Buy Any Tech Dip

Deflation is back and hard to believe after a disastrous 2022.

Tech investors finally are cheering on the positive structural backdrop as the mother’s milk has been removed for quite some time.

Last year was so bad for big tech that CEO Tim Cook’s compensation sunk from $99 million in 2022 to only $48 million in 2023.

Is that Putin’s fault too?

Jokes aside – yeh - it’s that bad for the tech CEOs so you can imagine how bad it is for the part-time worker censoring Facebook posts.

It’s not going all smooth at Apple either.

Apple is in the process of moving production from China to India and Vietnam.

Chinese factories aren’t as cheap as they used to be and they aren’t open consistently.

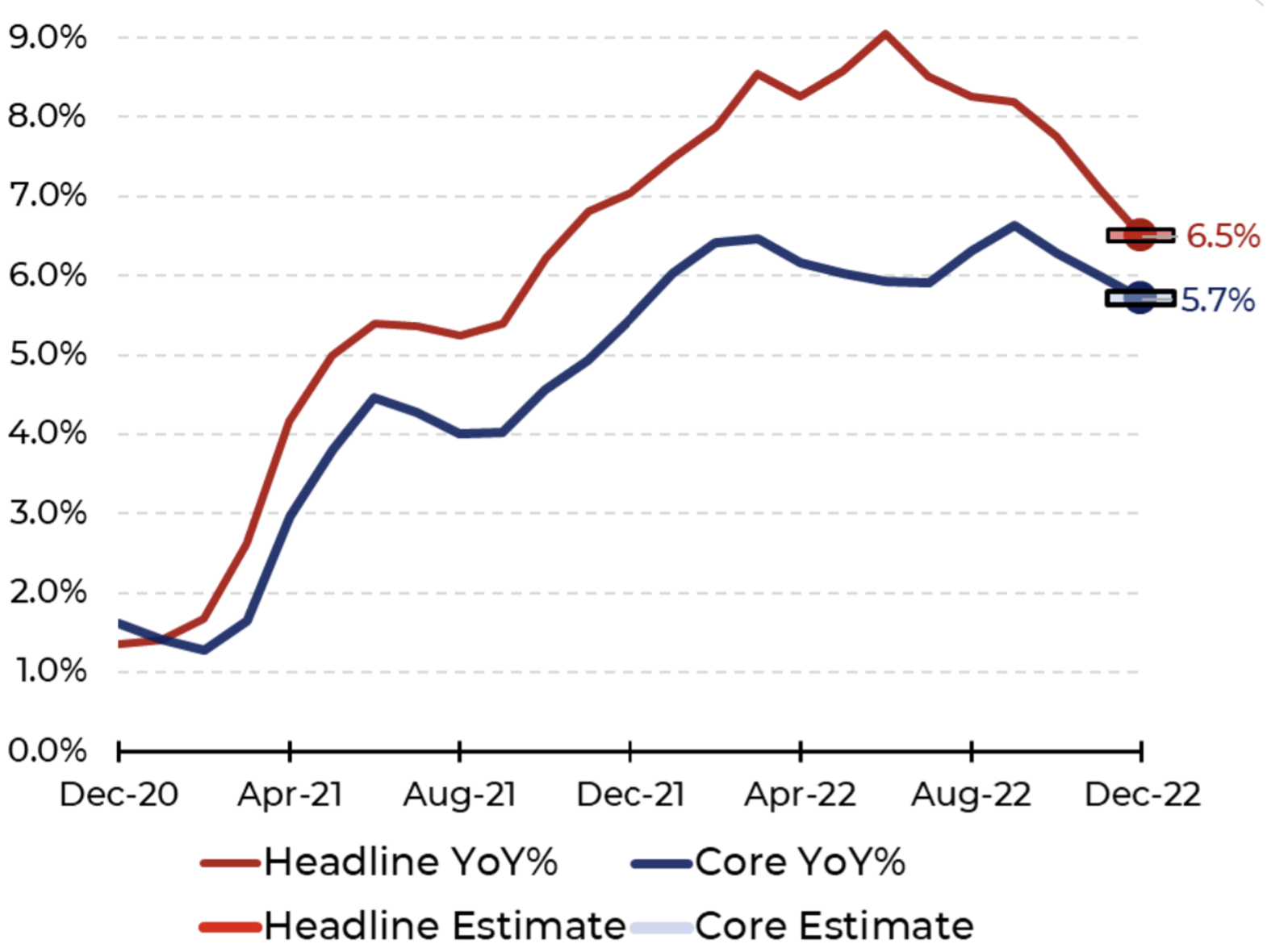

The 6.5% CPI was right bang on consensus yesterday and confirms the notion that prices are coming down fast.

Just look at some prices like used cars – prices are down 8.8% year over year.

The end result is that a recession will be delayed and the tech market won’t crash because of rapidly sinking earnings, but propped up by rapidly sinking interest rates.

Just look at the bond market – the U.S. 10-year rate has crashed.

Earnings won’t be great and tech has led the way with firings from many of the famous big tech firms.

It’s true that this is a down patch for big tech, but big tech will come roaring back like it always does.

The leaders will most likely be different motley crew this time around.

Tech companies aren’t doing great right now, but it could be worse.

The ones with strong balance sheets are looking to add growth externally such as Microsoft’s potential investment in OpenAI.

The dirty secret is that many tech companies aren’t looking to add cash-burning companies which prevent a lot of potential deals since most start-ups aren’t profitable.

Another clear sign that tech is on sale is the much-publicized Tesla price cuts so lower revenue is definitely on tap or at best – revenue plateauing.

Consumers can now get their Tesla for an eye-watering discount – just don’t anger the CEO or he’ll turn your software off.

The discounts have spread to Europe, in Germany, Tesla cut prices on the Model 3 and the Model Y from 1% to around 17%, depending on the configuration. Tesla’s Model 3 was the bestselling electric vehicle in Germany in December 2022, followed by the Model Y.

Part of the real reason that tech has rallied so hard to begin the year is because the sector was battered so badly last year.

We cannot claim victory after just 2 weeks of positive price action – only politicians get to claim victory for nothing – the rest of the year won’t be easy by any metric.

The world is wonky where the American consumer is tapped out, but much of the job firings have been limited to tech. Former tech workers can still rotate into other sectors to find work as tech companies become streamlined. I expect a very different tech sector moving forward with far less waste. I forecast something more similar to a single CEO delegating work to an army of bots and algorithms.

Tech overhired in the first place, so going back to 2020 staffing levels supersede any sensationalist headline that tech is over. I believe tech companies need to go back to 2015 staffing levels.

As long as deflation is priced into tech shares for the rest of 2023, tech stocks will be a buy-the-dip type of asset class.

However, in the short term, we have run quite hot for the first 2 weeks as the tech sector sets up for the first dip of the year.