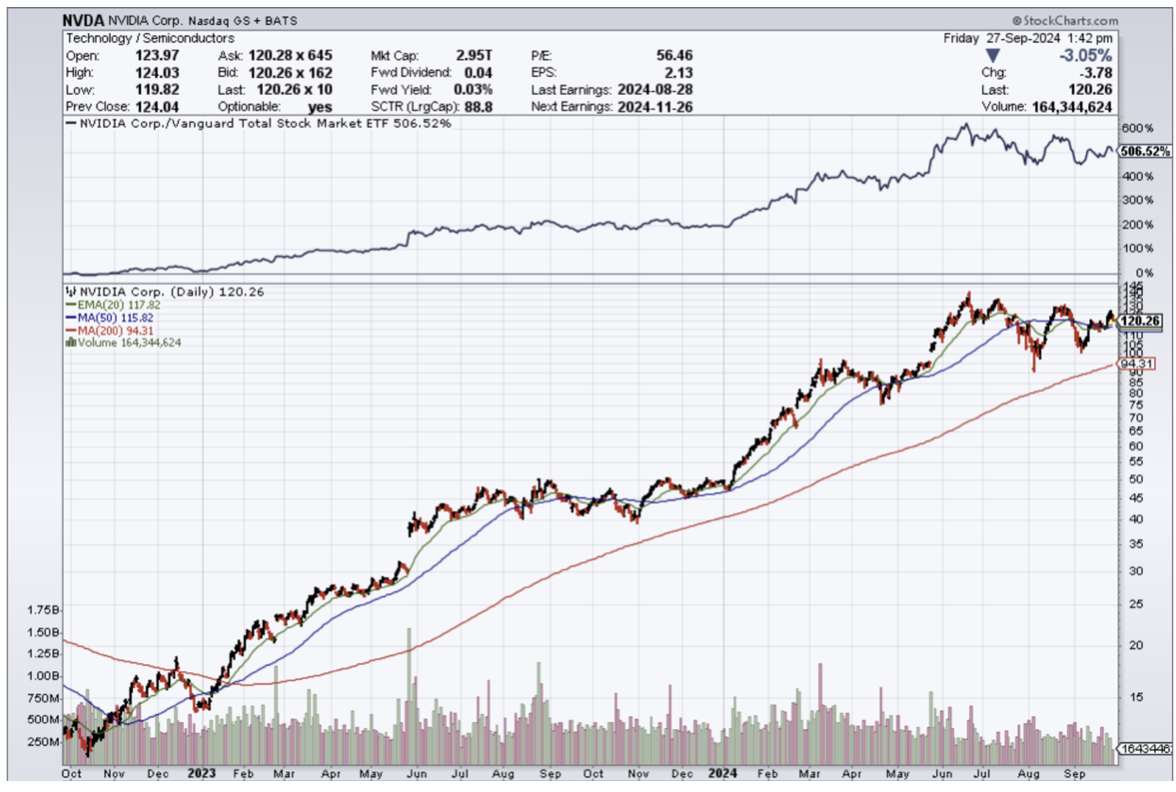

Chips Shine Through Again

I have been pounding on the table urging my readers to buy chip stocks.

Why?

Because chip stocks will carry the Nasdaq to higher highs.

Jump on the bandwagon while you can.

My thesis was validated when Micron stock (MU) jumped over 17% yesterday and is up over 20% for the week.

That type of stock appreciation isn’t as widely found in the tech sector anymore now that much of the tech sector is deadweight.

The sub-sector that isn’t dead weight is chips and specifically the AI chips which Micron is part of.

So when we talk about growth, you won’t hear stuff like earnings or revenue growing in the single digits.

We hear numbers more similar to revenue growing at 90% or 100% or even 300% in some cases.

The outperformance in growth is helping these stocks reach greater heights and this is just the beginning.

The commentary has been widespread that AI data spend on chips is going through the roof.

Micron’s management told us they raised guidance because of a more favorable pricing environment as well as robust demand for Micron's memory chips used in data centers to power artificial intelligence.

Executives now expect the market for high-bandwidth memory (HBM) chips used in AI data centers to increase to $25 billion in 2025, up from $5 billion this year — and heightened demand for its HBM chips to bring in multiple billions of dollars next year.

Micron is the first chipmaker to report quarterly results this earnings season and their stellar earnings bode well for the rest of its peers.

The company reported revenue of $7.75 billion — 93% higher than last year.

Micron distinguishes itself by partnering with, rather than competing against, industry superpower Nvidia (NVDA). Micron supplies memory chips for Nvidia’s hotly demanded GPUs.

The company is also set to benefit from a bill awaiting signature from President Joe Biden that would loosen environmental requirements for microchip projects funded by the CHIPS and Science Act. Micron is one of the biggest beneficiaries of CHIPS Act funding, and the Building Chips in America Act passed by the US House of Representatives Monday would allow it to access funding for its projects in Idaho and New York faster.

It is quite transparent that these companies cannot make enough chips in the short term and tech companies are throwing money at them to try to produce the supply that is required for the AI build-out.

Whatever you think of how many AI chips will be needed to deploy AI in full capacity - the real number will dwarf that.

The energy generation needed to power this new technology is so immense that it could even raise the temperature of the earth a few degrees from the sheer energy it will emit.

We are at the beginning of the AI revolution and the chips are currently the best way to play it.

I am bullish chip companies who produces AI chips.