An Underappreciated Stock with a Boatload of Cash

Warren Buffett is nothing but a dyed-in-the-wool type of investor. A key strategy in his success is to target companies with notably solid fundamental businesses but with shares trading at a bargain or at least a discount in relation to their intrinsic value.

Needless to say, this value-oriented tactic has worked well for roughly six decades, with Berkshire’s stock delivering total returns of 6,450% on its capital.

Taking a cue from the Oracle of Omaha’s playbook, let’s take a look at one of the cheapest biotechnology and healthcare stocks in Berkshire’s portfolio to date and see how it has been performing.

At a hair below eight times its forward earnings, Bristol Myers Squibb (BMY) comes out as Berkshire’s third-cheapest stock holding overall.

This pharmaceutical giant, which has a market capitalization of $144 billion, is the sixth-biggest in the list of what is informally called the “Big 8” US pharma firms.

However, BMY’s stock had fallen by -2% in the past 12 months after experiencing some genuine momentum in 2021 when it reached $69 in August. The share price fell to $54 in December. It has since recovered and is now at $65.

A primary reason for investors snubbing this pharmaceutical giant is the impending loss of market exclusivity of three of its best-selling treatments, Revlimid, Opdivo, and Eliquis.

Although it’s reasonable to be anxious over these patent expirations, BMY has developed a great plan to not simply offset the future decline in sales but also to sustain the momentum of its top line all the way until 2030.

Basically, BMY has lined up multiple new drug launches spaced in the following years, with a number of these candidates expected to become potential blockbusters.

Another key part of the company’s growth strategy is acquisitions.

One of the significant moves BMY executed in recent years is its whopping $74 billion acquisition of Celgene in 2019, which is expected to bolster its immunology and oncology sectors. This was immediately followed by a $13 billion buyout of MyoKardia in 2020, which would expand its cardiovascular roster.

Celgene's deal granted BMY a valuable collection of pipeline assets, which the company has been leveraging in preparation for the patent cliffs.

Aside from the added $15 billion in annual revenue stream from Revlimid, which BMY used to boost its cash flow and pay off some debts, the company also inherited Reblozyl.

Since the acquisition, Reblozyl has gained approval for beta-thalassemia and anemia patients.

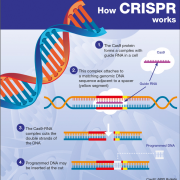

While this is not as groundbreaking as the gene therapies offered by CRISPR Therapeutics (CRSP), Vertex (VRTX), and even bluebird bio (BLUE), this treatment can still reach peak sales of $2 to $4 billion annually.

Another Celgene candidate poised to become an additional revenue stream for BMY is Inrebic, a JAK2 inhibitor created for myelofibrosis and polycythemia vera. This is projected to rake in $400 million in peak sales.

Zeposia, a treatment for autoimmune conditions, has already gained approval for multiple sclerosis and is queued for clinical trials for Crohn’s disease and ulcerative colitis.

If it receives the green light for all three, this is another $3 billion opportunity for BMY.

The inherited assets from Celgene are Breyanzi, a CAR-T therapy approved for large B-cell lymphoma, and Abecma, which is also an approved treatment for multiple myeloma.

These last two treatments are potential blockbusters as well.

Breyanzi’s list price is $410,000, with the therapy estimated to reach $3 billion in peak sales. Meanwhile, Abecma is listed at $491,500 and is projected to peak at $1 billion.

By 2029, BMY expects to develop new revenue streams worth $25 billion from its current portfolio and growing assets.

Looking at the above assets, BMY’s strategy becomes evident.

When BMY acquired Celgene for an exorbitant amount three years ago, the bigger company’s management team showed just how prepared they were to take the hit in the form of substantial debts in exchange for massive steps forward.

Adding to its expansion efforts, BMY has recently completed a deal with Century Therapeutics.

This marks BMY’s major foray into the promising cell therapy space.

While BMY has not concentrated on this sector before, it already has promising candidates in the form of its Celgene assets, Breyanzi and Abecma.

So far, Century and BMY have agreed to develop four different CAR-T cancer therapies on top of expanding the indications for Breyanzi and Abecma.

At the moment, the big pharma names focusing on this sector include Gilead Sciences (GILD) and Novartis (NVS).

This means BMY has a fighting chance to dominate in this market following its strategic collaboration with Century.

If all goes according to plan, BMY’s work with this cell therapy company might even turn out to be as lucrative as its deal with Celgene acquisition.

Overall, BMY has proven itself to be a reliable money-making titan in the biotechnology and healthcare industry.

BMY is a growth machine that consistently comes up with ingenious plans to grow over the years.

From $20.8 billion in 2017, its profits skyrocketed to an impressive $46.4 billion in 2021, indicating a remarkable 123% increase.

Moreover, the company anticipates that its free cash flow will surpass $50 billion by 2024, implying that it’s not worried over the impending loss of patent exclusivities and flexing its ability to generate a boatload of cash to complete even more collaborations and acquisitions.