December 22, 2010 - A Nice Update on Cisco Systems

Featured Trades: (CISCO SYSTEMS), (CSCO)

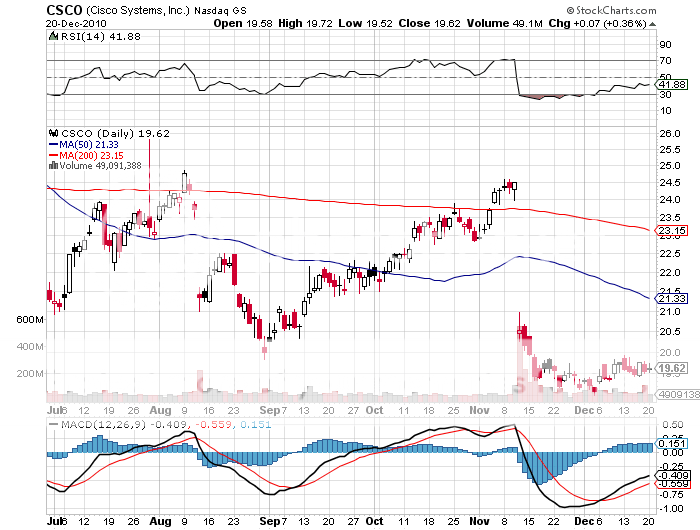

3) A Nice Update on Cisco Systems. For those of you who caught my trade alert to buy the Cisco Systems (CSCO) $20-$22 bull call spread last week and where hoping to get it at lower prices can forget about it. I spoke to an analyst today whose outlook for the networking giant was even more optimistic than mine.

The company has announced an incredibly aggressive buy back program that will soak up 17% of its outstanding shares on any further dip in prices. Cash on the balance sheet has ballooned from $38 billion last year to a staggering $45 billion today. Its fundamental business is rock solid, which it has successfully moated against any potential competitor. All of the mega trends currently in play in the online world, like cloud computing and the upgrade to video streaming, play directly into Cisco's hands. The income statement and cash flow couldn't be healthier.

He believes that the current 30% dip from the April high was purely sentiment driven and creates the buying opportunity of a lifetime. According to his estimates, CSCO is currently selling at 12 times next year's earnings. Get a multiple expansion on the upside, and you could see the shares rocket from today's $19.55 to as high as $28 in the foreseeable future. If for some reason you are unable to employ the options strategy here, the outright stock is a huge buy here.

Just thought you'd like to know.

-

Cisco is Looking Impenetrable