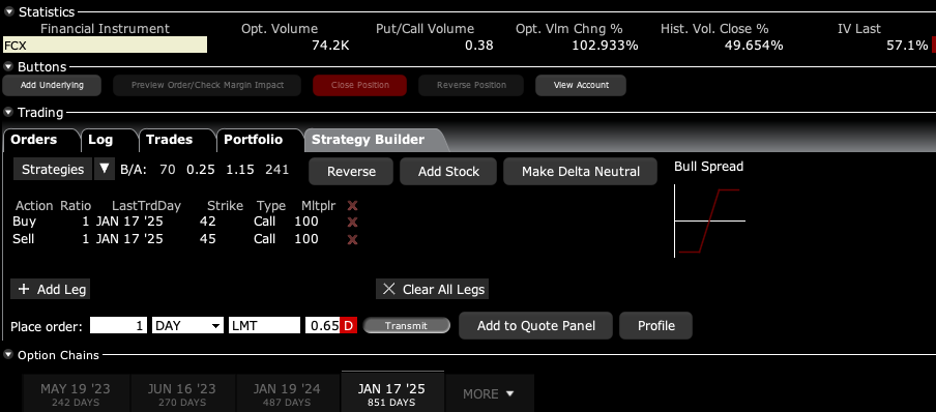

BUY the Freeport McMoRan (FCX) January 2025 $42-$45 out-of-the-money vertical Bull Call spread LEAPS at $0.65 or best

Keep in mind that NVIDIA is one of the most volatile stocks in the market. You don’t have to buy it today. A big selloff would be ideal. But it should be at the core of any long-term LEAPS portfolio.

Trade Alert - (FCX) – BUY

BUY the Freeport McMoRan (FCX) January 2025 $42-$45 out-of-the-money vertical Bull Call spread LEAPS at $0.65 or best

Opening Trade

10-4-2022

expiration date: January 17, 2025

Number of Contracts = 1 contract

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 2:1 in your favor. And the payoff is 3.6:1. That is the probability that Tesla shares will rise by 82% over the next two years and four months.

You may not have noticed, but we have just entered the golden age of the electric vehicle, thanks to climate change and massive government support. Each EV will need 200 pounds of copper, and Freeport McMoRan is the world's largest copper producer. It is also the world’s largest producer of molybdenum and owns some of the world’s largest gold mines.

The company’s output will have to increase by at least 500% over the next eight years to accommodate projected copper demand. (FCX) has also been especially accommodating in that its shares have just dropped by 52% over the last 6 months.

To learn more about the company (and to order a car), please visit their website at https://www.fcx.com

I am therefore buying the Freeport McMoRan (FCX) January 2025 $42-$45 out-of-the-money vertical Bull Call spread LEAPS at $0.65 or best

Don’t pay more than $1.00 or you’ll be chasing on a risk/reward basis.

January 2025 is the longest expiration currently listed. If you want to get more aggressive with more leverage, use a pair of strike prices higher up. This will give you a larger number of contracts at a lower price.

Please note that these options are illiquid, and it may take some work to get in or out. Start at my price and work your way up until you get done. Executing these trades is more an art than a science.

Let’s say the Freeport McMoRan (FCX) January 2025 $42-$45 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50. Enter an order for one contract at $0.50, another for $0.60, another for $0.70, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious, but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that an 82% rise in (FCX) shares will generate a 360% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 3.6:1 across the $42-$45 space. In other words, the stock has to just get to where it was in June for you to make the maximum 360% profit on this trade.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it until you find the real price.

This is a bet that Freeport McMoRan will close above $45 by the January 17, 2025 options expiration in 2 years and 4 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (FCX) $42 call at………….………$6.00

Sell short 1 January 2025 (FCX) $45 call at….………$5.35

Net Cost:………………………….………..…………....….....$0.65

Potential Profit: $3.00 - $0.65 = $2.35

(1 X 100 X $2.35) = $235 or 3.6X in 2 years and 4 months.