December 7, 2010 - There is @$*% Scalp Here in Financials

Featured Trades: (A SCALP IN THE FINANCIALS)

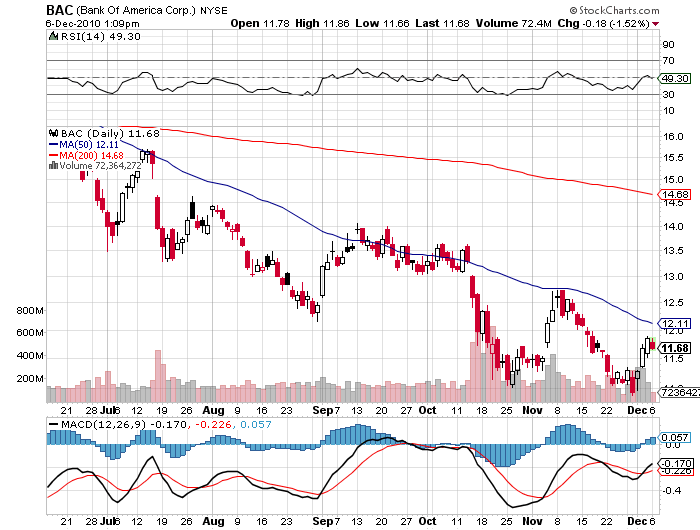

2) There is @$*% Scalp Here in Financials. Regular readers of this letter are well aware that I despise financial stocks for the worthless pieces of paper that they are. Therefore, I think you should rush out and buy financials stocks right now.

There is a method to my 'Madness.' Financials are the preeminent lagging sector in the world's top lagging market. That alone will prompt some hedge fund managers to pull money out of super performing emerging markets for investment into the unloved and ignored sector. The 'Dogs of the Dow' crowd will most likely get sucked into the logic too.

Lets face it, the banks are making money hand over fist here. A steepening yield curve gives them the best free lunch of all time, borrowing from the Fed at zero interest rates and investing in government paper further down the curve . They can also lend it to prime corporate borrowers at 4%, 5%, or even 6%. The environment is so friendly that even bankers can make money. Rumors abound that they are ready to restore dividends early, Fed permission be damned, putting them on the menu for pension funds once more. ??Maybe this is why the Vampire Squid, Goldman Sachs, upgraded the sector last week to an overweight?

Mind you, I'm only recommending a one night stand with the banks here, not a long term relationship. If you do get married, make sure it is in Reno, Nevada, where you can get one of those quickie divorces. If banks were forced to use the same accounting rules that the SEC foists on me, like marking positions to market on a daily basis, they'd be showing huge negative net worths, and would be out of business overnight. All of those subprime loans they took on at the peak of the real estate bubble are still carried at full value. Banks will only lend to the best quality firms because they know huge hits are coming their way, and have to conserve capital. This is also why the foreclosure rate is so slow. Any faster and they'd really go broke.

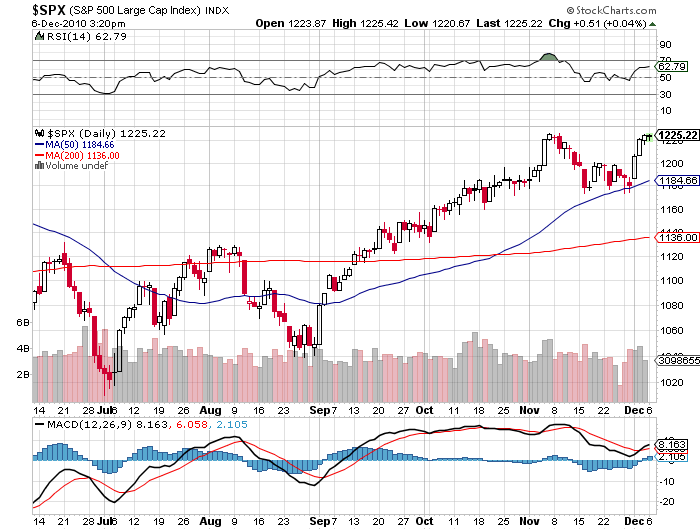

Of course, the banks all know this, Ben Bernanke knows this, and I know this, hence the free lunch. There is another side to this coin. If banks join the party, it could give the S&P 500 the juice to make it up to my 1348 target, or even 1,400 in 2011. That is a best case scenario.

-

-

Look for a One Night Stand Only