Global Market Comments

April 7, 2020

Fiat Lux

Featured Trade:

(WHY GLOBALIZATION WORKS)

Global Market Comments

April 7, 2020

Fiat Lux

Featured Trade:

(WHY GLOBALIZATION WORKS)

“It looks like consumers are going to continue to do what they do best, which is to spend,” said Brian Jacobsen of Wells Fargo.

Global Market Comments

April 6, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MAD HEDGE GOES POSITIVE ON THE YEAR)

(INDU), (SPY), (VIX), (VXX), (AMZN), (MSFT), (BAC), (JPM)

There is no doubt that the Corona pandemic will be the WWII challenge of our generation. Since we are Americans, we will rise to the task. We all have our jobs to do, being it working as a front-line medical professional, or simply staying at home.

We will get through this.

I was standing in front of a Reno gun store yesterday waiting my turn to enter. Under Nevada’s strict shelter-in-place rules, only one person is allowed to enter a store at a time. I needed some ammo and black powder for my 1860 Army Colt revolver, which is hard to find in California.

I struck up a casual conversion about the pandemic with other waiting customers on a clear, brisk Nevada morning. A blue-collar worker with an AR-15 said he really wasn’t paying attention to it. A latino gang member with a heavily tattooed neck and fingers looking for a box of 9mm Glock shells confessed he hadn’t heard about it. A white nationalist with a heavily militarized SUV argued that the whole thing was a left-wing conspiracy meant to discredit Donald Trump.

Which can only mean one thing.

The worst days of the of the pandemic are ahead of us, as are the consequences for the stock market. Remember, 40% of the country don’t read newspapers or watch the news and are only barely aware of the seriousness of the disease.

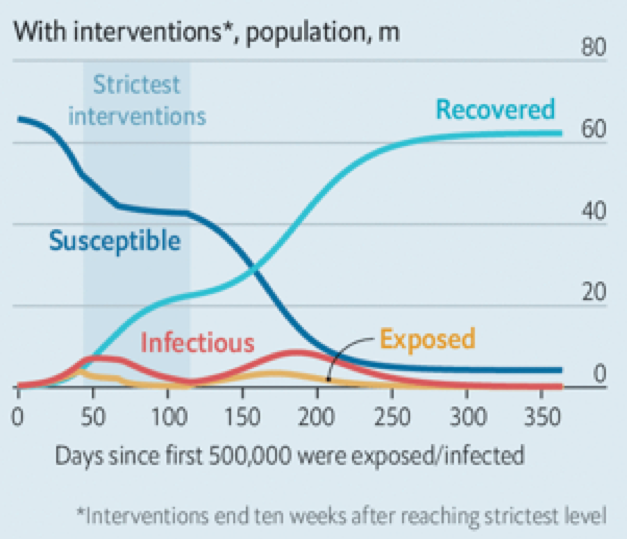

The White House us currently forecasting 12 million cases and 250,000 deaths. That’s just an optimistic guess. Only one third of the country started their shutdowns early, one third were late, and the last third not at all. This means that the highest death rates will be in southern and midwestern states that are following the presidents advance and dismissing the pandemic out of hand, refusing to wear face masks.

So, we are really looking at a potential US 120 million cases and 2.4 million deaths. On that scale the food distribution system will start to break down for shear lack of workers. No one really knows how effective shelter-in-place will be, although the early data is encouraging. We are all living in one giant experimental petri dish right now.

And we will be the lucky country. Deaths in the Southern Hemisphere, which is just going into the winter, will be much higher.

Anytime I consider adding a long position, I first ask myself how it will stand up against a picture on the front page of the New York Times showing a pile of a thousand bodies outside a local hospital. I saw that sort of thing in Asia a half century ago. Markets will crash.

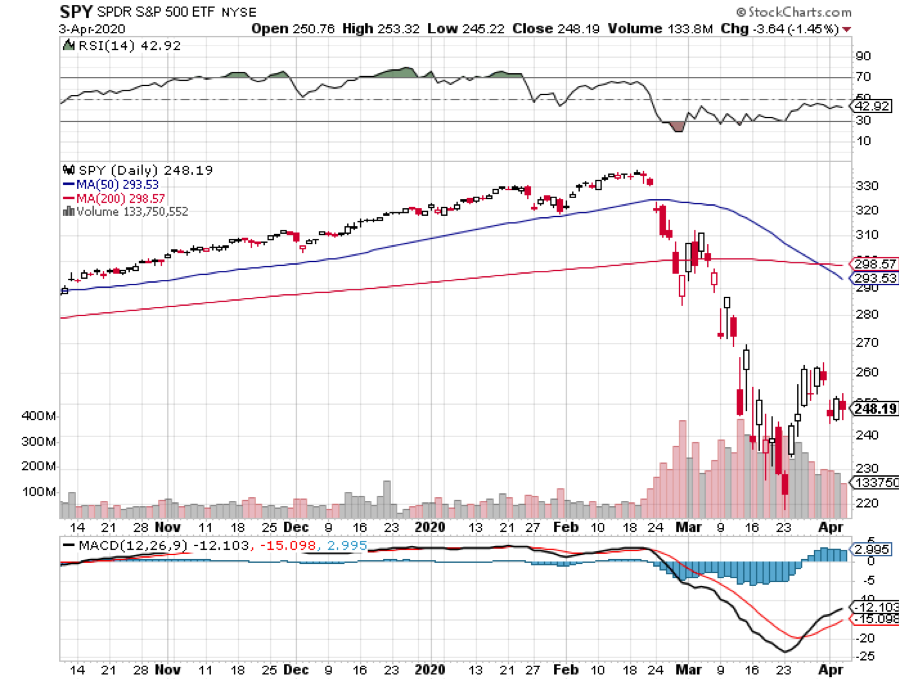

The game we are now in for the coming weeks is to trade an $18,000 to $22,000 range in the Dow Average. The sharp selloff in the Volatility Index (VIX) last week, which we caught with both hands, suggests that the next retest of the $18,000 low will be successful.

Further down the road, I’m not so sure. Any prediction beyond tomorrow in this environment is dubious at best. The world is moving on fast-forward now and the unbelievable is happening every day.

But here’s a shot. If the $18,000 to $22,000 range doesn’t hold, then we are moving to a $15,000 to $18,000 range. If that fails, then we are looking at $12,000 to $15,000 range. Then we will be looking at Great Depression levels of stock market sell-off, with a total corporate capitalization loss of an eye-popping $17 trillion.

The great challenge here is to buy your best stocks and LEAPs as low as possible before an unprecedented $6 trillion in federal stimulus that is coming our way. There will be the $2 trillion in jobs and corporate bailout money already passed, a $2 trillion infrastructure bill coming, and a second jobs and bailout bill that will be needed. On top of that, the Federal Reserve has committed to $8 trillion backstopping of the financial.

And here is the problem. Trump has spent the last three years shrinking the government. The pandemic is a very large government event. So, the Feds may simply not have enough bodies in place to spend, or to lend, all the money that has already been authorized.

That is your economic and market risk.

There is no doubt that the next month will be grim. The U-6 Unemployment Rate published on Friday was 8.9%, indicating the total number of jobless is already at 14.4 million. If the Fed is right and we soon hit 32%, total joblessness will soar to 52 million. During the Great Depression, that unemployment rate peaked at only 25%, throwing 20 million out of work. We could exceed those levels in the coming week!

Dr. Fauci predicts 200,000 US deaths. I think that’s a low number, given that 100 million Americans are still not sheltering-in-place. Corona is starting to take its toll on Wall Street, claiming the life of the Jeffries CFO, Peg Broadbent. Every state and city should prepare for a New York-style spike in cases.

The Fed is expecting 47 million unlucky individuals to lose jobs. This week, Macy’s (M) chopped 150,000, while Tillman Fertitta laid off 40,000 restaurant workers in place like Morton’s Steakhouse and the Bubba Gump Shrimp Company. Many more are to come. Weekly Jobless Claims have already exploded to 6.64 Million. That is three full recessions worth of job losses in two weeks.

The March Nonfarm Payroll Report was a disaster. Here is another number to put in your record book of awful numbers, the report showing 701,000 job losses in March. It’s the first negative number since 2010. Leisure & Hospitality fell by a staggering 459,000.

A second Corona wave might arrive in the fall, warns JP Morgan (JPM). We may not have visited the Volatility Index at $80 for the last time. I’m setting up more (VXX) shorts if we do revisit there. Sell all substantial stock market rallies.

It’s worse than you think. Brace yourself. Bank of America (BAC) has come out with the first GDP forecast I’ve seen that factors in a second wave of Coronavirus cases in the fall. It is not a pretty picture. They see every quarter of 2020 as coming in negative. These easily takes US GDP back to levels not seen since the Obama administration. The only consolation is that (BAC) has never been that great at forecasting the economy, basically leaving it to a bunch of kids. Here they are:

2020 Q1 -7%

2020 Q2 -30%

2020 Q3 -1%

2020 Q4 -30%

Oil rich countries will have to dump $225 billion in stocks, thanks to the collapse of oil to a once impossible $20 a barrel. An 80% plunge in national revenues is forcing asset sales at fire sale prices to avoid a brewing revolutions. They don’t retire former heads of states to golf clubs in the Middle East, they stand them up in front of a firing squads.

Oil Hit an 18-year low at $19.30 a barrel and it could get a lot worse. All of the world’s storage is full, so producers might have to PAY wholesalers to take Texas tea off their hands. Yes, negative oil prices are possible. Otherwise, producing wells will be permanently damaged with a total shutdown. Most of the industry has a negative net worth, save the majors. I told you to stay away!

China PMIs turn positive, coming in at 52 versus an expected 45 indicating a recovering economy. Watch the Middle Kingdom’s economic data more than usual. US PMIs are still in free fall. However, consumers still are staying at home. Their economy went first into the pandemic and will be the first out. There’s hope for us all the quarantine is working.

A $2 trillion infrastructure budget is in the works, and the Democrats will support it because the money won’t be spent until they get control of government in 2021. With most of the construction industry closed, the government’s cumbersome bidding process can’t even start until the summer.

You wonder how that last $2 trillion rescue package got done in five days? This will take us to Great Depression levels of bailout spending. The Fed balance sheet has exploded from $3.5 trillion to $5 trillion in weeks. I know 10,000 bridges that need to be fixed.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had a spectacular week, blasting my performance back to positive numbers for the year. That is thanks to the ten-point collapse in the Volatility Index (VIX) on Thursday and Friday, which had a hugely positive effect on all our positions.

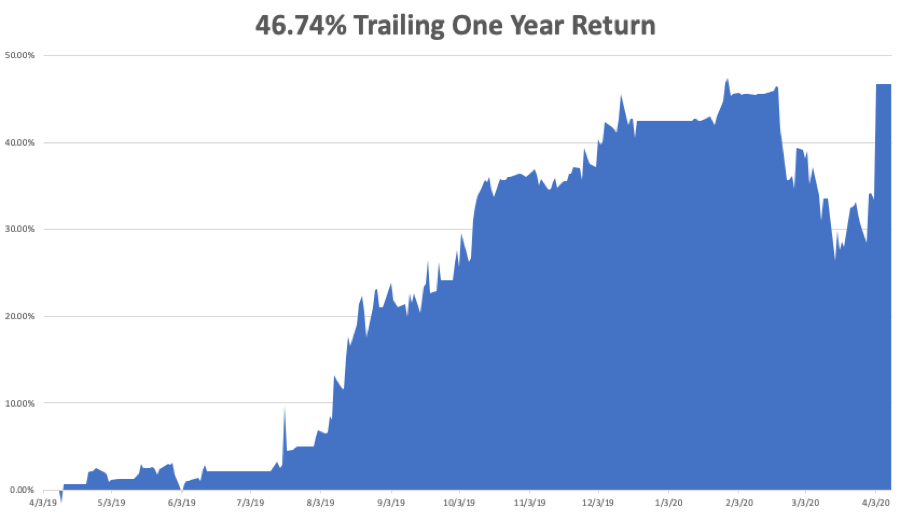

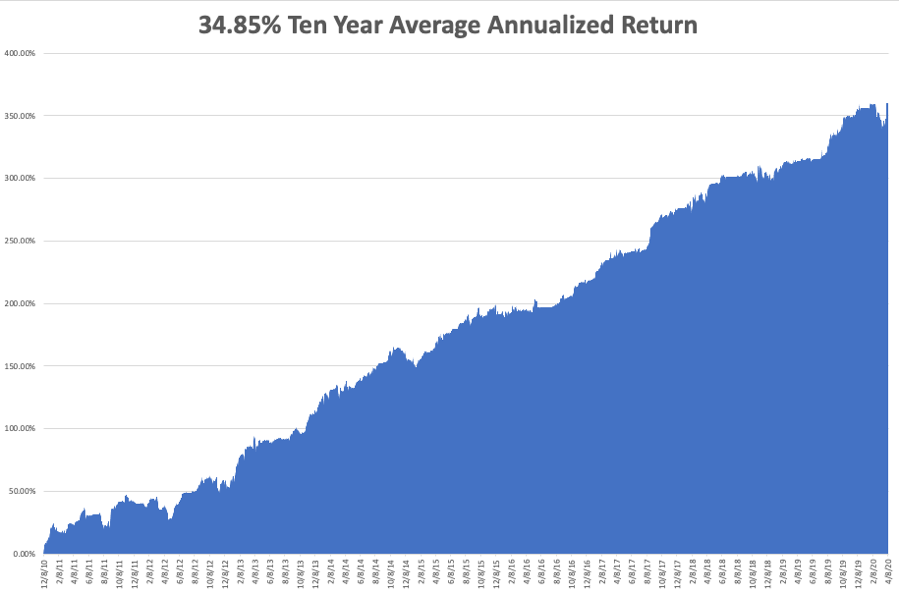

We are now up an amazing +11.02% for the first three days of April, taking my 2020 YTD return up to +2.60%. We are a mere 68 basis points short of an all-time high. That compares to an incredible loss for the Dow Average of -28.8%, with more to go. My trailing one-year return was recovered to 46.74%. My ten-year average annualized profit recovered to +34.85%.

My short volatility positions (VXX) are almost back to cost. I used every rally in the Dow Average to increase my short positions in the (SPY) to almost obscene levels. Now we have time decay working big time in our favor. These will all come good well before their ten-month expiration.

I bought two very deep in-the-money, very short-dated call spreads in Amazon (AMZN) and Microsoft (MSFT), the two safest companies in the entire market, betting that we don’t go to new lows in the next nine trading days.

At the slightest sign of a break in the pandemic, the economy and shares should come roaring back. Right now, I have a 30% cash position.

All economic data points will be out of date and utterly meaningless this week. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here at https://coronavirus.jhu.edu

On Monday, April 6 at 6:00 AM, the Consumer Inflation Expectations for March are out.

On Tuesday, April 7 at 9:00 AM, the US JOLTS Job Openings Report is published.

On Wednesday, April 8, at 2:00 PM, the Fed Minutes for the previous meeting six weeks ago are released.

On Thursday, April 9 at 8:30 AM, Weekly Jobless Claims are announced. The number could top 3,000,000 again.

On Friday, April 10 at 7:30 AM, the US Core Inflation is released. The Baker Hughes Rig Count follows at 2:00 PM. Expect these figures to crash as well.

As for me, I have temporarily moved back to Oakland to retrieve my printer. As I left, my Tahoe neighbors told me I was nuts to go back to a big city. I then drove across an almost totally vacated Golden State, emptied by a pandemic.

With my free time, I have planted a victory garden. I managed to obtain tomatoes, eggplants, chili peppers, strawberries, lettuce, and bell peppers from the nearest Home Depot (HD) garden center. In two weeks, I should have something new to eat.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“This is not a time to go to the grocery store or the pharmacy,” said Dr. Deborah Birx, coordinator of the White House Coronavirus task force.

Global Market Comments

April 3, 2020

Fiat Lux

Featured Trade:

(THE CODER BOOM)

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD)

(AAPL)

Global Market Comments

April 2, 2020

Fiat Lux

Featured Trade:

(THE DEATH OF PASSIVE INVESTING)

(SPY), (SPX), (INDU)

(NOTICE TO MILITARY SUBSCRIBERS)

Global Market Comments

Apri1, 2020

Fiat Lux

Featured Trade:

(DINNER WITH DAVID POGUE)

(TSLA)

(WHY DOCTORS MAKE TERRIBLE TRADERS)

Global Market Comments

March 31, 2020

Fiat Lux

Featured Trade:

(MORE PLAYERS ENTER THE RACE FOR A CORONA CURE)

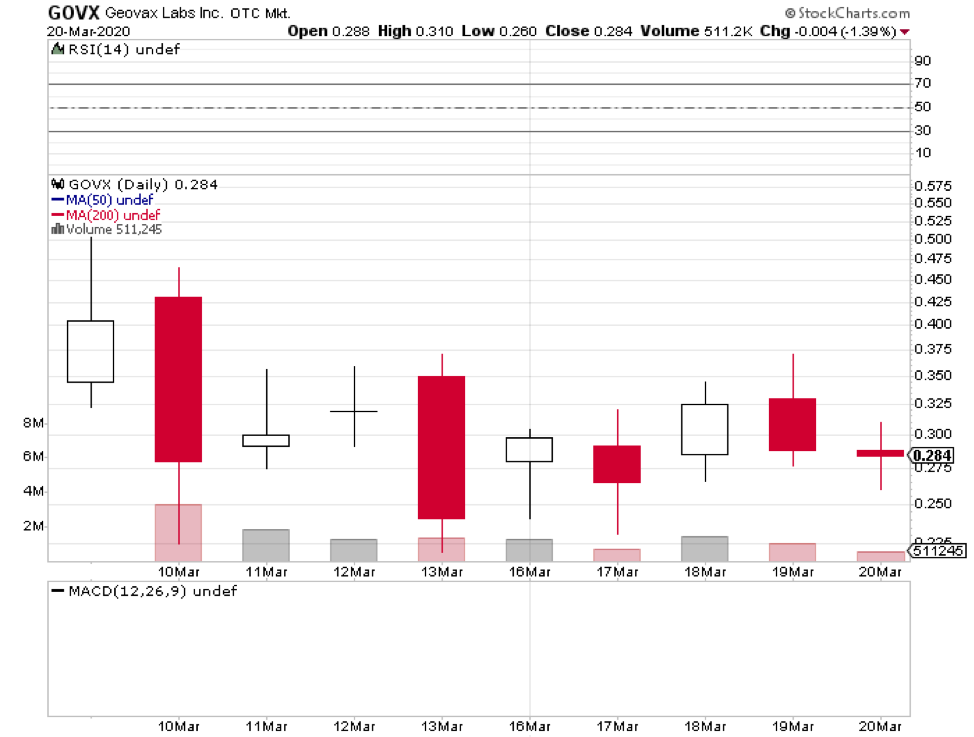

(MRNA), (ARCT), (JNJ), (SNY), (GOVX), (ALT), (NVAX), (GSK), (GNBT), (VXL.V), (INO), (APDN), (CADILAHC)

Special issue on COVID-19 vaccines: Moderna Inc (MRNA), Arcturus (ARCT), Johnson & Johnson (JNJ), Sanofi (SNY), GeoVax (GOVX), Altimmune (ALT), Novavax (NVAX), GlaxoSmithKline (GSK), Generex (GNBT), Vaxil Bio (VXL.V), Inovio Pharmaceuticals (INO), Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC)

The hunt is definitely underway for potential treatments to fight COVID-19 but coming up with vaccines will take a much longer time.

Since we already have the genetic code of the novel coronavirus (click here for the link), researchers can now use the complete blueprint to come up with ways to defeat this disease.

With code in hand, it takes a supercomputer just three hours to create model vaccines. Then it is just a question of how fast you can make them, if at all. Many proposed models are far beyond our existing technology.

To date, there are roughly 35 companies and academic organizations actively seeking ways to come up with a COVID-19 vaccine. While the process will still take time, there are several promising prospects.

Among the companies working on this, Moderna Inc (MRNA) has been recognized as the first biotechnology company to conduct human trials to test its COVID-19 vaccine in March. The trial includes 45 males and non-pregnant females aged 18 to 55.

Moderna’s vaccine utilizes the genetic sequence of the novel coronavirus. Basically, the goal is to build a vaccine out of messenger RNA.

Aside from Moderna, another biotech company called Curevac has been at the forefront of this cutting-edge technology.

In China, RNACure Biopharma has been working with Fudan University and Shanghai JiaoTong University on using the same technique to come up with a vaccine as well.

China’s CDC along with Tongji University and Stermina as well as Duke-NUS in partnership with Arcturus (ARCT) are also using a similar approach.

Although Moderna’s vaccine reached Phase 1 in record time, authorities cautioned that the development time frame is somewhere between 12 and 18 months — and this is even dubbed as an “overly optimistic” timeline.

Meanwhile, there are companies like Sanofi Pasteur (SNY) elected to use previously deployed vaccine platforms in earlier epidemics like SARS.

Johnson & Johnson (JNJ) also decided to employ the same strategy using its Ebola vaccine platform. In fact, JNJ shared that it’ll be ready to conduct human testing of its non-replicating viral vector by November.

Aside from JNJ, another biotechnology company in China called CanSino Biologics (HKG: 6185) in collaboration with the Academy of Military Medical Sciences is utilizing the same technology.

Just last week, Chinese authorities approved CanSino’s Phase 1 clinical trials.

Apart from JNJ and CanSino, other biotechnology companies are also working on a vaccine using the same non-replicating viral vector technology.

The list includes Wuhan’s BravoVax along with GeoVax (GOVX), Altimmune (ALT), Vaxart (VXRT), Greffex, and the University of Oxford.

Another strategy is employed by Novavax (NVAX), which is to construct a “recombinant” vaccine.

In a nutshell, this strategy entails extraction of the genetic code for the protein found on the Sars-CoV-2. This is a part of the virus that can trigger the immune system. This will then be pasted into the genome of a bacterium or yeast.

In effect, this vaccine will force the microorganisms to produce huge quantities of the protein to be able to fight off the virus.

Big biotechnology companies like Sanofi and GlaxoSmithKline (GSK) are following the same technique.

Smaller firms are also in on the action including Generex Biotechnology Corporation (GNBT), Vaxil Bio (VXL.V), EpiVax, and Clover Biopharmaceuticals.

The University of Georgia, Baylor College of Medicine, and the University of Miami are pursuing the same lead as well.

On top of these, several biotechnology companies use a DNA-based approach to come up with a vaccine.

Last March 12, the Bill & Melinda Gates Foundation provided a $5 million grant to Pennsylvania-based biotech firm Inovio Pharmaceuticals (INO) to help the company speed up the tests needed for its DNA vaccine called INO-4800.

This is on top of the roughly $9 million in funding it received from the Coalition for Epidemic Preparedness Innovations earlier.

At the moment, INO-4800 is in preclinical studies with plans to push it to Phase 1 clinical trials by April.

Aside from Inovio, Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC), Takis, and Evivax are also pursuing the same strategy.

Despite implementing the most effective and even draconian measures to contain COVID-19, these tactics only managed to slow down the spread of the virus.

With the World Health Organization tagging this situation as a pandemic, everyone has become more desperate in the search for a vaccine because only a vaccine can stop people from getting sick.

However, even the unprecedented speeds afforded, the biotechnology companies couldn’t change the fact that developing a vaccine requires at least a year. It’s crucial to not make mistakes along the way especially since the product could potentially be injected into most of the world’s population.

After all, there’s only a single thing that can be considered worse than a bad virus — and that is a bad vaccine.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.