Buy Amazon on the Dip

The one sound bite that really jumped out at me on Amazon’s earnings calls that sums up the zeitgeist right now in the tech sector is when CEO Andy Jassy said “customers are looking for ways to save money however they can right now.”

Savings money is foreign to growth tech, but investors should get used to the new Silicon Valley.

When the success of a tech firm is utterly reliant on mass volume of sales, this isn’t the type of trend that will drive earnings higher in the future.

I am not blaming Amazon for customers pinching pennies.

It has more to do with the generally macro malaise that US consumers are facing with the explosive price rises of the last few years.

There is no point to rehash about inflation, but the net effect is that there is less opportunity for these ecommerce companies to flog products.

The US consumer is even more reliant on debt to finance purchases than before and smart companies like Apple (APPL) have rolled out savings accounts because they are aware that the fight for deposits is up for grabs after the banking contagion.

Even though AMZN delivered us a great quarter in terms of profitability and top line growth, the larger takeaway was the uncertain path going forward.

Amazon CFO Brian Olsavsky told investors on the company's earnings call AWS customers are continuing "optimizations" in their spending.

The CFO described the first quarter as “tough economic conditions.

Revenue in Amazon's AWS unit grew 16% during the first quarter, down from an annual growth rate of 37% seen in the same quarter last year.

Disclosure that sales growth at AWS had slowed further in April sets the stage for AWS’s weakest growth rate since Amazon began breaking out the unit’s sales.

Amazon’s advertising business continues to deliver robust growth, largely due to ongoing machine learning investments that help customers see relevant information when they engage.

US customers are moderating spending on discretionary categories as well as shifts to lower-priced items and healthy demand in everyday essentials, such as consumables and beauty.

A little bit of a mixed bag, but disappointing guidance in AWS really sticks out like a sore thumb.

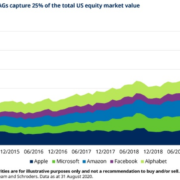

As we exit the bulk of big tech earnings, it is clear there is quite a bit of runway left for big tech shares to go higher.

I can’t say the same for every tech stock, because growth stocks have a different set of challenges that they haven’t been able to overcome.

Amazon still posted great earnings and investors should absolutely look to buy shares on the dip.

Even at less than 100%, AMZN is still worth owning over a lot of SPACs, growth tech, or emerging tech.

What we are seeing now are these behemoth tech companies leveraging their balance sheet in an interest rate matters world which is why small companies can’t compete anymore.

Although not technically monopolies, some of these tech firms are getting darn close with their closed “ecosystems.”

Buy AMZN on the next dip.