Below please find subscribers’ Q&A for the February 16 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: Is it a mistake to try to be nimble with the ProShares UltraShort 20+ Year Treasury ETF (TBT), or is it better just to hold it through the rest of the year?

A: You should do both; have a core long position which you keep through the end of the year, and you also have a second position that you trade. A good example is how I just took profits on the short iShares 20+ Year Treasury bond ETF (TLT) even though it had a month to run because we had 91.67% of the profit in hand. So, when you get way in the money and still have a lot of time duration left, there’s no point in continuing with these put spreads to catch the last 5 or 10% in the position. The risk/reward is no good.

Q: The iShares 20+ Year Treasury bond ETF (TLT) seems washed out.

A: There is a risk of that, which is why I went long the (TLT) $127-$130 March vertical bull call spread. I think even if we get down to $130, it will take us at least a month to get down that far. There will be several short-covering rallies along the way that we can run out the clock with, and I think even my 3/$127-$130 should expire at max profit.

Q: Should we buy puts or spreads?

A: When you get the CBOE Volatility Index (VIX) over 30, it’s only because you get a very sharp collapse in stocks, and there you’re looking at very deep in the money call spreads— 10-20% in the money can still make you $1,000 or $2,000 a month. And if you get extreme selloffs with (VIX) up to $40, then you’re really looking for long-term LEAPS, one-year call spreads on your favorite stocks, like Tesla (TSLA), NVIDIA (NVDA), and Microsoft (MSFT), and so on.

Q: Is it time to enter Tesla (TSLA) now?

A: I’m waiting for one more final selloff—if we get that, we could get back into the low 800s or even the 700s in Tesla. That's the figure I’m hanging on for, and that's where you get into Tesla LEAPS because Tesla is clearly expanding beyond just the electric car business. SpaceX is now worth $100 billion dollars, and the boring company could be worth just as much if they get more contracts for building underground mass transit. There is also Solar City to consider plus some other stuff they haven’t even announced yet.

Q: What are your thoughts on Google (GOOGL)?

A: The 20 to 1 split is in the price already. But any selloff and I would go back into there with call spreads because Google is a fantastic company and a legal monopoly which I love owning.

Q: What about the ProShares Ultra Technology ETF (ROM)?

A: Yes, I’m watching very closely. It had a huge dive in January, then made back nearly half its losses. So again, I'm waiting for another dip to go back into (ROM) with lots of leverage.

Q: Do we get Volatility Index (VIX) over $30 within 2 months?

A: Yes, I think we probably will. We’re pretty close to it now; we got up to $26 this morning. So yes, I’d be a buyer of that.

Q: Is a (TLT) $128-$131 call spread for March still ok?

A: Yes, I kind of like that. I don’t think we’ll get down below $131 in four weeks, and at the very least we’ll get one rally of several points, and that’ll be your chance to get out of that position.

Q: Is it too early for (TLT) LEAPS?

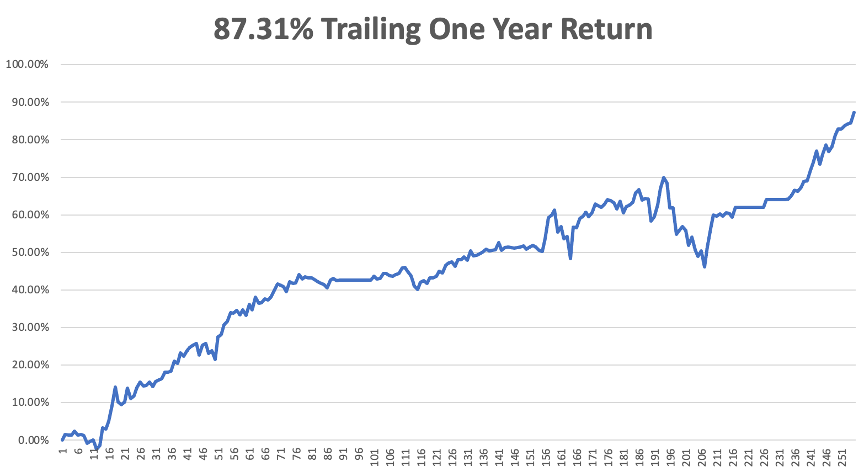

A: No, it’s too late for TLT LEAPS. You should have been doing put LEAPS in November, and everybody who did that got profits of nearly 100% on that position. I don’t see a call side LEAPS in TLT for at least 5 to 10 years when interest rates get up over 6% on 10 year US Treasury bonds. We are a long way from a (TLT) call LEAP.

Q: Are we at a Bitcoin bottom?

A: Possibly, 50/50 chance we go back and retest the lows. We’ll just have to see how Bitcoin behaves in a rising interest rates scenario because ever since Bitcoin was invented, interest rates have been falling. Rising rates are a new thing for Bitcoin and no one knows what that will look like.

Q: When will you update your long-term portfolio?

A: Soon; things have been kind of busy issuing 30 trade alerts a month.

Q: How high will the ProShares UltraShort 20+ Year Treasury bond fund (TBT) go?

A: Looking for $26 from current levels, so yes, much higher to go. And we have a double in three months on (TBT) at the $28 level.

Q: If one believes in the war in Ukraine happening soon, what companies or sectors do you invest in for the short term?

A: None; if we actually do get a war, everything gets absolutely slaughtered, and then you’re looking for the buy. And that will be buys in tech especially. I don’t think there’s going to be a war in Ukraine, but the only things that go up in a Ukraine war scenario are energy stocks (USO), oil companies, and so on.

Q: Do you like China EV stocks?

A: No, I don’t. I visited BYD Motors 15 years ago and they just don’t have the technology, the battery lengths are poor, and they tend to catch on fire. They have never been able to reach American quality standards on any of their cars, not only the EVs but also the conventional internal combustion engines as well..

Q: Which index will outperform in the second half, the Invesco QQQ Trust (QQQ) or iShares Russell 2000 ETF (IWM)?

A: I vote (QQQ). I think we have a technology-led bull market in the second half, and the Russel will be lagging.

Q: What’s better, copper or copper miners?

A: You always go for the miners like Freeport McMoRan (FCX)—they will outperform the physical metal by at least three or four to one, to the upside. That’s also true with gold miners and other derivative plays; the miners always outperform the metals.

Q: What is a bond vigilante?

A: That is a term we heard from the ‘70s and ‘80s when you would get enormous selling of bonds on even the slightest negative piece of economic data or inflation data. They called the bond traders the bond vigilantes because they just crushed the bond market for the slightest transgression on the inflation/economic front. And they are back, by the way, hugely punishing the market as we have seen ($20 points in two months is a lot of punishment) on even the slightest increase in inflation.

Q: Do you have a yearend price for Freeport McMoRan (FCX)?

A: Over $50—just rallied from $30 in September.

Q: Isn’t inflation wildly understated?

A: Yes, you can find individual items that are up 30 or 50%, but the inflation calculation is actually based on 105 different items, and some of them are going down in price. For example, you had an enormous increase in used car prices in December, but they actually went down last month. So, whenever you get a basket this big, eight groups of 80,000 items, you get smaller moves. As anyone will tell you who trades baskets of stocks against the individual stocks, the same mathematical effect happens in the calculation. And while it is being wildly understated now, it’ll be wildly overstated in a few months when we get back to the 3% level, which I am expecting.

Q: What is your TLT prediction after the next 3 or 4 interest rate hikes?

A: Remember, the interest rate hikes only affect the overnight rate. TLT is a 10 to 20-year basket of bonds, so they don’t trade one for one. We may reach a bottom by the end of the year in the (TLT) somewhere in the $120s, but it’s not going to 100 this year and it’s not going to zero like some people are predicting.

Q: The inflation measure is a joke.

A: Yes, it has always been a joke. Any collection of data among 330 million people is going to be inaccurate, late, and have huge lags—but you trade the data you have, not what you wish you had, and that is the real world. I've been trading economic data for 50 years and that is my conclusion.

Q: Martial Law was declared in Canada— is there anything to trade off of that news?

A: No; even a major international event only gets a stock market reaction of usually one day or two at the most. Whatever’s happening on a bridge in Canada, nobody here really cares.

Q: Are you doing a cruise?

A: Yes, I’m doing a Norwegian cruise. Just go to the lunches section on the madhedgefundtrader.com website, and you can still buy tickets. We would love to have you for lunch on the Queen Victoria, a Norwegian Fjord cruise. We’re coming up to payment time on the tickets.

Q: Will there be earnings disappointment in April?

A: Yes, the year-on-year comparisons are going to be difficult. That will be another problem for the market in the spring in addition to the Fed.

Q: What happens with the FOMC out today at 2:00?

A: It will show a heightened fear of inflation and a greater urgency to raise interest rates.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1932 De Havilland Tiger Moth