“Amazon isn’t happening to the book business. The future is happening to the book business,” said Amazon founder Jeff Bezos.

Global Market Comments

December 28, 2020

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEEKING INTO THE FUTURE WITH RAY KURZWEIL),

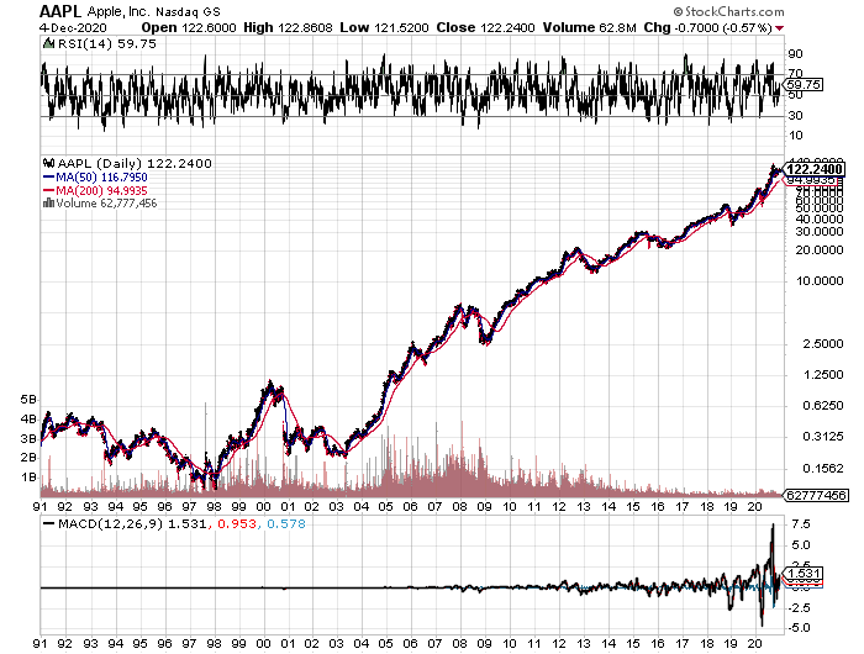

(GOOG), (INTC), (AAPL), (TXN)

Global Market Comments

December 24, 2020

Fiat Lux

Featured Trade:

(TRADING THE NEW APPLE IN 2021),

(AAPL),

(TESTIMONIAL)

Not a day goes by when someone doesn’t ask me about what to do about Apple (AAPL).

After all, it is the world's largest publicly-traded company at a $2.1 trillion market capitalization. It is the planet’s most widely owned stock. Almost everyone uses their products in some form or another. It buys back more of its own stock than any other company on the planet. Oh yes, it is also one of Warren Buffet’s favorite picks.

So, the widespread adulation is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take Steve Jobs around to the big New York Institutional Investors to pitch a secondary share offering for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong, me in my three-piece navy blue pinstripe suit and Steve in his work Levi’s. It was the worst day of my life. Steve was not a guy who palled around with anyone. He especially hated investment bankers.

I got into Apple with my personal account when the company only had four weeks of cash flow remaining and was on the verge of bankruptcy. I got in at $7, which on a split-adjusted basis today is 25 cents. I still have them. In fact, my cost basis in Apple is less than the 84 cents annual dividend now.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years.

And here is the great irony: Nobody would touch the stock with a ten-foot

pole at the end of 2018. Since then, Apple has rallied 71%, creating more market cap in a year than any company in history.

Here’s why. Apple was all about the iPhone which then accounted for 75% of its total earnings. The TV, the watch, the car, iPods, the iMac, and Apple pay were all a waste of time and consumed far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly predictable cycle. Apple launches a major new iPhone every other fall. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out between major upgrades. This is because consumers start delaying purchases in expectation of the introduction of the new iPhones, more power, gadgets, and gizmos.

So during those in-between years, the stock performance was disappointing. 2018 certainly followed this script with Apple down a horrific 30.13% at the lows. Maybe it’s a coincidence, but the previous generation in Apple shares in 2015 brought a decline of, you guessed it, exactly 29.33%.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

This is not your father’s Apple anymore. Services like iTunes and the new Apple+ streaming service are accounting for an even larger share of the company’s profits. And guess what? Services companies command much higher multiples than boring old hardware ones. It’s the old questions of linear versus exponential growth.

An easing of trade relations with China under a new Biden administration will bring a new spring to Apple’s step, where sales have recently been in free fall. Their new membership lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

It all adds up to keeping Apple as a core to any long term portfolio.

Just thought you’d like to know.

Global Market Comments

December 23, 2020

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

Global Market Comments

December 22, 2020

Fiat Lux

Featured Trade:

(A CHRISTMAS STORY),

(MY FAVORITE SECRET ECONOMIC INDICATOR)

Global Market Comments

December 21, 2020

Fiat Lux

SPECIAL END OF YEAR ISSUE

Featured Trade:

(THANK YOU FROM THE MAD HEDGE FUND TRADER),

(MY LAST RESEARCH PIECE OF THE YEAR)

You are in safe hands now, with your trading portfolios up nearly 65% on the year, if you had followed every one of my Trade Alerts to the letter.

I know a lot of you made more, a lot more.

I will be making a beeline for my beachfront estate at Incline Village, Nevada on the pristine shores of Lake Tahoe and work from there for the next two weeks. That is if I can battle my way through the nightmarish Sacramento holiday traffic.

My Tesla Model X packed to the gills with Christmas presents, ski equipment, snowshoes, board games (yes, “Qi” is a word in Scrabble), and my expedition backpack. No extra food this year because the pandemic has barred all guests. Thank you Elon Musk and your P100D!

For proof that after working 12 hours a day, six hours a week, to make you wealthier and wiser, please read my last research piece of the year below, written tongue in cheek with a certain Hollywood film classic in mind.

And what a year it has been. Pandemics, wildfires, economic collapse, lockdowns, recoveries, and a presidential election still being fought out in the courts. It all seems like some cheap Hollywood thriller!

The research I gathered was enough for me to publish 760 letters totaling one million words, including Global Trading Dispatch, the Mad Hedge Technology Letter, the Mad Hedge Biotech & Health Care Letter, and Mad Hedge Hot Tips.

That is about almost double the length of Tolstoy’s War and Peace, but then Tolstoy in his time had to write with a quill and ink, not Word for Windows. I am a writing machine. I haven’t received a single complaint this year that I was not sending out enough content.

I also managed to pump out over 300 trade alerts with a success ratio of 92%. That’s an average of more than one each trading day.

According to the email traffic, many of you did extremely well. If you are into triple digits, please send me an email. I would love to get a testimonial from you. I know that many of you have run out and purchased the new Tesla Model X gullwing P100D with the “ludicrous mode” on my recommendation.

You know that when they are advertising power tools and Pelotons on CNBC, it is time to get out of Dodge. I’ll take the hint.

At Tahoe, I will consume a suitcase full of research and, after much cogitation and contemplation, write my 2021 Annual Asset Review, which I will publish on Wednesday, January 6.

I will also be rethinking my business model, so if any of you have suggestions on how I can improve this service, send me an email at madhedgefundtrader@yahoo.com.

Just put “suggestions” in the subject line. My intention is to never stop improving the product, to always under-promise and over-deliver.

It’s a nostrum of Silicon Valley that whenever you think you're finished, you’re finished.

Please forgive me in advance if I take a few hours catching some “big air” off of Squaw Valley’s treacherous double X black runs.

If you have any trading questions, please seek me out on the northern section of Tahoe Rim Trail around 11,000 feet, where I will be snowshoeing my way around the lake in subzero temperatures.

I will probably be the only guy up there, so you can just follow the first set of tracks you find. That is if hungry mountain lions don’t get you first.

I’ll have my Bowie knife and an industrial-sized can of bear spray, so I’ll be fine. As for you, I’m not so sure. This is what I do during my winter leisure time.

During my absence, I will be posting some of my favorite pieces from the last year which give insights on how markets will play out over the coming decades, and a lot of basic educational pieces.

I have thousands of new subscribers who will be reading these for the first time, and many legacy readers may have missed them the first time around or forgotten the data because they are older than me.

I hope you find them as another useful step towards your education on the global financial markets. Charts and data have been updated to make them relevant.

Finally, I want to thank you all for my incredible life. Thanks to you I have crossed the Atlantic in luxury in the owner’s suite of Cunard’s Queen Mary 2 (My uncle took the Queen Mary 1 in 1943 in somewhat more cramped conditions).

I rode the Orient Express from London to Venice. I lived in the lap of luxury at the Hotel Cipriani in Venice and at the Raffles in Singapore.

And I managed to haggle the merchants in Tangier’s historic bazaar down in the price of the most elegant hand-made carpets.

I had the opportunity to meet heads of state, CEOs, top money managers, our nation’s military leaders, and even a Maori chieftain.

I had the pleasure of flying the length of the Grand Canyon at low altitude as a pilot, weaving my way along the Colorado River. And, oh yes, I made it to the top of the Matterhorn one more time.

I really did get to rub shoulders with the high and mighty who run the world and harvest their pearls of wisdom, which I passed on to you.

I logged 200 hours as a pilot flying to such diverse locations as the Great Barrier Reef in Australia and Honda’s loading docks in San Francisco.

I never minded the horrendous jet lag, the well-deserved hangovers, or the traffic jams in China. Your subscriptions to my services, your support of my research, and your endless compliments made it all worth it.

I always tell people that I am not in this for the money, and it’s true.

Not a day goes by when I don’t receive an email from a grateful reader who claims that I have paid off their mortgage, a kid’s college education, a parent’s uninsured operation, or a child’s chemotherapy.

They tell me that I am teaching them to fish; thus, sparing them from the frozen tasteless kind they sell at Safeway, which they must wait in line to pay inflated prices. You can’t buy that kind of appreciation, not with all the money in the world.

It certainly beats the hell out of spending my retirement scoring a 98 on the local golf course. And I’ll never beat Tiger Woods, no matter how many blonds I date.

To leave you all in the Christmas spirit, I have posted a video and pictures of the Polar Express in Portland, Oregon.

Taking my family for a ride has become an annual event, and it is a thrill for my younger kids as well. To watch a short video of one of the largest steam engines in the world, please click here.

Merry Christmas and Happy New Year to All!

Good Trading in 2021!

John Thomas

The Mad Hedge Fund Trader

You Have to Know the Right People to Call This Market

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

All work and no play makes Jack a dull boy.

With Apologies to "The Shining" (1980)

“If the Fed brings a lump of coal in 2020, then they better bring some candy canes for the kids as well,” said Bill Gross, former CEO of bond giant PIMCO.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.