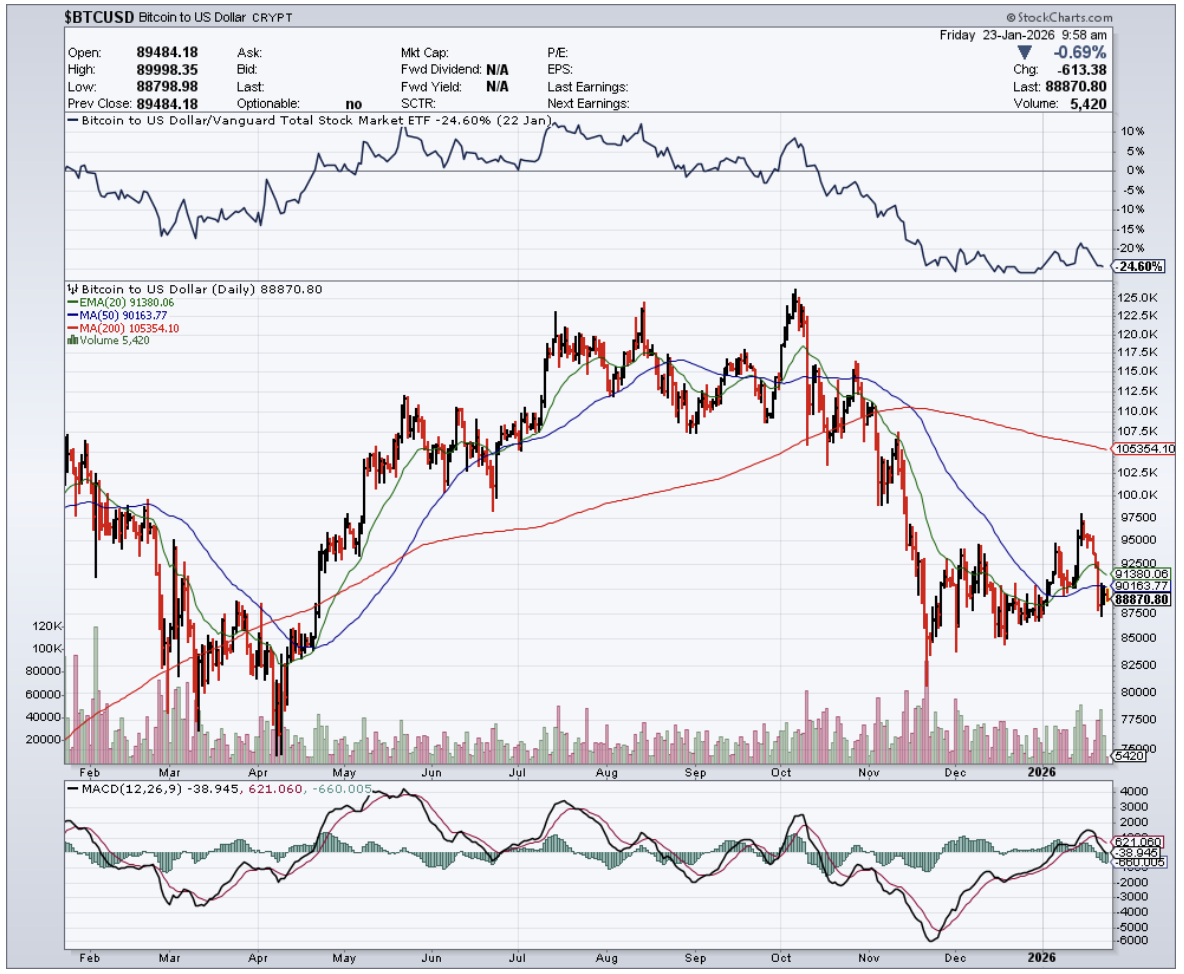

Bitcoin lately has been resting, and the good thing is, it hasn’t been overly choppy.

After reaching prior cycle highs, it retraced into a broad consolidation range that reflects digestion rather than exhaustion, and that is a sign of things to come.

We are well past the era of large-scale asset purchase programs, and many outsiders expected the transition away from ultra-loose monetary policy to be disorderly.

That has not been the case.

Orderly normalization matters for an inherently volatile asset like Bitcoin, and so far, that is largely what markets have experienced.

Inflation readings have established a clear upper bound relative to earlier peaks, and as subsequent data settled into a lower but still elevated range, Bitcoin’s long-term narrative remained intact rather than impaired.

As the price of Bitcoin has persistently maintained levels well above prior-cycle ranges, the talking heads and diva hedge fund managers have largely stopped questioning its legitimacy.

It’s about time.

That shift represents a meaningful validation milestone for the asset class.

At a broader level, the Federal Reserve remains constrained.

Each policy path carries trade-offs, and most of them are structurally favorable to scarce, non-sovereign assets. The primary risk remains a loss of confidence driven by uncontrolled inflation, which would destabilize the U.S. dollar itself.

Conversely, periods of renewed liquidity support or slower-than-expected tightening continue to reinforce Bitcoin’s role as a hedge against monetary debasement.

Inflation ultimately proved more persistent than initially described, and that persistence has gradually eroded confidence in central banks’ ability to fine-tune outcomes. That erosion continues to benefit Bitcoin’s positioning as a long-duration alternative asset.

Liquidity-driven moves in Bitcoin have increasingly followed a familiar pattern of anticipation followed by consolidation rather than violent reversals.

High inflation surprises that once would have caused panic selling now tend to reinforce Bitcoin’s perceived store-of-value characteristics over longer horizons.

Sometimes markets still need to take one step back to move two steps forward.

Risk-off reactions driven by currency strength and macro uncertainty continue to weigh on speculative assets in the short term, but those reactions have become more contained than in earlier cycles.

Doubts about inflation being temporary have long since faded, and the market has broadly accepted that a structural shift in the global economic backdrop is underway.

Another knock-on effect has been recurring concerns about stagnating growth paired with elevated inflation, a combination that complicates capital deployment across traditional assets.

That environment makes it psychologically harder for investors to commit aggressively to large alternative investments, including real estate, during periods of uncertainty.

This helps explain extended consolidation phases rather than decisive breakouts in either direction.

On a constructive note, the supply of bitcoin held on exchanges remains structurally lower than in prior cycles, suggesting a continued preference among investors to self-custody rather than keep coins readily available for sale.

That behavior aligns with a market in observation mode rather than distribution.

Long-term holders continue to represent a dominant share of total supply, and their reluctance to sell has become a defining feature of Bitcoin’s maturity.

Short-term consolidation phases have repeatedly given way to renewed trend moves once macro uncertainty clears or stabilizes.

At the household level, the case for holding Bitcoin has strengthened rather than weakened.

Living costs remain elevated across energy, housing, food, transportation, and other essentials, reinforcing awareness of currency debasement among everyday consumers.

Against that backdrop, Bitcoin continues to be viewed by many as a hedge against long-term monetary erosion rather than a short-term trading vehicle.

Interest-rate expectations now shift incrementally rather than violently, and markets have adapted to a world where higher rates do not automatically invalidate the Bitcoin thesis.

A measured approach to policy normalization has reduced the shock factor that once triggered sharp selloffs.

A move of this magnitude would have produced far deeper drawdowns in earlier years. Instead, Bitcoin has increasingly absorbed macro stress while maintaining structural support.

That resilience remains one of the strongest signals that Bitcoin has evolved beyond a purely speculative asset and into a durable component of the global financial landscape.