Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 20 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: If there is a China trade deal, should I buy China stocks, specifically Alibaba?

A: To a large extent, both Chinese and US stocks have already fully discounted a China trade deal, so buying up here could be very risky. The administration has been letting out a leak a day to support the stock market, so I don’t think there will be much juice left when the announcement is actually made. The current high levels of US stocks make everything risky.

Q: Is it time to buy NVIDIA (NVDA)?

A: The word I’m hearing from the industry is that you don’t want to buy the semiconductor stocks until the summer when they start discounting the recovery after the next recession (which is probably a year off from this coming summer). The same is true for Micron Technology (MU), Advanced Micro Devices (AMD), and Lam Research (LRCX).

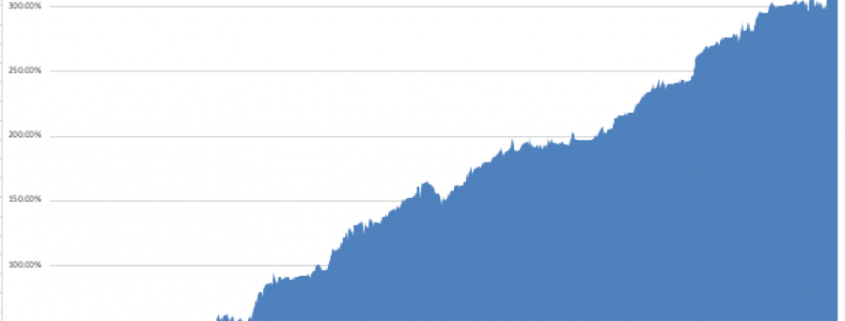

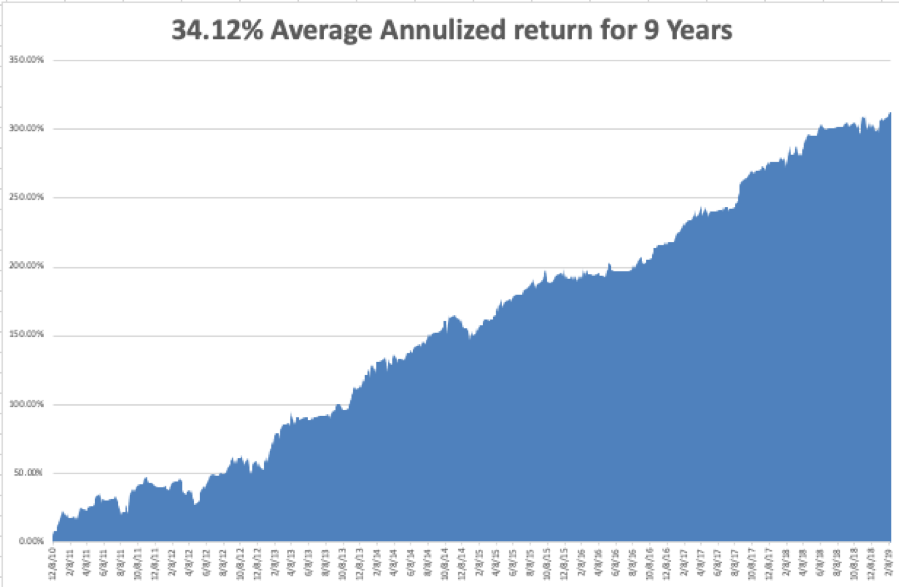

However, if you’re willing to take some heat in order to own a stock that’s going to triple over the next three years, then you should buy it now. If you’re a long-term investor, these are the entry points you die for. Looking at the charts it looks like it is ready to take off.

Q: Should I be shorting the euro (FXE), with the German economy going into recession?

A: No. We’re at a low for the euro so it’s a bad time to start a short. It’s interest rates that drive the euro more than economies. With the U.S. not raising interest rates for six months, maybe a year, and maybe forever, you probably want to be buying the currencies more than selling them down here.

Q: Would you buy the British pound (FXB) on Brexit fears?

A: I would; my theory all along has been that Brexit will fail and the pound will return to pre-Brexit levels—30% higher than where we are at now. I have always thought that the current government doesn’t believe in Brexit one iota and are therefore executing it as incompetently as possible.

They have done a wonderful job, missing one deadline after the next. In the end, Britain will hold another election and vote to stay in Europe. This will be hugely positive for Europe and would end the recession there.

Q: What do we need to do for the market to retest the highs?

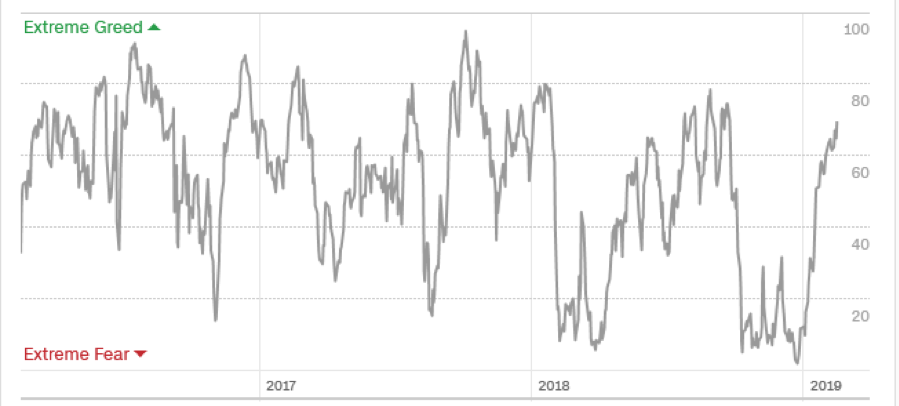

A: China trade deal would do it in a heartbeat. If this happens, we will get the 5% move to the upside initially. Then we’re looking at a double top risk for the entire 10-year bull market. That’s when the short players will start to come in big time. You’d be insane to new positions in stocks here. There is an easy 4,500 Dow points to the downside, and maybe more.

Q: Do you think earnings growth will come in at 5%, or are they looking to be zero or negative?

A: Zero is looking pretty good. We know companies like to guide conservative then surprise to the upside; however, with Europe and China slowing down dramatically, that could very well drag the U.S. into recession and our earnings growth into negative numbers. The capital investment figures have been falling for three months now. US Durable Goods fell by 1.2% in January.

This explains why companies have no faith in the American economy for the rest of this year. This was a big reason why Amazon (AMZN) abandoned their New York headquarters plans. They see the economic data before we do and don’t want to expand going into a recession.

Q: When will rising government debt start to hurt the economy?

A: It already is. Foreign investors have been pulling their bids for fear of a falling US dollar. They have also become big buyers of gold (GLD) in order to avoid anything American, so we have a new bull market there. In the end, the biggest hit is with business confidence.

Nothing good ever comes from exploding US deficits and companies are not inclined to invest going into that. That is a major factor behind the sudden deterioration in virtually all data points over the past month.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader