DeepSeek Puts A Scare Into Tech Stocks

The narrative that China is a decade behind in cutting-edge technology compared to Silicon Valley is total B.S. at this point.

It couldn’t be further from the truth.

First, it was the smartphone where Apple built an insurmountable lead for the Chinese.

Second, it was the EV and no Chinese company would ever surpass Tesla.

China is now leading in both EVs and smartphones at this point.

This narrative has been debunked and today is the final nail in the coffin.

Now…enter the wrath of artificial intelligence where reports indicate China has produced that aha moment in which China has managed to output the same quality of AI without Nvidia supercomputers and without a $100 million data centers.

Imagine the sigh of relief from American households that won’t have to deliver an electricity wealth transfer to Silicon Valley.

If this holds true, the Chinese have played the CEO of ChatGPT Sam Altman like a fiddle.

It’s extremely worrisome that Altman has irked Elon Musk so badly that it is widely known that Altman is Musk’s arch-enemy.

For everyone who doesn’t know, the app is called DeepSeek and it is now #1 in the Appstore.

Chinese artificial intelligence startup DeepSeek’s latest AI model sparked a multi-trillion rout in US and European technology stocks.

DeepSeek is a visible challenge to costlier models like OpenAI and raising suspicious if Sam Altman is just taking Silicon Valley on a ride for his gargantuan bank account.

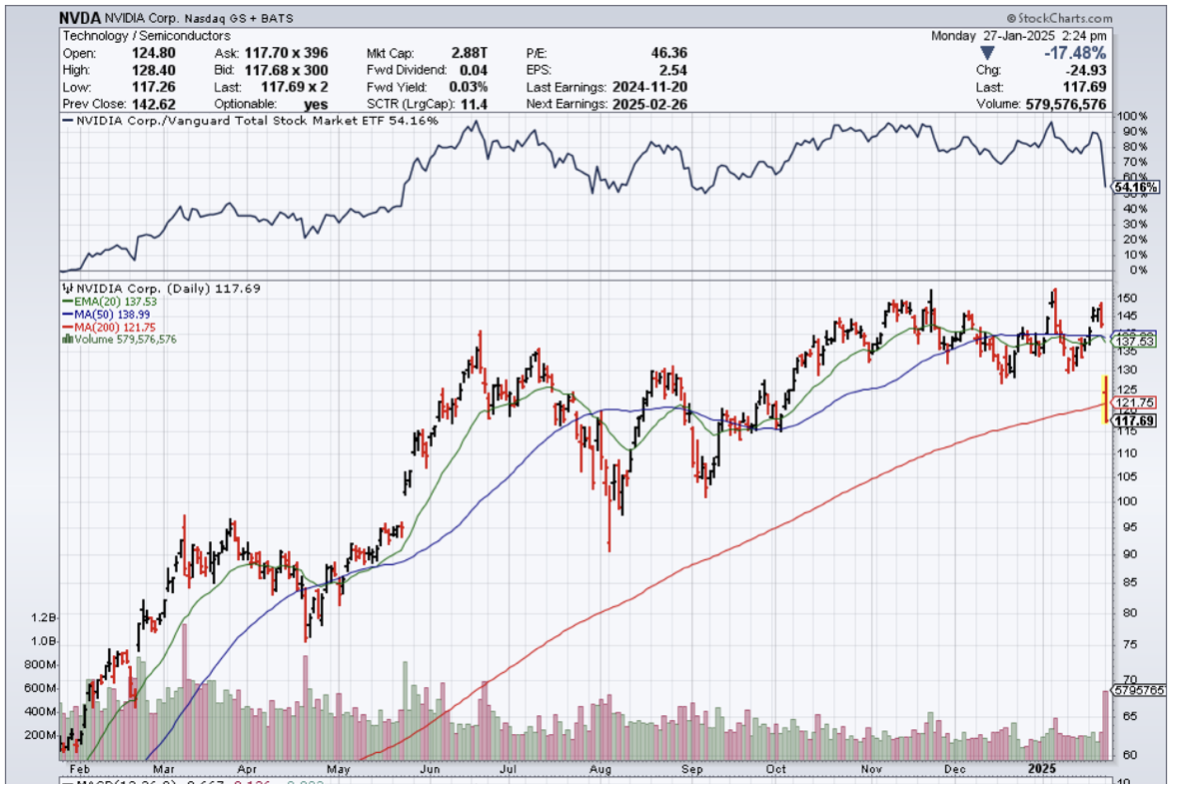

Nvidia tanked 17% by mid-day and clearly would be one of the companies hurt by the Chinese.

DeepSeek shows that it is possible to develop powerful AI models that cost less and can potentially derail the investment case for the entire AI supply chain, which is driven by high spending from a small handful of hyperscalers.

The AI model from DeepSeek — founded by quant fund chief Liang Wenfeng — is widely seen as better than ChatGPT and will no doubt be a better value.

The DeepSeek product is deeply problematic for the thesis that the significant capital expenditure and operating expenses that Silicon Valley has incurred are the most appropriate way to approach the AI trend.

The DeepSeek release raises new doubts, challenging the notion that China’s AI technology is a decade behind US counterparts. Washington’s trade restrictions had kept the most cutting-edge chips out of China’s hands, but DeepSeek’s model was built using open-source technology that is easy to access.

The biggest and most important takeaway from this chaos is that Nvidia is now canceled as the best buy and holds long-term tech stock.

The newfound competition instills pricing issues for Nvidia and raises questions about the very model they support.

Many asset classes have become overly expensive and the narrow reason for the pricing to stay higher is the lack of competition.

So what now?

Although I don’t expect Nvidia’s stock to experience a straight move lower, this puts a hard ceiling on any meaningful stock appreciation for the rest of 2025.

This new development also puts hard ceilings on other AI chip stocks looking to benefit from those higher premiums.

Then the question of what is the next big thing to come from Silicon Valley is again thrust to the fore.

Innovation has been behind in California and Altman is looking less credible by the day.