Dell Is Not A Dinosaur Anymore

Investors are looking through any bad part of Dell’s business because they have faith in the AI narrative.

Dell is one of those legacy companies that produce a great deal of enterprise products.

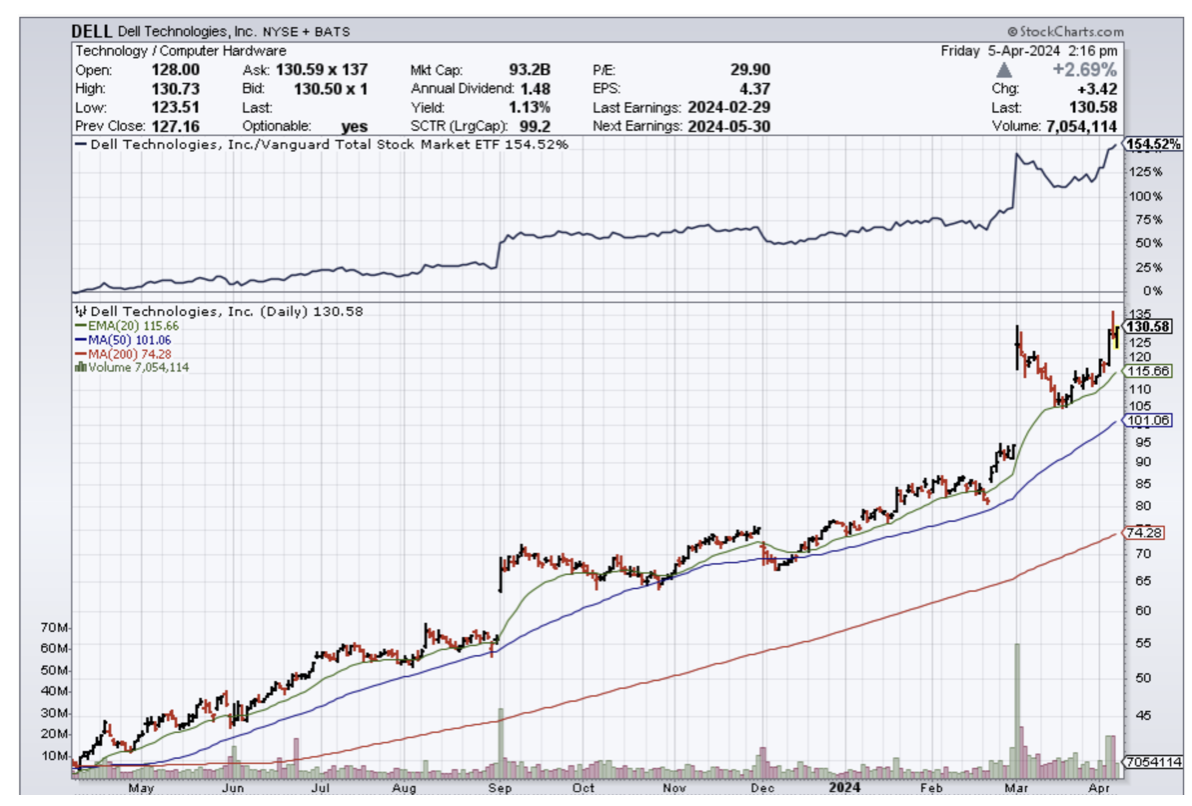

The stock went nowhere for a long time but now it is different.

Mixed into their earnings story was a torrent of negative numbers like the company's net revenue was down 14% year over year in 2024 and down 11% in Q4.

A weak PC market isn't helping its numbers. And the drop in revenue led to a 10% drop in full-year operating income.

Dell stock nevertheless has crushed in the short term to churn out all-time highs.

Investors are solely focused on Dell’s potential with artificial intelligence (AI).

Peeling back the numbers, Dell suddenly has a massive backlog of orders for its AI-optimized servers.

They are finally relevant after so many years out to pasture.

Dell is driven in particular by strong demand for AI servers powered by Nvidia H100 chips.

The company said at the time that its backlog of orders for AI servers at quarter end had reached $2.9 billion, up from $1.6 billion in the previous quarter and $800 million two quarters earlier.

Dell also said that it has a pipeline of interest in AI servers that is “multiples” of its current backlog.

And the company said at the time that there is additional demand for servers powered by AMD’s (AMD) pending MI300 GPU and for the next generation of Nvidia (NVDA) chips.

One still on the horizon is the emergence of AI PCs, which should start shipping later this year from Dell and other PC makers.

Management revealed that by the end of January 2025, one of every five PCs Dell sells will be capable of running AI workloads. They also estimate that the total could double by the end of 2026.

Another business that could see an AI-driven improvement is enterprise storage, which accounted for about 20% of overall revenue in the latest quarter. That business was down 10% in the most recent quarter from the year-earlier period.

Dell's management said that it had $800 million in shipments for AI-optimized servers in Q4 alone which is greater than the $500 million they did last quarter.

There will be many winners and losers in this Game of Thrones tech sub-industry of AI.

Tech firms will go from boom to bust with some even going boom based on pure potential.

That’s how much money is flowing into this segment of tech right now.

Many companies are counting on cloud computing platforms to provide AI expertise and power, but Dell's business is betting on AI-equipped on-premise servers.

These servers make sense for big entities that need on-site installation.

I am not talking about the single guy working from home in his little studio apartment.

I do believe there is a use case for multiple types of set-ups and Dell spearheading the enterprise-style large on-premise servers will be suitable for large corporations that need high amounts of storage capacity.

AI on-site data servers aren’t for everyone, but it has the stock raring to go for the rest of 2024.

Buy the Dell story on big dips until the AI bubble pops.