China And Nvidia At Loggerheads

Claiming Nvidia (NVDA) is stunting competition is just the beginning of the end as the tech war between China and the United States heats up again as we get prepared for a new administration to take over the White House.

This appears like a strategic shot across the bow and instead of just talking tough, China is throwing up a pre-emptive attack to counter whatever is in store for them past 2024.

Technology has been a national issue for some time and the follow through has been quite robust as China has bulldozed their way to corner the EV market with national champion BYD.

China is doing well in tech, but understands their tech sector cannot co-exist with Silicon Valley in the long term.

The probe is aimed at Nvidia's practices regarding possible anti-monopoly violations. It is also set to examine its 2020 acquisition of Mellanox, a purchase that was approved by China's State Administration for Market Regulation under the condition that the chipmaker would avoid discriminating against Chinese companies.

According to a Chinese media report, the government believes Nvidia’s $7 billion purchase of the Israeli computer networking equipment maker may have violated Beijing's anti-monopoly rules.

The U.S. has amped up restrictions on chip sales to China in recent years, barring Nvidia and other key semiconductor manufacturers from selling their most-advanced artificial intelligence chips in an effort to limit China from strengthening its military. The company has worked to create new products to sell in China that abide by the U.S. regulations.

I remember the golden years in China where growth was unwavering and every recent American college graduate would jump at the chance to make a career in China.

China, along with many other rich Western countries, have hit a wall with growth models that are delivering diminishing returns.

Asia is struggling and there is no other way to describe it.

The United States continues to power through with the top income bracket and enterprise money propping up the rest of the market and minting millionaires through higher tech stocks.

Nvidia is the jewel of America’s recent success and they promise to bolster Americas claim as the flag bearer of the AI movement. The loser would be zero sum and that loser would be China.

Threatening the best in show of American tech is a bold move by China and it smells of desperation.

There have been whispers of a major currency devaluation to the Chinese yuan in the pipeline which would hurt the economy similar to how the Japanese yen crash has crippled the Japanese.

Then, over the weekend, Syria being overthrown and Russia being able to pull back resources indicates that Russia plans to wind down its operation in Eastern Europe and America could set the stage for conflict in China.

Pulling military resources in Eastern Europe and allocating it further east to China would make sense since the upcoming administration views China as a bigger threat than Russia.

China’s political move to name Nvidia as anti-competitive could be the new beginning of a nasty pernicious relationship for the next 4 years between the 2 governments.

What does that mean for tech stocks?

Buy the dip in Nvidia on news like this.

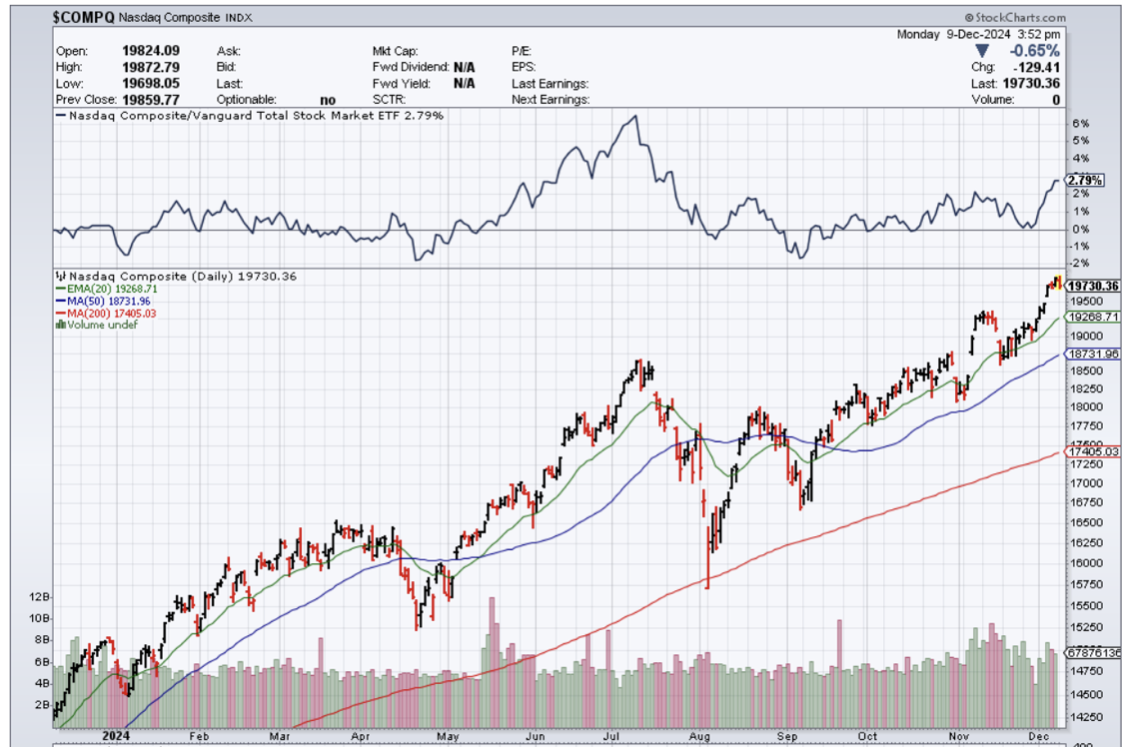

Stepping back and looking at the Nasdaq ($COMPQ), this won’t take down the index.

Nvidia shares grew around 200% in 2024 and although I don’t expect a repeat performance in 2025, capital is pouring in from the sidelines from abroad and at home.

One thing I can tell you is that money from nowhere is pouring into China, especially the foreign type, because the hostile government means investing there is impossible and idiotic for outsiders.

I am bearish China’s economy and optimistic that U.S. tech stocks can muscle through the China headwinds.