December 22, 2009

December 22, 2009 Featured Trades: (JOHN BRADY?S 2010 STRATEGY), (SPX), (TBT), (GOLD, (EWZ), (EZA), (XOM), (XTO), (CAP & TRADE), (A CHRISTMAS STORY)

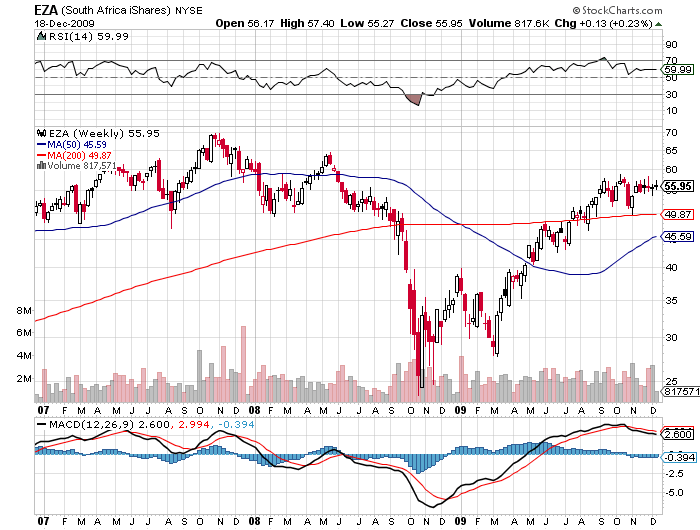

1) MF Global?s strategist for interest rate products, John Brady, sees the S&P 500 rocketing 18% to 1,300 during the first half of 2010, driven by enormous productivity gains that are creating historic profit margins. A flood of money should hit the market just after the New Year. Let there be no doubt that the world is in risk accumulation mode. However, while monetary policy will stay on hold for possibly all of next year, long rates will start to rise because of the sheer volume of Treasury issuance. Think the (TBT). Investors will then start taking profits into June, prompted by the uncertainties of the midterm congressional elections and a possible ?W? recession. John thinks that emerging markets will keep devaluating their currencies to keep exports competitive and stock markets flying, but watch out for the volatility. China is a special situation. By tying the Yuan to the dollar, they are letting Washington set their monetary policy, and guess what? Bubbles are contagious. Like the rest of the planet, John loves Brazil (EWZ), and also South Africa (EZA), where gold, a rising middle class, and an international trade hub are the motivating stories. We are in a secular bull market for the barbaric relic, with a rise to $2,200 feasible, but don?t be surprised if we tick at $800 first. Commodities look great long term as a synthetic short dollar trade. But the buck could rally until mid year before a new big down leg renews. He is also a peak oil believer, and thinks the recent Exxon/XTO Energy deal speaks volumes about the shortage of supplies. It?s cheaper to drill on the floor of the New York Stock Exchange than 30,000 feet down in the Gulf of Mexico. To hear the full 40 minute interview, please go to Hedge Fund Radio by clicking here

2) You are about to be pounded senseless by competing sets of data arguing that global warming is accelerating, not changing, or like Santa Claus, doesn?t exist at all. You will be offered truckloads of contradictory, apple and orange comparisons which sound relevant to non-scientists, but with which it is impossible to reach any meaningful conclusions. With health care out of the way, cap & trade, alternative energy, and the restructuring of our energy infrastructure will move to the head of the queue as the next battleground in Washington. A stubbornly high unemployment rate and a potential double dip recession means that Obama could lose control of the house in November. So he has no choice but to ram through his most radical legislation in 2010. The president certainly made no secret of his desire to wean the country off of imported oil during the election, which means that we have to come up with 20 million barrels a day of crude in energy equivalent or savings somewhere. The problem I have with all of this is the environment is first and foremost an engineering issue. The last time I checked, both parties, even their most radical wings, agreed that the boiling point of water was 100 degrees C, the atomic number of carbon was 6, and the formula for carbon dioxide was CO2. That won?t stop politicians from hijacking,?? emotionalizing, and clouding the issue. At stake is nothing less than the 10% of America?s GDP that the energy industry accounts for, and the moving of substantial economic activity out of Texas, Oklahoma, and Louisiana to the East and West coasts. Don?t expect this to happen without a knockdown, drag out fight. Since I believe that alternative energy will be one of the dominant investment themes of the coming new decade, and have the luxury of a science background, I will be wading through this morass attempting to provide readers with whatever insights I can. Watch this space.

3) A CHRISTMAS STORY

When I was growing up in Los Angles during the fifties, the most exciting day of the year was when my dad took me to buy a Christmas tree. With its semi desert climate, Southern California offered pine trees that were scraggly at best. So the Southern Pacific Railroad made a big deal out of bringing trees down from much better endowed Oregon to supply holiday revelers. You had to go down to the freight yard at Union Station on Alameda Street to pick them up. I remember a jolly Santa standing in a box car with trees piled high to the ceiling, pungent with seasonal evergreen smells, handing them out to crowds of eager, smiling buyers for a buck apiece. Watching great lumbering steam engines as big as houses whistling and belching smoke was enthralling. We took our prize home to be decorated by seven kids hyped on adrenalin, chugging eggnog. A half century later, the Southern Pacific is gone, the steam engines are in museums, anyone going near a rail yard would be mugged or arrested for vagrancy, and Dad long ago passed away. Dried out trees at Target for $30 didn?t strike the right chord. So I bundled the kids into the SUV and drove to the primeval, foggy coastal redwood forests of Northern California. Five miles down a muddy logging road, it was just us and a million trees. The kids, hyped on adrenalin, made the decision about which perfect eight footer to take home. I personally chopped it down, tied it to the roof, and drove us the three hours home. With any luck, these memories will last until the next century, and long outlast me.

?If I only has enough food, defeating the Russians would be child?s play,? said Napoleon in 1812.