Chinese Tariffs At The Forefront

Tariffs on Chinese EVs skyrocketing by 400% are just another example of the federal government getting in the way once again as the current administration limps to the November starting line.

These levies are directed at everything central to producing EVs like the battery and the car itself.

I understand that the point is to protect EV companies at home, but tariffs don’t work and in almost every case, the end price to consumers rises painfully.

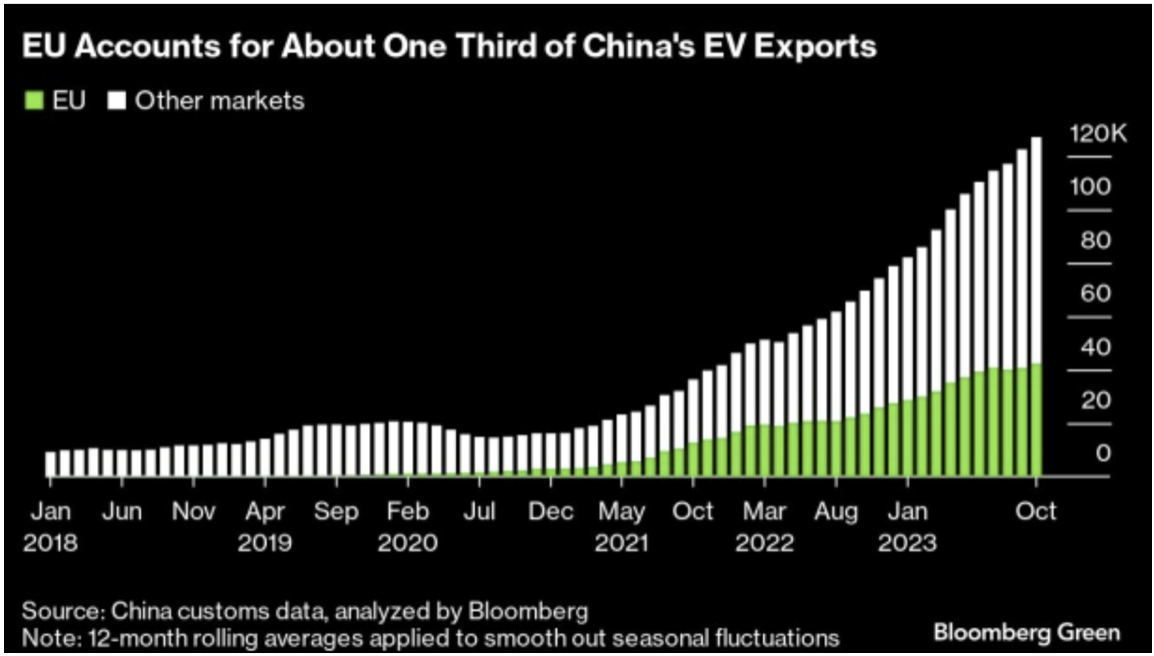

It’s not any better over the Atlantic so this frees us China to innovate and get ahead with government support.

The Chinese are playing the long game.

This review of Chinese tariffs was triggered by the administration before it, and it just smacks of inefficiency to me. It only took 4 years to finish the review as infighting took hold and the glacial pace finally ended with a decision.

In fact, Biden's $7.5 billion investment in EV charging has only produced 7 stations in two years, per Washington Post.

Where did the rest of the money go?

My guess is carrying out a raft of economic surveys isn’t cheap when there are no guard rails in price setting.

Maybe the thousands of consultants giving their 2 cents to keep that bureaucratic machine humming in Washington made a dent with another few billion invoices.

I’ll at least give it to the White House that they were able to produce 7 and not 1 or 2.

A billion dollars per EV charger is not good enough in 2024 while the Chinese forge ahead with their technological prowess.

The Chinese tariff rate on electric vehicles is expected to quadruple from roughly 25% to 100% plus an additional 2.5% duty would apply to all automobiles imported into the US.

The EU launched an EV subsidy investigation in October that may lead to additional tariffs by July as well.

The tariffs would likely have little immediate impact on Chinese firms since its world-beating EV manufacturers have steered clear of the US market due to tariffs.

Its solar companies mostly export to the US from third countries to avoid curbs, with US firms seeking higher tariffs on that trade, too.

The move comes after Biden last month proposed new 25% tariffs on Chinese steel and aluminum.

Protecting the American EV sub-sector feels like a situation in which China is outcompeting American EV companies and the government is directly reacting to that in an emotional way.

My guess is that it won’t work.

China will be able to circumnavigate these tariffs easily. It’s impossible to put the genie back in the bottle once it is out.

The only way American EVs will find a solution is to innovate itself away from the competition and that will be tough with the level of interruption by the Federal government.

Sooner or later, these better-made Chinese cars will find themselves in Europe and America on a grand scale.

If the government would get out of the way, tech companies would be forced to innovate or die.

A main strategy of stopping the Chinese from selling to you is a wack-a-mole strategy and the products will eventually arrive,

I am strongly bearish the American EV sub-sector at this point.

This is another tech sub-sector that has turned stale, similar to the streaming sub-sector where I just took profits in a bearish Roku trade.

Why doesn’t the admin go after the Chinese unrealized profits while they’re conjuring up some more tariffs? I wouldn’t put it past them.