Everyone's celebrating the Bitcoin miners who signed long-term HPC leasing deals last year. TeraWulf (WULF) up 226%. Hut 8 (HUT) up 171%.

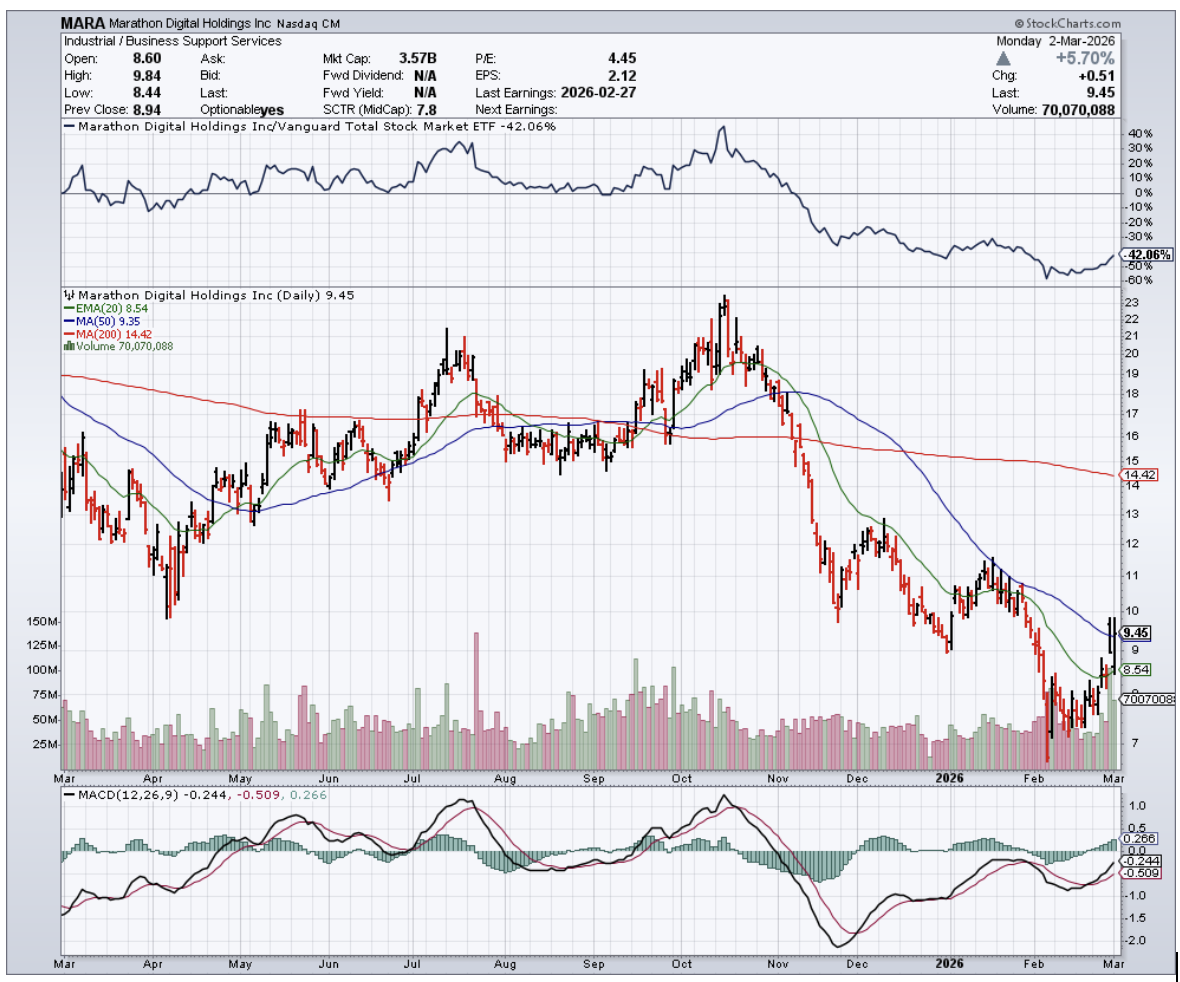

Meanwhile MARA (MARA) fell 53%. The narrative writes itself: MARA missed the boat. I've heard that story before. Usually, right before the boat comes back to pick someone up.

The story of 2025 in Bitcoin mining was simple enough.

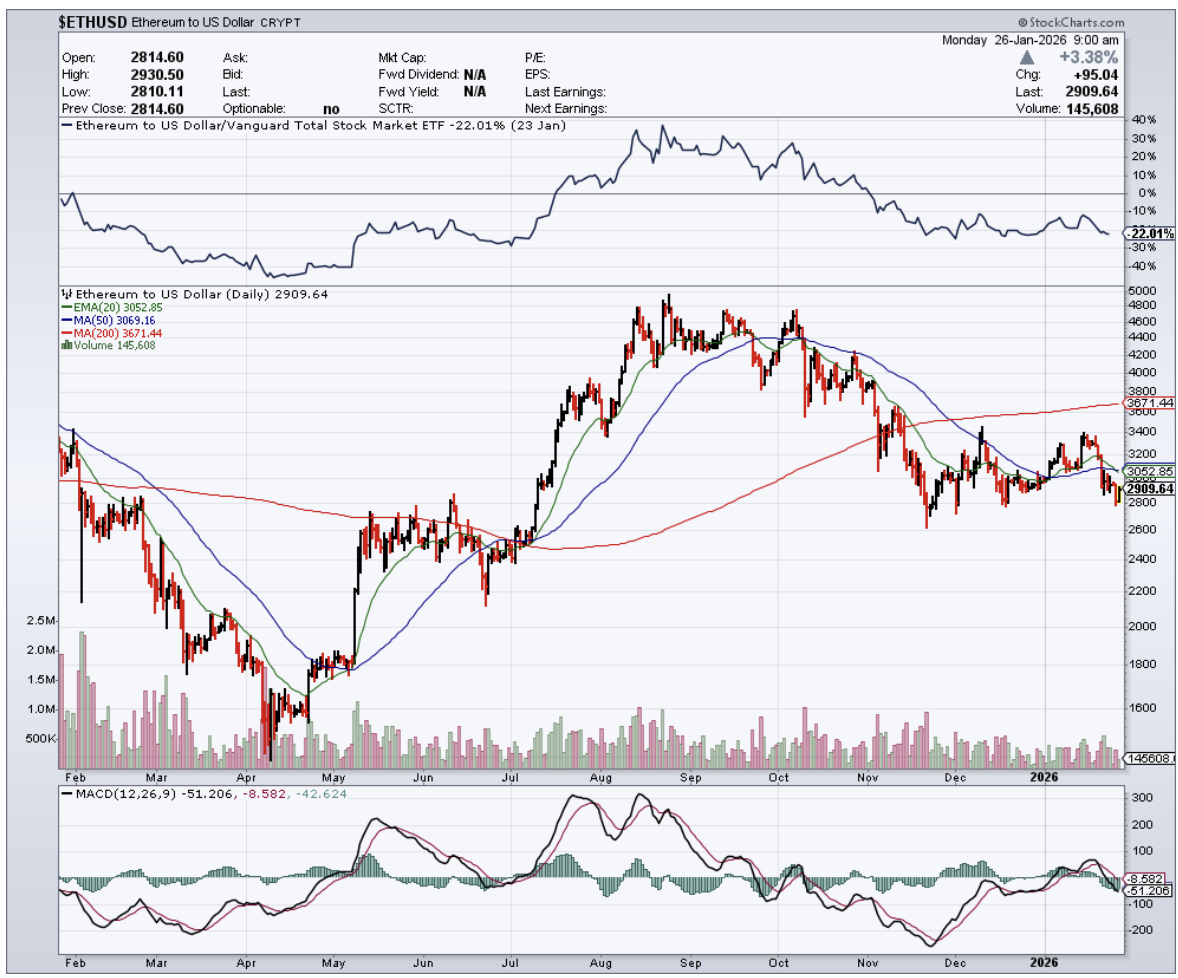

Companies like TeraWulf, Hut 8, Core Scientific (CORZ), and Cipher Digital (CIFR) looked at their warehouses full of computing infrastructure and made a pragmatic decision: the AI boom needed GPU capacity right now, and they had it.

So they leased it out - long-term contracts, predictable revenue, instant re-rating from the market. Fluidstack and CoreWeave (CRWV) got the compute they needed without waiting five years to build it themselves.

Everybody shook hands and went home happy. Everybody except MARA.

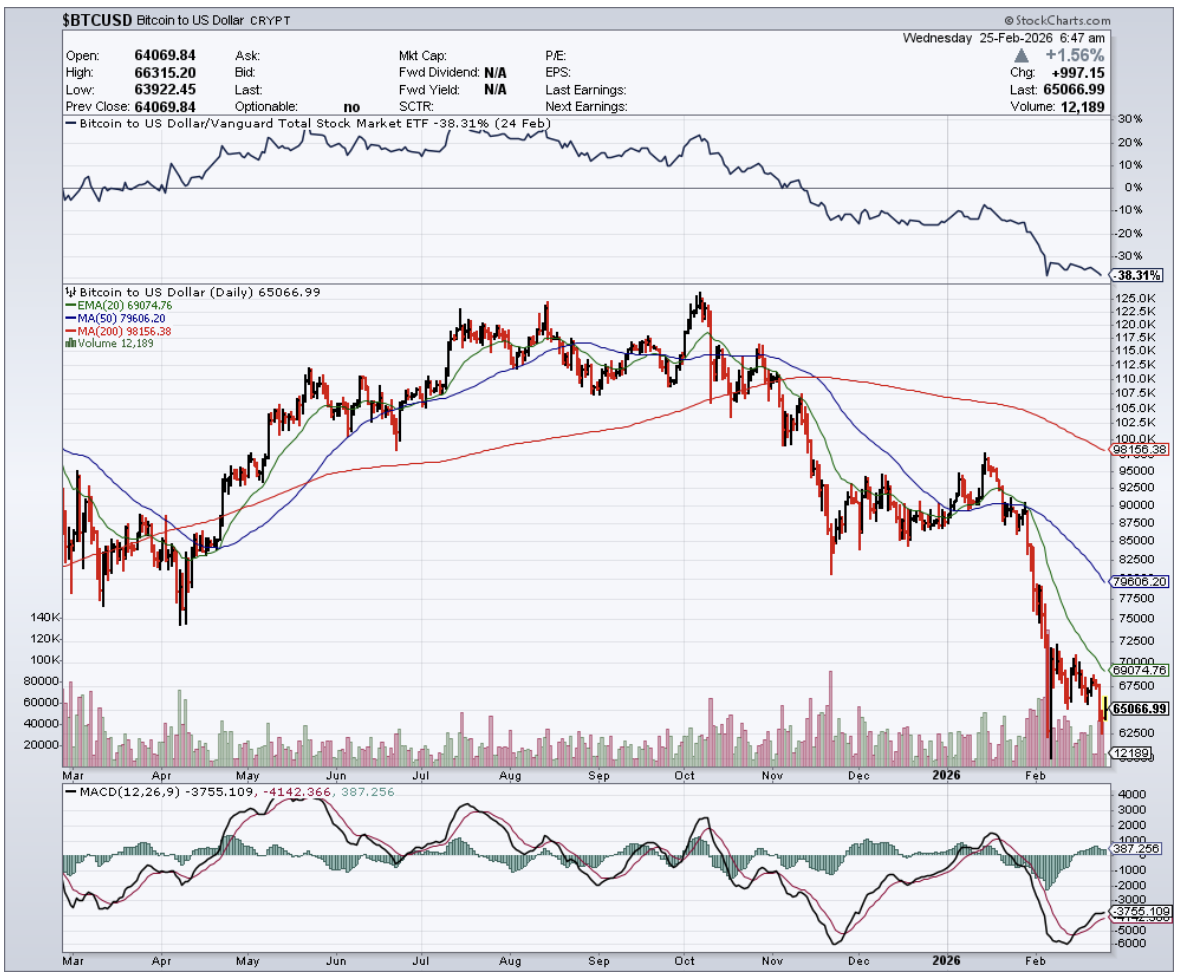

What the celebratory narrative skips over is that MARA's situation was never quite the same as its peers to begin with. While most miners sell the majority of Bitcoin they produce, MARA made a deliberate choice to accumulate.

They didn't just hold what they mined. Instead, they leveraged up and bought more, including a $100 million Bitcoin purchase in July 2024.

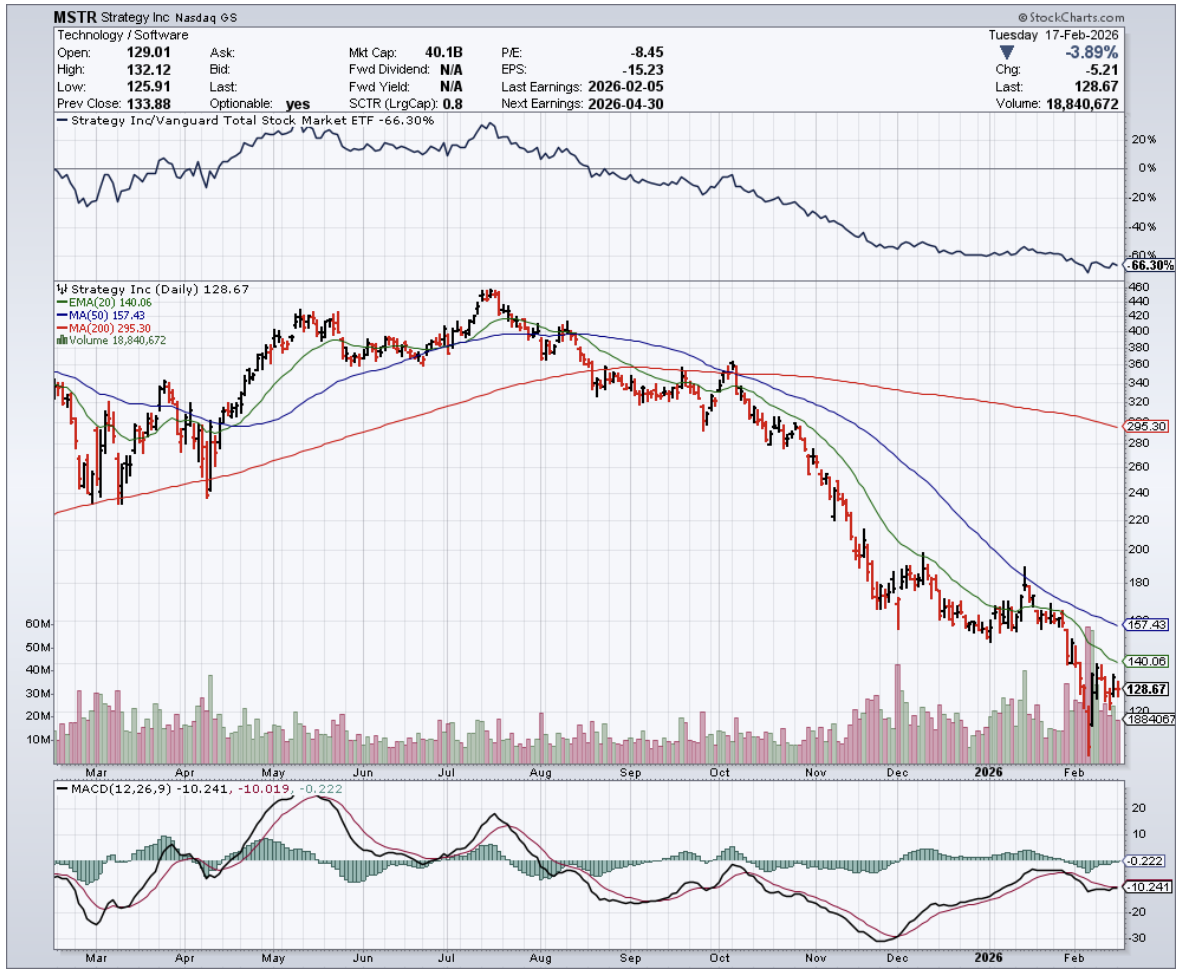

Today, they carry the second-largest Bitcoin treasury of any public company on earth. That's not a mining company that forgot to pivot. That's a company that made a different bet entirely, one far closer to Strategy Inc. (MSTR) than to TeraWulf.

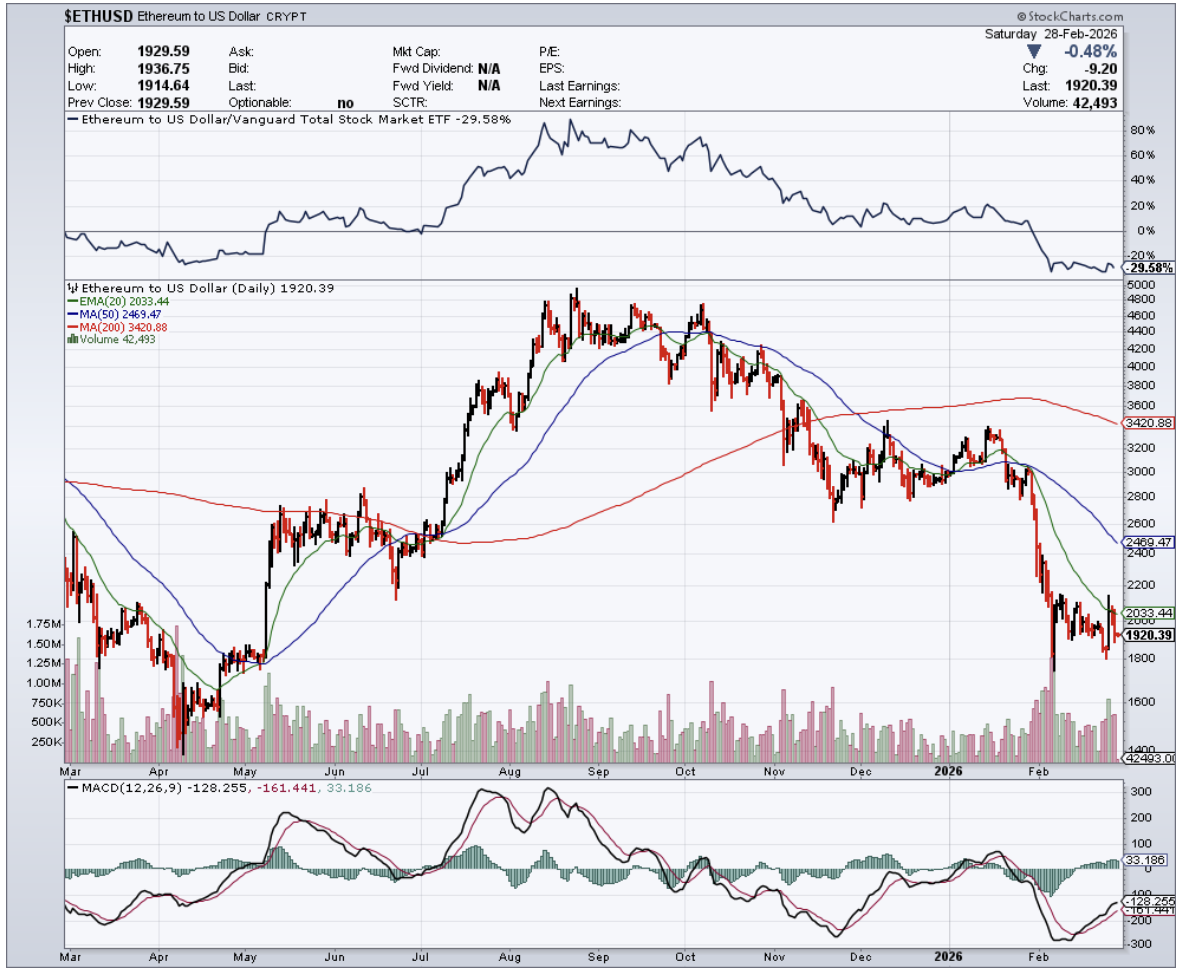

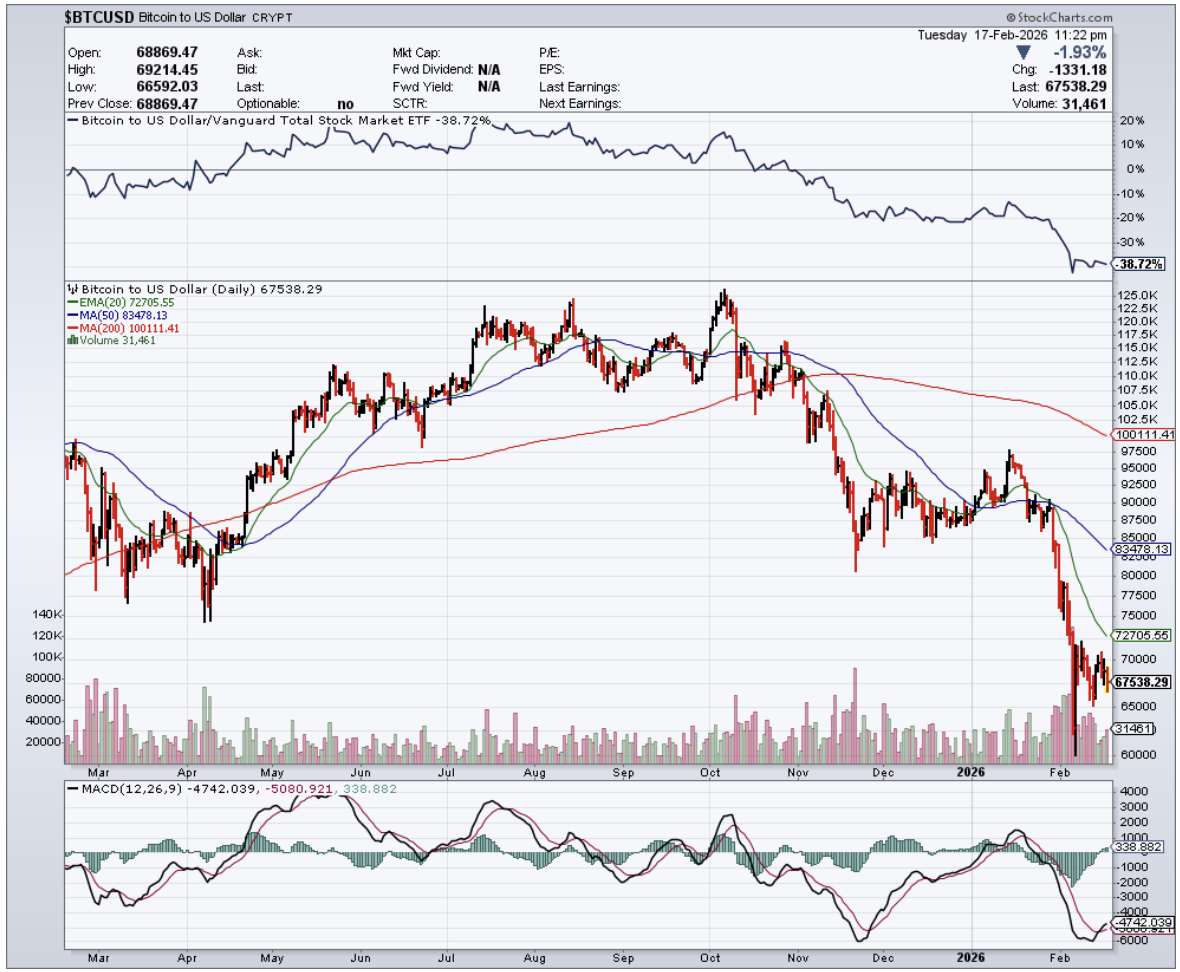

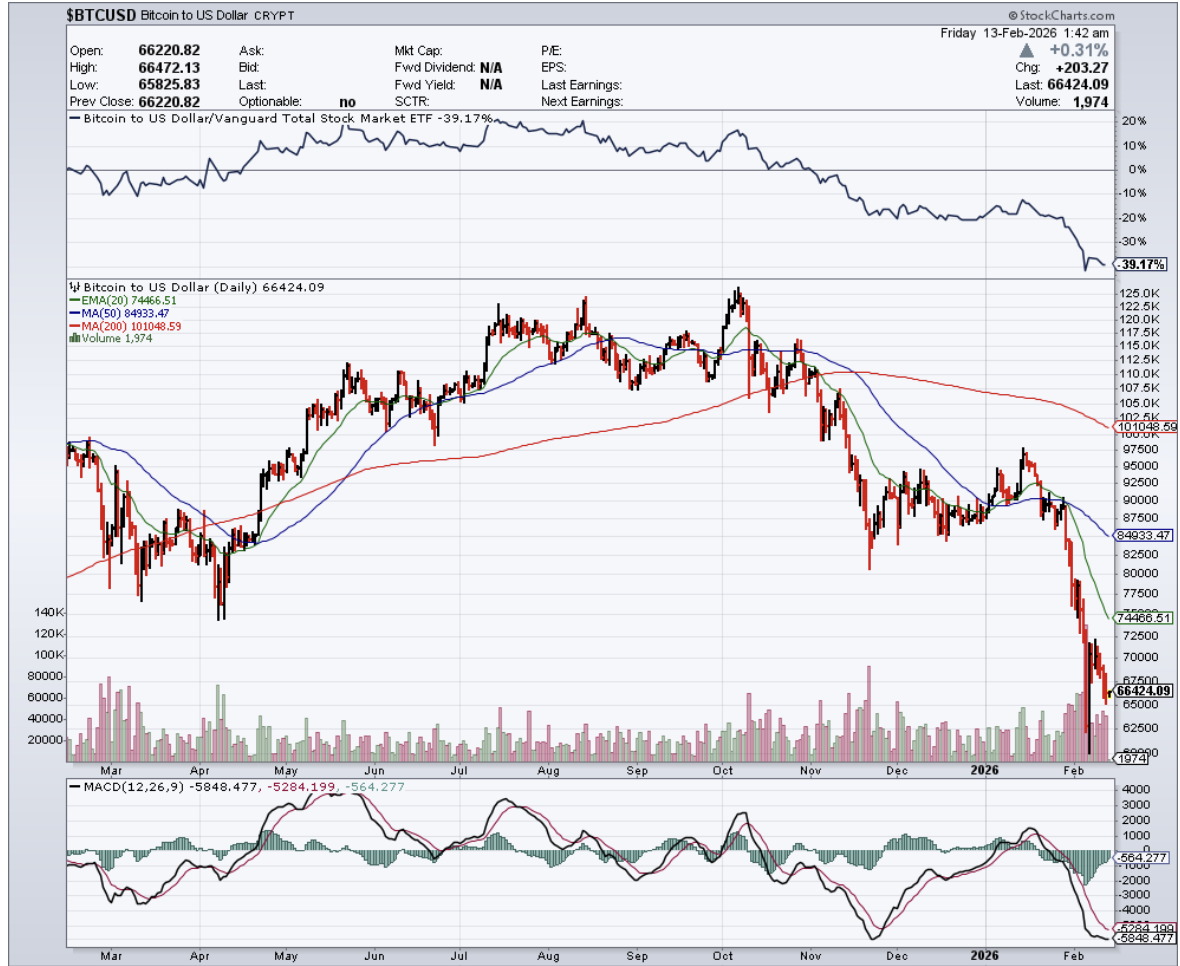

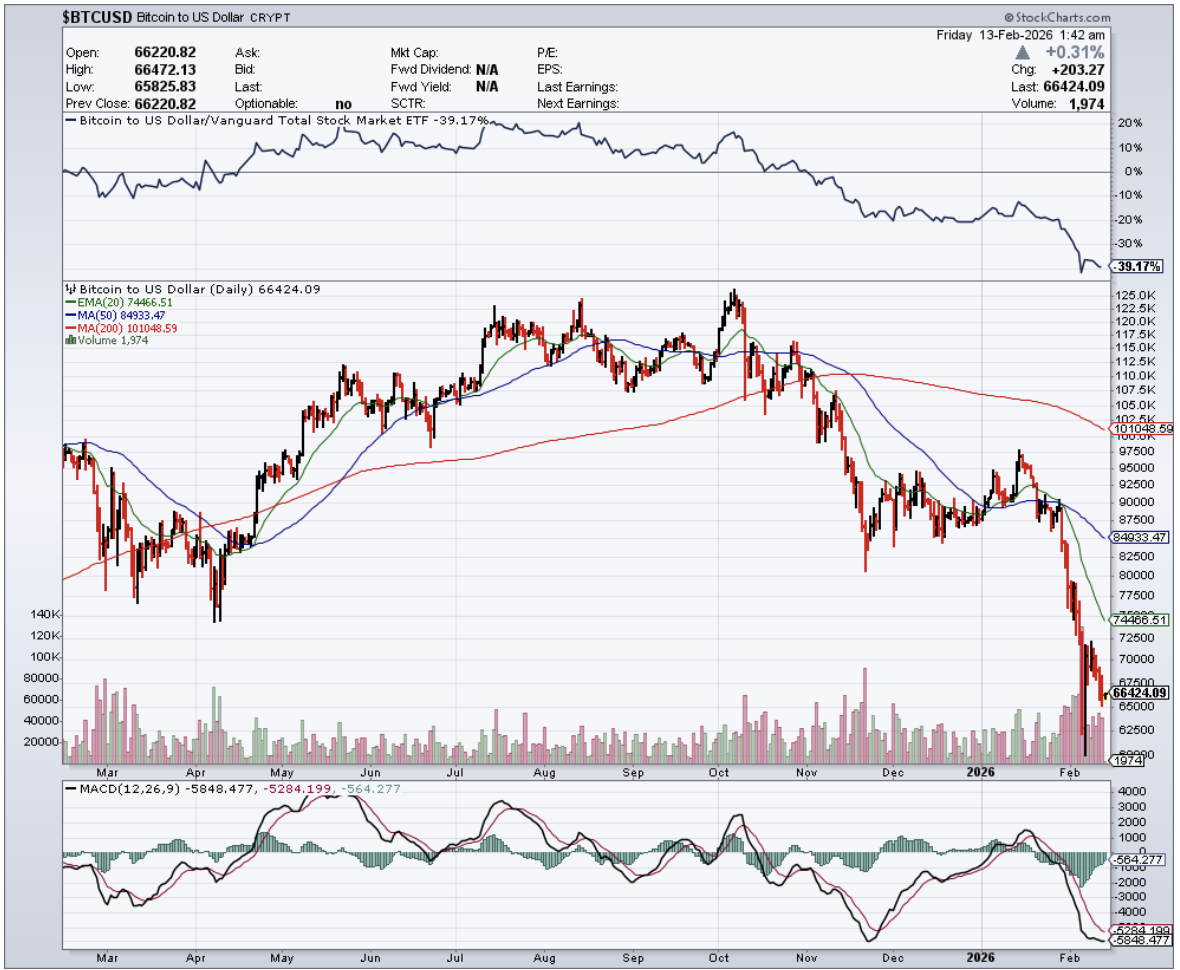

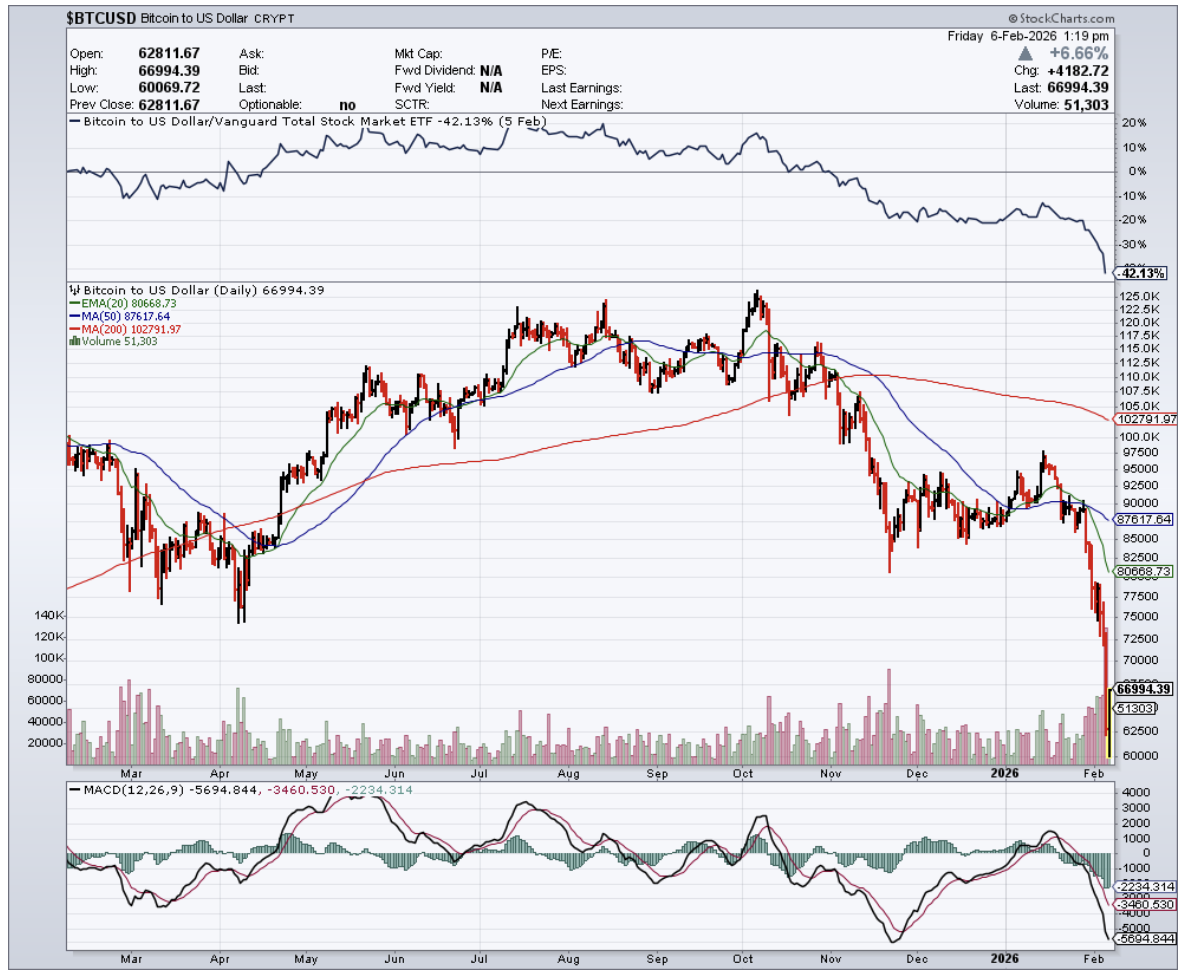

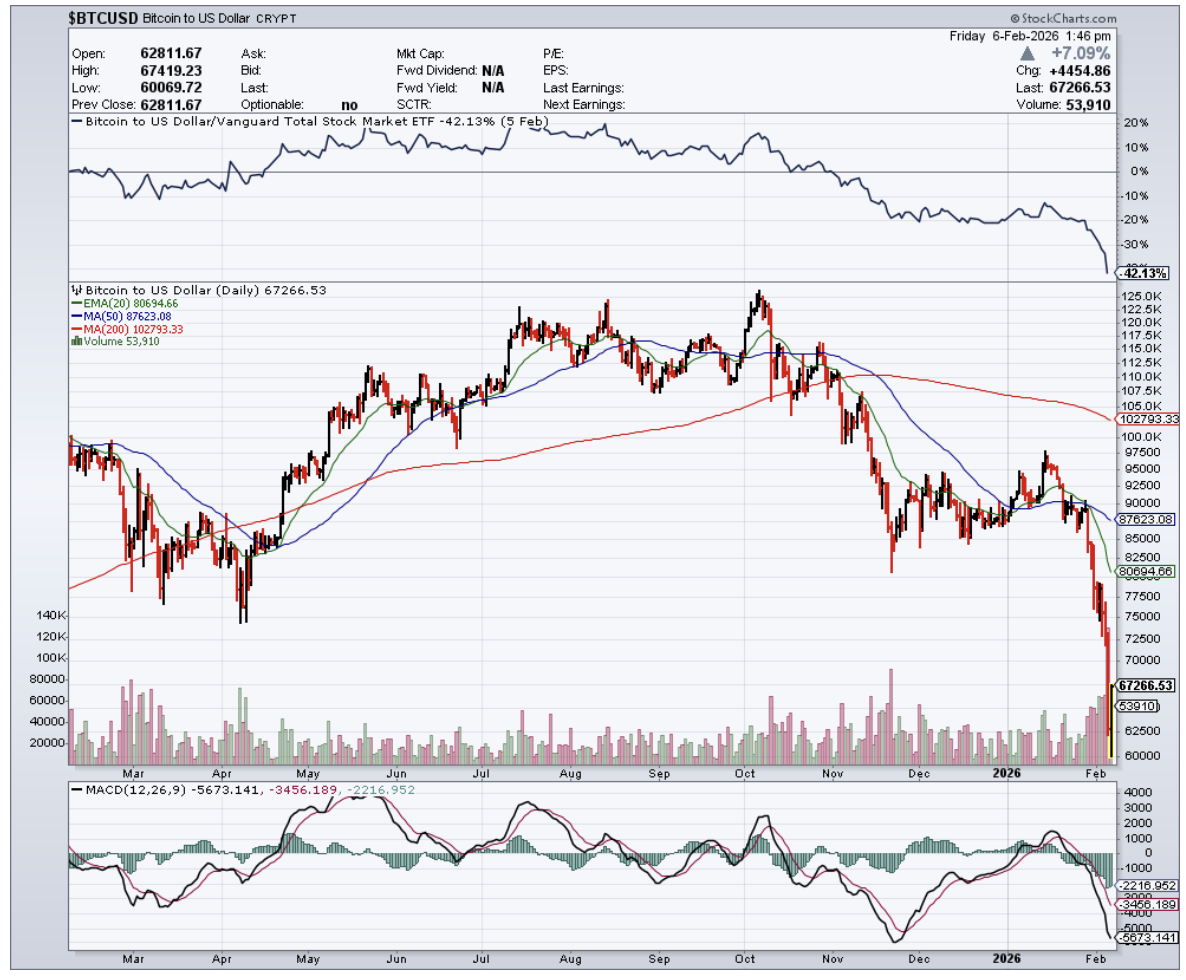

A leasing deal would have trimmed the bleeding in 2025, but it wouldn't have fixed the fundamental exposure. Bitcoin (BTC) fell nearly 30% from its highs, and MARA was always going to feel that more than anyone else.

So what MARA actually announced on their February earnings call deserves more careful reading than the market's knee-jerk 15% after-hours pop suggests.

First, they closed the acquisition of Exaion, a deal originally proposed in August 2025, which gives them HPC infrastructure with genuine international reach.

Second, and more significantly, they announced a partnership with Starwood Digital Ventures to develop, finance, and operate next-generation digital infrastructure targeting enterprise, hyperscale, and AI customers.

MARA brings the data center sites and cheap energy access. Starwood brings capital, operational expertise, and tenant relationships.

The structure is a joint venture where MARA can invest up to 50%, with an initial target of 1 gigawatt of capacity scaling to 2.5 gigawatts over time.

This is where the distinction from their peers actually matters.

TeraWulf and Hut 8 are locked in known revenues for known gigawatts over known time periods. Safe, sensible, and now fully priced in.

MARA is not doing that. They're positioning themselves as a cloud infrastructure provider, competing not with fellow miners but with CoreWeave and Nebius (NBIS), companies currently trading at revenue multiples that would make a Bitcoin miner blush. The execution risk is real. CoreWeave and Nebius are growing at a pace that is genuinely difficult to match, and they have head starts that don't shrink easily. But the upside math is completely different from a leasing arrangement, and management knows it.

The piece of this that doesn't get enough attention is MARA's energy strategy. Their CEO, Frederick Thiel, has been consistent on this point: control of low-cost energy is the real competitive moat in HPC, not the hardware. CoreWeave is building data centers wherever capacity exists right now, which is smart for near-term growth but tends to produce ugly cost structures over time. MARA is approaching it the other way — anchor the energy costs first, build around that foundation. Anyone who's spent time in the energy business recognizes this logic immediately. The companies that controlled cheap power in the fracking era didn't just survive the commodity cycles — they defined the economics for everyone else.

Quarterly revenues came in at $202 million, down 5.6% year over year, with GAAP losses of $4.52 per share driven almost entirely by marking their Bitcoin holdings to market. Neither number is the point. The point is whether MARA can execute a transition from leveraged Bitcoin accumulator to credible HPC infrastructure provider while Bitcoin works through what looks like another 6 to 12 months of pressure. That's the actual risk, and it's a serious one. The balance sheet remains heavily exposed. The Starwood partnership is promising but unproven. Competing with CoreWeave at scale is not something you pencil in as a given.

Own it for what it is: a high-octane option on two simultaneous recoveries — Bitcoin finding its floor and MARA's HPC ambitions gaining traction. Size accordingly. The potential return if both legs work is several hundred percent. The downside if neither does is most of your investment.

The boat, as it happens, is still at the dock. The question is whether you want a ticket.