December 16, 2024

(THIS WEEK THE FED WILL SET THE MOOD OF THE MARKETS AS WE SIGN OFF ON 2024)

December 16, 2024

Hello everyone

WEEK AHEAD CALENDAR

MONDAY DEC. 16

8:30 a.m. Empire State Index (December)

9:45 a.m. PMI Composite preliminary (December)

9:45 a.m. PMI Manufacturing preliminary (December)

9:45 a.m. PMI Services preliminary (December)

TUESDAY DEC. 17

8:30 a.m. Retail Sales (November)

8:30 a.m. Capacity Utilization (November)

8:30 a.m. Canada Inflation Rate

Previous: 2.0%

Forecast: 2.2%

9:15 a.m. Industrial Production (November)

9:15 a.m. Manufacturing Production (November)

10 a.m. Business Inventories (October)

10 a.m. NAHB Housing Market Index (December)

Earnings: Amentum Holdings

WEDNESDAY DEC. 18

8:30 a.m. Building Permits preliminary (November)

8:30 a.m. Current Account (Q3)

2:00 p.m. FOMC Meeting

Previous: 4.75%

Forecast: 4.50%

2:00 p.m. Fed Funds Target Upper Bound

Earnings: Micron Technology, Lennar, General Mills

THURSDAY DEC. 19

7:00 a.m. UK Rate Decision

Previous: 4.75%

Forecast: 4.75%

8:30 a.m. Continuing Jobless Claims

8:30 a.m. GDP Chain Price final (Q3)

8:30 a.m. GDP final (Q3)

8:30 a.m. Initial Claims (12/14)

8:30 a.m. Philadelphia Fed Index (December)

10:00 a.m. Existing Home Sales (November)

10:00 a.m. Leading Indicators (November)

11:00 a.m. Kansas City Fed Manufacturing Index (December)

Earnings: Nike, FedEx, Conagra Brands, Darden Restaurants, CarMax.

FRIDAY DEC. 20

8:30 a.m. Core PCE Deflator (November)

8:30 a.m. PCE Deflator (November)

8:30 a.m. Personal Consumption Expenditure (November)

8:30 a.m. Personal Income (November)

10:00 a.m. Michigan Sentiment final (December)

ON THE RADAR THIS WEEK

The Federal Reserve policy meeting will set the tone for the markets heading into year-end. It will also shed light on what investors can expect in 2025.

The odds are for a cut in interest rates this week.

But the Fed meeting will also highlight its projections going forward. Markets are pricing in further rate cuts, and if they do take place, we could eventually see the fed funds rate between 3.50% and 4.00%.

In addition to the FOMC, we get the PCE report on Friday. Some investors are concerned about sticky inflation and its effect on the markets, particularly with Trump’s policy promises that include mass deportations and big tariffs imposed on imported goods. We have to wait and see if that talk is real. Even if those policies are introduced, we still don’t know the extent they will be enforced or any detail about the numbers involved. As always, investors need a clear lens into government policies - the devil is in the details – before rational decisions can be made about investments.

THE MARKET PICTURE IN 2025

Strategists are anticipating that the strong rally we have enjoyed in 2024 can continue into early 2025. However, by around mid-year, volatility could return, and a bumpy ride may ensue. I am expecting a 10%-20/25% market correction sometime in 2025. Interestingly, no strategists are suggesting that the market will be lower at the end of 2025 than where it is now. So, that means hold tight and ride the waves.

MARKET UPDATE

S&P500

Uptrend continues. Even though we have plenty of risk hanging over the market, including bearish technical, the market can still trend higher. A short-term pullback would probably find support over the next few weeks as markets traditionally perform well towards year-end.

Resistance: $6090/$6120

Support: $6025/$5970

GOLD

Gold is choppy and is undergoing a correction. And this correction could take some time. As I said last week, we could see $2,400 and even $2,200 before a low is found. That being the case, you could look at selling calls on precious metals’ stocks. Barrick Gold (GOLD) is a suggestion here.

Resistance: $2720/$2730

Support: $2630/$2590

BITCOIN

As I write this, Bitcoin is sitting above $105k. Next stop is the $109k area. Last week, Bitcoin thrashed around the $100k mark. Some people believe this zone marks a top for Bitcoin, but I believe it is merely a pit stop on the way to higher targets.

Support: $94000/$94,500/$90,000/$90,750

QI CORNER

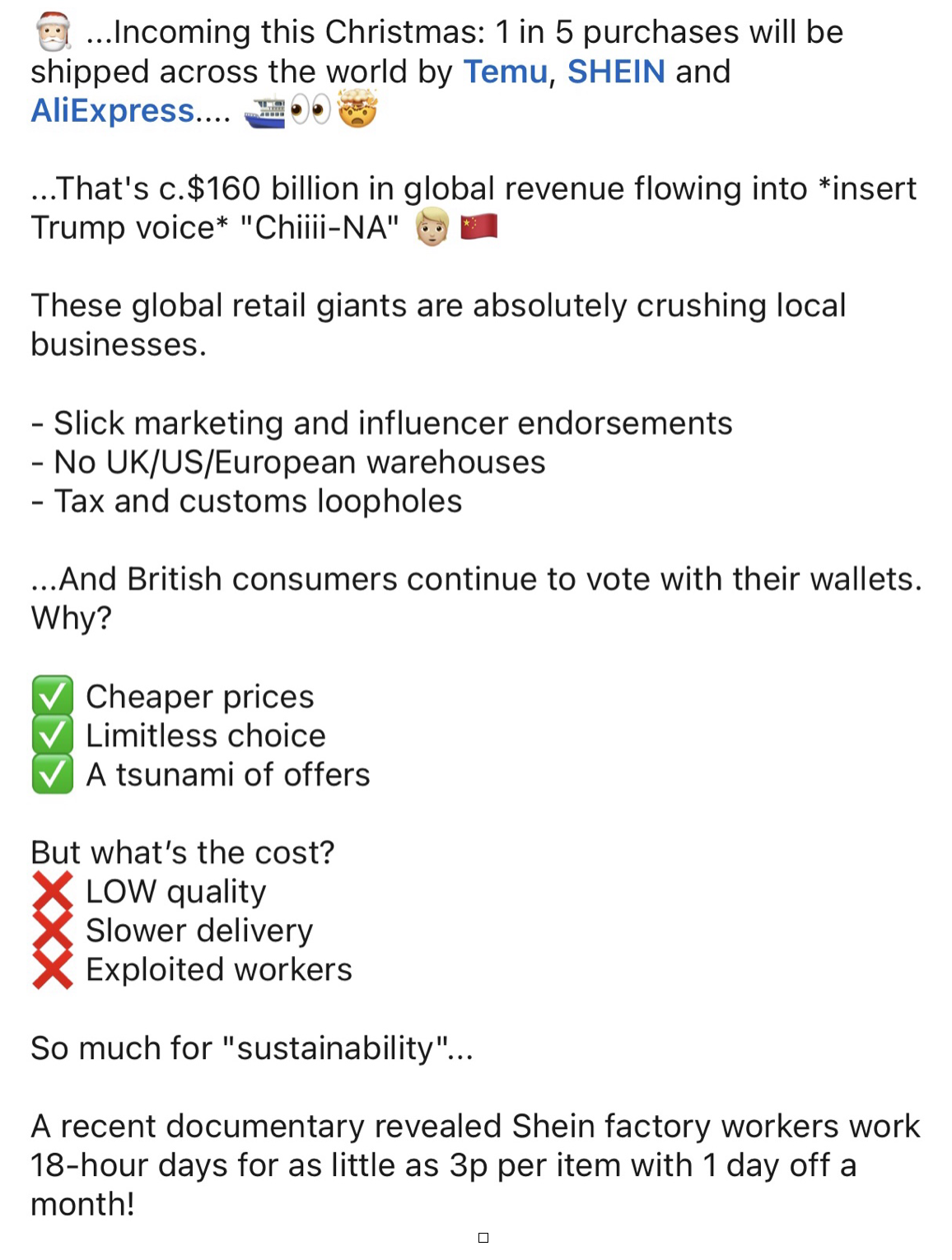

Solution: quit buying from these companies and support local businesses.

SOMETHING TO THINK ABOUT

Cheers

Jacquie