Buy Facebook on the Dip?

A company such as Facebook (FB) simply must be on investors’ radar all the time because of the profitability element to it.

In a truncated period where growth stocks are out of favor, these bottom-line tech behemoths can weather the storm.

This tech firm doesn’t produce any real products because the user is the product.

A favorable expense layout is why net income this past quarter was $9.5 billion on $26.17 billion revenue.

Even a grossly profitable company such as Apple (AAPL) does a lot worse per dollar generated.

For every $3.79 billion in revenue at Apple, they only profit $1 billion, which is great compared to the status quo except Facebook.

Yes, it costs money to source raw materials and supplies to construct iPhones, iPads, and iMacs, which makes Apple’s operation much more impressive than Facebook.

Strip the hassle of making stuff like iPhones and iMacs and you have Facebook, an online portal to post stuff and serves no real purpose but to display ads to people.

Their attempts to get into the device and ecosystem games have utterly fizzled because users simply have no trust in Facebook management and how they fumble around personal data.

Why buy a Facebook Portal, the firms’ microphone video tablet, when there are trustful options out there without sacrificing the quality?

Before releasing the Portal, during the product announcement, Facebook initially claimed that data obtained from Portal devices would not be used for targeted advertising.

One week after the announcement, Facebook changed its position and stated that “usage data such as length of calls, frequency of calls” and “general usage data, such as aggregate usage of data will also feed into the information that we use to serve ads”.

So Facebook is quite stuck with what they have now, which is a blossoming Instagram and legacy Facebook portal both of which are cash cows.

They aren’t able to do M&A because of fear of anticompetitive legislation and their debauchery of privacy has locked them out of the hardware market.

Facebook wants to monetize WhatsApp, Facebook’s wildly popular chat app, but is finding resistance in funneling user data with an updated user agreement being criticized heavily worldwide with users deleting the app and downloading an alternative mainly the app Telegram.

Facebook rescinded the user agreement and has delayed their WhatsApp targeting ad division until they can ram the updated agreement down WhatsApp users’ throats.

I will say that “what they have” has been working out extremely well for the company when Facebook reported daily active users reaching 1.88 billion, up 8% or 144 million compared to last year.

Q1 total revenue was $26.2 billion, up 48% and this is attributed to growth in advertising revenue largely driven by continued strength in product verticals such as online commerce.

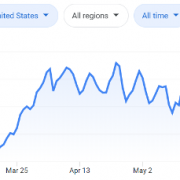

If investors don’t remember, Facebook was dragged down to the 20% revenue growth level just a few quarters ago on all the privacy hullabaloo.

To reaccelerate revenues is a major win for Facebook that can’t be understated.

Growth was broad-based across all advertiser sizes, with particular strength from small- and medium-sized advertisers.

Facebook’s year-over-year ad revenue growth also benefited from lapping pandemic-related demand headwinds experienced during March of last year. On a user geography basis, ad revenue growth accelerated in all regions.

Facebook’s bread and butter are the strength of their advertising revenue growth in the first quarter of 2021, which was driven by a 30% year-over-year increase in the average price per ad and a 12% increase in the number of ads delivered.

What is Facebook doing to branch out revenue channels?

They haven’t quit the hardware game with their Virtual Reality (VR) headset product called Oculus Quest 2 and management only played it down by saying they saw “sustained strength” without busting out any specific metrics.

I read the tea leaves as this isn’t doing enough for management to offer real data on it.

When I analyze the Oculus Quest 2 VR headset, the $299 retail price, it practically means they are losing money on it by a wide margin.

There is no premium in the pricing because the price is one of the few ways that consumers can overlook data privacy issues.

The $299 gets you a robust virtual reality headset with 6GB of RAM, a Qualcomm Snapdragon XR2 CPU, 64GB of storage, 1832x1920 per eye display, and a pair of controllers.

The jury is out whether the stickiness of VR will actually continue and if it does, how long full-scale adoption will take.

But it is painfully clear that Facebook will be losing money even on Oculus Quest products until there’s a 5th or 6th or even 7th iteration or even further.

There is nothing to suggest that VR is on the verge of full-scale adoption.

CEO and Founder Mark Zuckerberg must be tearing his hair out about how he has effectively been locked out of hardware products since the inception of his empire.

And no, data centers, their largest expense along with remunerations, to hold the data you give him don’t count as hardware.

A few headwinds to take note of, in the third and fourth quarters of 2021, Facebook expects year-over-year total revenue growth rates to significantly decelerate sequentially as they are facing tough comparable data from the prior year.

Lastly, Facebook will continue to expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recently launched Apple iOS 14.5 update, which will have an impact in the second quarter.

As the global economy and US economy open back up in a roaring fashion, it’s hard not to like this stock.

Ad budgets are on the verge of exploding and Facebook is still one of a nicely forged duopoly.

Even if they haven’t been able to branch out, they are incredibly proficient at what they do, and serving ads to a 2 billion plus user base will become more voluminous and expensive as the year advances.

No surprise the stock is at $325, another all-time high, and even if I personally hate the company, the stock is a viable candidate to buy on any dip.

As we move into the next part of the year, I do believe the buyback story will accelerate for big tech and cash cows like Facebook, and its stock will hit $400 by the year-end.

At the end of the day, this a story of the big getting bigger.

OCULUS QUEST 2 – THE NEXT DISASTROUS FACEBOOK HARDWARE?