Diamonds Are Still an Investor’s Best Friend

If you forgot to buy your loved one a birthday present and spent a week sleeping on the sofa, eating canned food, and cleaning out the cat box, you now have a chance to redeem yourself.

Diamond prices have just taken a steep plunge thanks to competition from the new artificial diamonds.

A revolutionary new way of selling diamonds is offered by Blue Nile (NILE) instantly becoming the 800-pound gorilla in the market.

The company cut costs by keeping inventories low, relying instead on a secretive web of anonymous suppliers. Now, second-generation entrants are snapping at its heels and eating its lunch with polished websites, better service, and lower prices, seducing potential customers with free diamond blogs.

Just for fun, I appraised the diamond I bought for my late wife, which I bought from a Hasidic Jew in an alley off of Manhattan’s West 47th Street. He kept his inventory hidden in an envelope in his sock. How times have changed! The two-carat, VVS1, round-cut diamond that I paid $3,000 for in 1977, would fetch $39,800 today. Great trade!

In fact, the $95 billion a year diamond industry is undergoing radical change by moving online, much the same way as the book, music, and travel industries have gone. Your local neighborhood jewelry store is about to get wiped out or become a quaint relic. As a result, global diamond sales are expected to reach $140 billion by 2030.

The US accounts for about half the world market, so the new frugality will be a challenge. That will be offset by flight to safety purchases by inflation wary Americans, and new demand from the emerging market middle class.

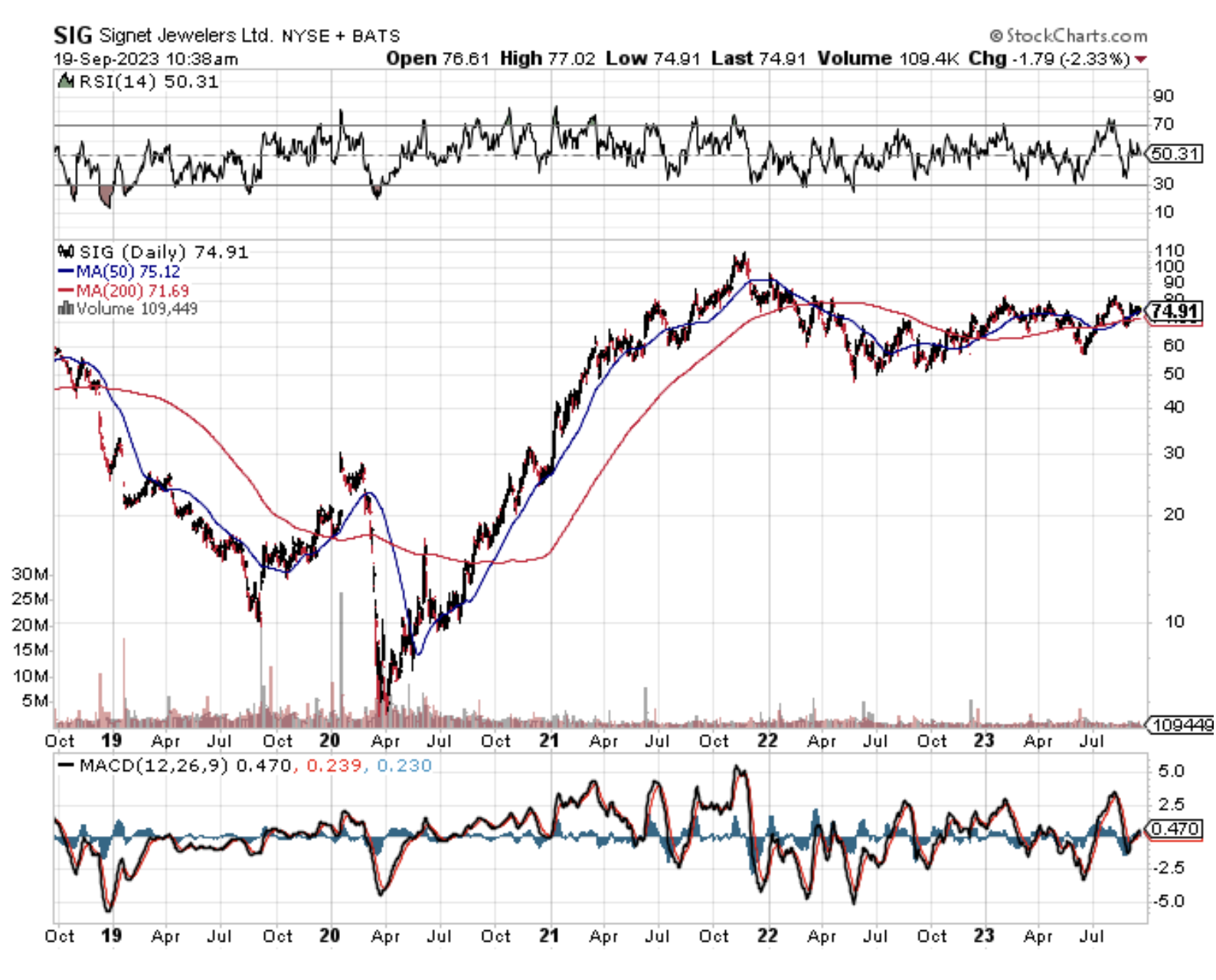

Blue Nile was founded in 1999. It is based in Seattle, Washington. In February 2017, it became a subsidiary of Bain Capital. In 2022, Blue Nile was acquired by Signet Jewelers (SIG), which has seen its stock nearly double from the June lows.

Investment-grade diamonds have been steady earners, gaining an average of 5% a year over the last four decades. To avoid another week on the sofa, you might even think about buying next year’s Valentine’s surprise early.

Like now.