One can’t help but be appalled to see the former driver of global growth China turn radically inward, preferring a deeply authoritarian economic model.

What they had in the Hu Jintao years between 2002 to 2012 was legendary and might not ever happen again.

Friends of mine who have managed to flee China all mention how it was easier to leave before 2020.

Good luck now navigating Chinese lockdowns.

Authorities have made it impossible to leave and they track everything including a digital yuan now.

China and its backward economy have a lot of problems, and the more problems that add up nudge the people to a crypto solution.

I am not saying that every Chinese person will invest in crypto, but for the wealthy ones that usually immigrate to Singapore or Hong Kong, the data backs up my thesis.

KPMG accounting firm has indicated a colossal interest in the crypto market from the wealthy elite of Singapore and Hong Kong.

In fact, a 2022-survey by KPMG found that 58 % of the 30 family-offices and high-net-worth individuals (AUM US$10 m–500 m) across Singapore/HK were already invested in digital assets and a further 34 % intended to allocate funds to bitcoin, stable-coins, ether, as well as DeFi opportunities.

Of those 58 % who already invested:

- 100 % held bitcoin,

- 87 % held ether,

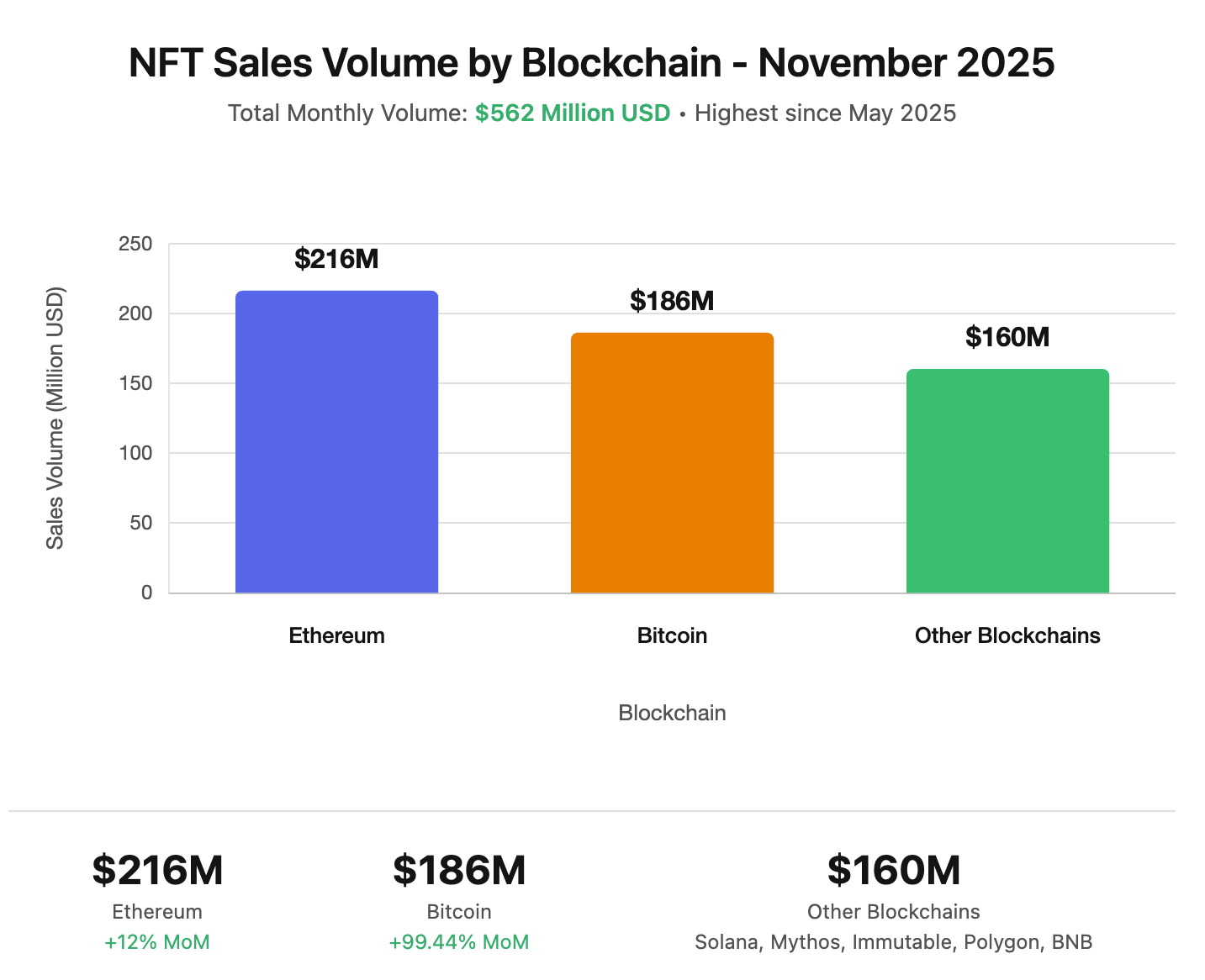

- 60 % bought NFTs/metaverse tokens,

- 47 % held DeFi tokens.

Beyond that, most already invested only allocated less than 5 % of their portfolio to the digital-asset class (reflecting caution around regulation/valuation).

But since 2022, things have evolved:

- In 2025, the global fintech investment in H1 reached US$44.7 billion across 2,216 deals.

- In Singapore, fintech (including cryptocurrency/digital assets) pulled in around US$1.04 billion in H1 2025.

- Meanwhile in China, the stance toward cryptocurrencies remains very hostile: crypto ownership, trading and DeFi operations in mainland China are being criminalised and enforcement has stepped up markedly in 2025.

- And the digital yuan (e-CNY) is being actively deployed: for example, by end Sept 2025, cumulative e-CNY transactions hit RMB 14.2 trillion (~US$2 trillion) and 225 million personal wallets were in circulation.

So: The good news is that there is a pathway that links rich Chinese to the future of crypto, but it’s largely contingent on whether crypto can get its act together or not.

China is ramping up its control over money supply by advancing the digital yuan that they can track and regulate with fine control.

This is really 1984 in its purest form.

As the crypto winter continues, there are indeed some silver linings.

However, crypto needs to be careful that it doesn’t turn into just another centralized version of what the Chinese are running away from.

Decentralization is hard to pull off in the long term as the government will want its cut.

Rome wasn’t built in one day.