Consolidation Time

The Nasdaq experiencing a big dip is in fact healthy for the tech sector long term.

Shaking out the weak hands is necessary a few times per year.

It doesn’t hurt that tech stocks boast the higher growth rates in the entire stock market.

The price action has suggested a winner-take-all mentality with winners like Nvidia and other big tech companies experiencing outsized gains.

Chip stocks have been recent victors while smaller software stocks have been pounded.

Just take a look at social media stock Pinterest (PINS) which is down over 12% on a weak forecast.

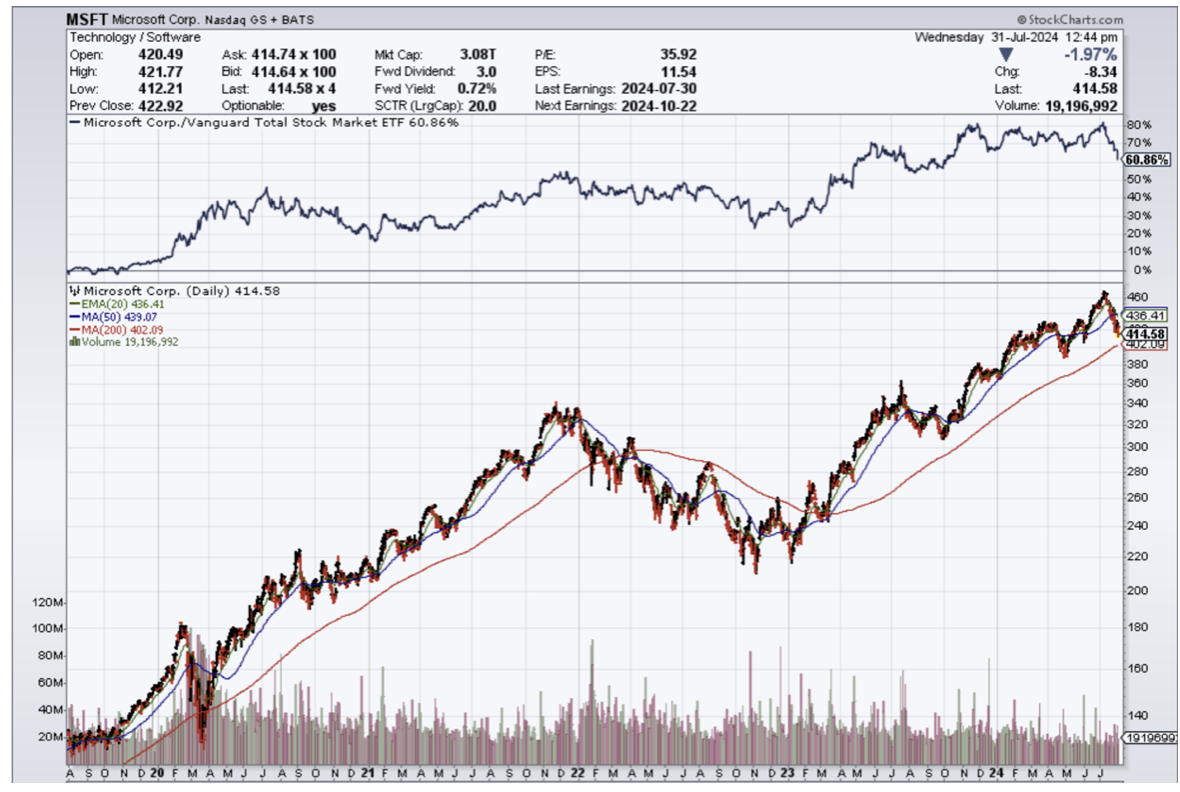

At the top end, Microsoft (MSFT) is the perennial flag bearer of cloud growth but this time it was different.

The stock sold off hard after earnings because the company missed cloud revenue expectations.

Cloud has been MSFTs bread and butter for years.

Even the CEO Satya Nadella came from the cloud division to grab the title of CEO.

Microsoft's overall cloud revenue came in at $36.8 billion, in line with expectations of $36.8 billion, but the company's Intelligent Cloud revenue, which includes its Azure services, fell short, coming in at $28.5 billion versus expectations of $28.7 billion.

While Microsoft's cloud business missed expectations, overall revenue still rose 21% year over year. Intelligent Cloud revenue, meanwhile, increased 19% year over year. What's more, Microsoft said AI services contributed 8 percentage points of growth to its Azure and other cloud services revenue, which increased by 29%.

The most consistent theme in this round of checks was the number of customers and partners that cited share gains by Microsoft resulting from its early lead on the AI front.

During Alphabet’s earnings call, CFO Ruth Porat said the company spent $13 billion on capital expenditures, up from $12 billion in the prior quarter, adding that the vast majority of that spending is going toward AI.

There are data points showing that growing the cloud is becoming something more similar to stealing rival clients from Google or Amazon.

That is a worrying sign because total addressable cloud revenue has been going up for a whole generation.

The cloud industry has never seen a scarcity mentality.

In the earnings rhetoric, the management talked as if growth is harder to come by in 2024.

I would be hard-pressed to find anyone who disagrees with that opinion.

The overall consensus starting to form is that these growing expenses related to AI won’t produce the blockbuster revenue projected so quickly.

The more likely case is that revenue from AI comes online in late 2025 or 2026 or maybe not at all.

The delay in the benefits of AI will mean shareholders pulling back temporarily and offer AI stocks a “prove it” period to show if they are legit or not.

Before winter, I do expect a consolidation phase in tech and in AI stocks that will set the stage for a Santa Claus rally.

MSFT stock is up over 200% in the past 5 years, and although this 11% or so dip in the past month is very unlike MSFT, this is a healthy and orderly dip.

I am still bullish MSFT in the long term.