First of all, I have to apologize for skipping the last Monday Global Strategy Letter, the highlight of my writing week.

I usually write this letter on weekends, but the last one followed Thanksgiving. I thought that 30 years in the future when I am on my deathbed, I’m definitely NOT going to be regretting that I didn’t write one more letter. Instead, I will be asking myself, “Why didn’t I take an extra day off?”

There’s your answer.

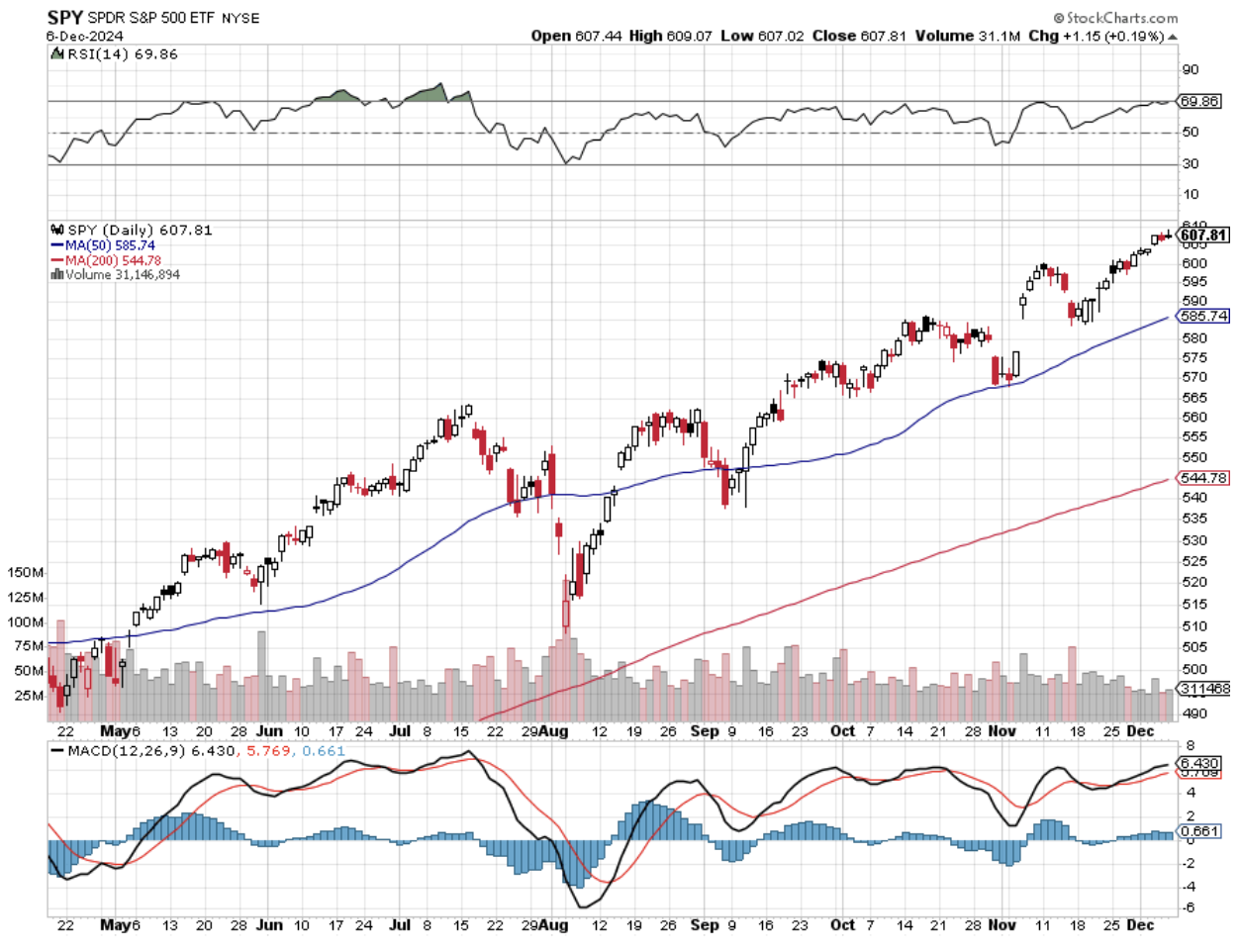

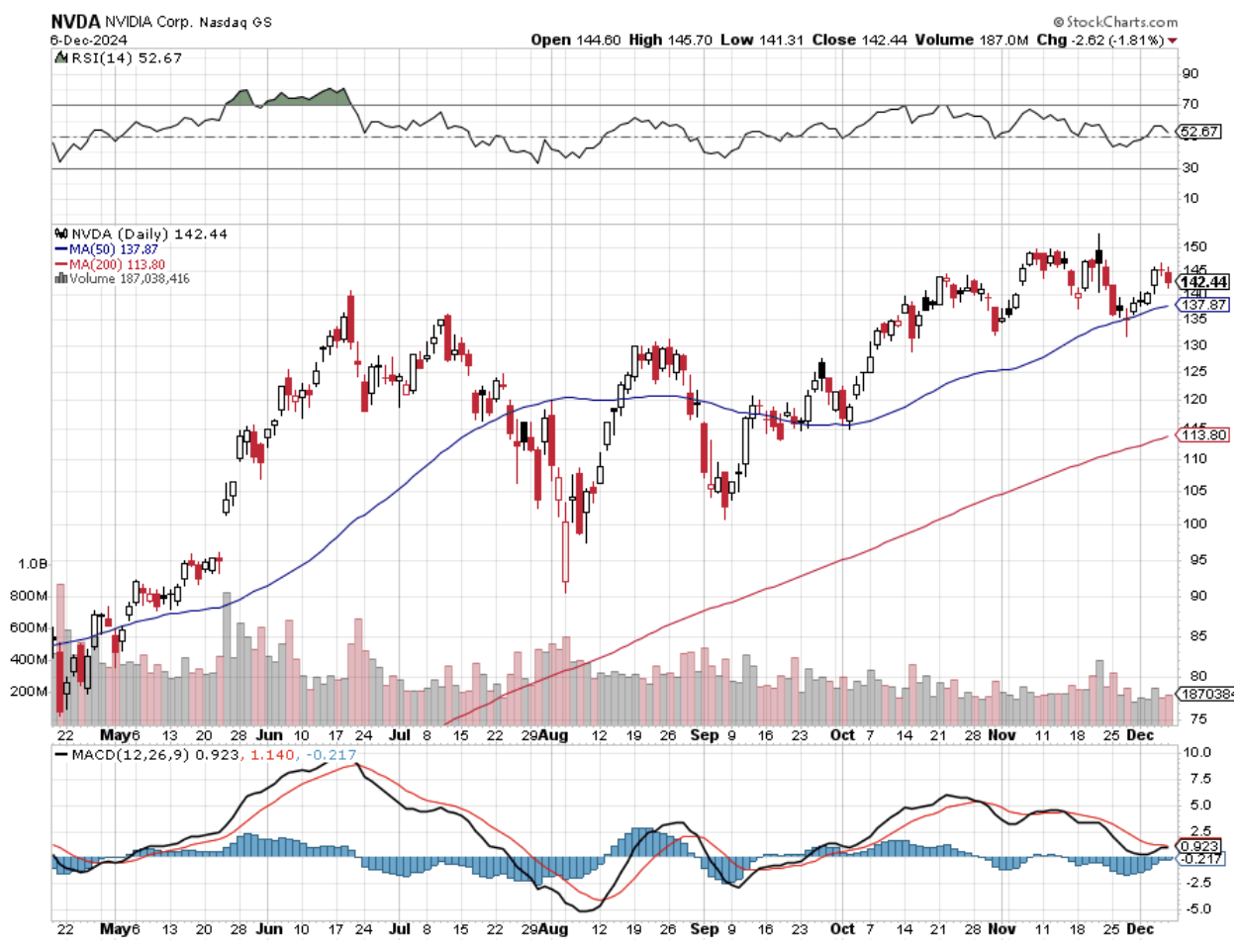

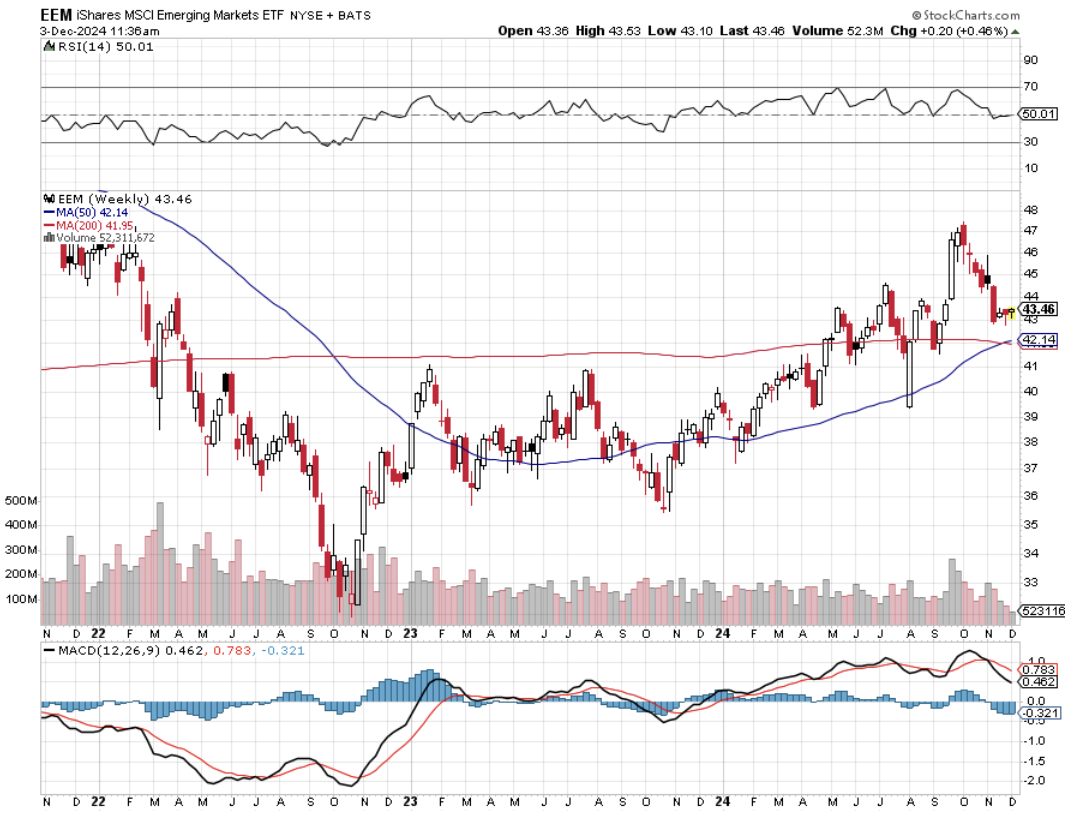

Which leads us to the pressing question of the day. Why has the performance of the Magnificent Seven shares been fading since June? Largely, they have been drifting sideways, and Nvidia (NVDA) is down. Only Tesla has rocketed, thanks to an election push.

This is a big deal because all of you own the Mag Seven stocks as the bulk of your portfolios, with (NVDA) as the single largest position, thanks to spectacular performance (up 10X). This sector has buttered our bread very nicely, thank you very much, allowing Mad Hedge Fund Trader to outperform all others by a huge margin.

The reason is very simple. Their earnings growth rate relative to the rest of the market has been steadily declining. They delivered a 66% performance premium relative to the S&P 500 last year and 22% this year, compared to 3% for the rest of the market and 8% for the market as a whole. That drops to only 11% in 2025.

So, the Mag Seven will continue to perform but at a fraction of the pace of the last two years.

The slowdown is happening largely because these companies have gotten so big. You have three giants with $3 trillion-plus market capitalizations battling it out for the position as the world’s largest company (AAPL), (NVDA), and (MSFT). They are followed by Meta (META) is at $1.5 trillion, (GOOGL) is at $2 trillion, and (AMZN) at $2.2 trillion. Combined, they represent 35% of the total stock market.

That is a lot.

I’ll give you another interesting factoid.

There has not been a single 10% correction in the stock market this year. That has not happened since 1928. What happens when you skip corrections? They bunch up in the following year. We all know what happened in 1929. There has been a massive pull forward of performance from 2025 into 2024.

The bottom line is that we are going to have to work harder for our crust of bread in 2025 and get less of it in return. That is….unless you are a subscriber to the Mad Hedge Fund Trader.

Fortunately, we will still have plenty of new fish to fry. I jumped in with a 100% fully invested portfolio on day one of the new deregulation trend, up 19% in November alone. This has several more months to run.

After That? Ask me in March.

I learned a fascinating statistic the other day. The Labor Force Participation Rate for 75-year-olds and older has doubled to 9% of the total workforce since 1987. My barber is 85, and my seamstress is 84, and there are many more like them.

I happen to be one of these “Never Retirers”. They are going to have to pry my cold, dead fingers off my keyboard. Why quit taking tests when you already know all the answers? Never quitting also has health benefits in that it can substantially extend the quality and quantity of your life. I’ve had many billionaire hedge fund manager friends retire because they earned more money than they could ever possibly spend. All they do now is play golf or waste my time calling me looking for free stock tips.

I have another disincentive to retire. Some 15 people spread all over the US and around the world would lose their jobs. At some time or another, all five of my kids, aged 19-39, have worked for Mad Hedge Fund Trader. Others who own their own companies face the same predicament.

Unfortunately, the US tax system isn’t exactly set up for people like me. When I turn 73 in January, I will be forced to withdraw and pay the maximum income tax rate of 4% of my entire retirement funds, even though I don’t need them. Such is the price of a tax system that was designed in 1937, back when half of all men died before age 65.

However, there are those rare times when I am ready to throw in the towel and cash in my chips. That happens when a customer asks for a refund despite making a +75.25% profit this year. A particularly thick follower when it comes to understanding options trading strategies occasionally pushes me over the edge.

That’s when I look to my role model and mentor, Warren Buffet. He’s still working, and he’s 95.

If you’re worried about a market crash next year, one has already started. Rare Whiskey is down 40% by price and 34% by volume this year. Bottles such as the 50-year-old Macallan Lalique had been selling for as much as 50,000 pounds, while bottles of Bowmore’s First Edition have been going for 15,000 pounds. First, it was hedge fund managers trying to outbid each other. Then, wealthy Chinese piled in.

Overall, Scottish whiskey exports are off 18% this year, thanks to Brexit choking off European markets. Low interest rates had prompted investors to seek out unusual asset classes. But the bubble has popped. American whiskey prices have held up better thanks to the strong economy. But the current high interest rates have scotched that appetite as fixed income offers a more generous and stable return.

Who knows what they will collect next?

Finally, I would be remiss if I did not mention that Saturday was Pearl Harbor Day, December 7. Although the tragic 1941 attack happened before I was born, I know many people who were there on both sides and have accumulated dozens of stories. However, I do have a personal connection with this historic event.

I did my flight training at the Ford Island Naval Air Station. In the 1970’s, they used to say, “No heavy landings, please, because we still haven’t found all the Japanese bombs.”

While in the circuit, you could see the wreckage of the superstructure of the USS Arizona, the battleship that took a direct hit and took town 1,177 sailors. The location has always been kept secret by the Navy because they didn’t want fortune hunters selling souvenirs to the public.

But I know right where it is. Today, only 16 Pearl Harbor veterans survive.

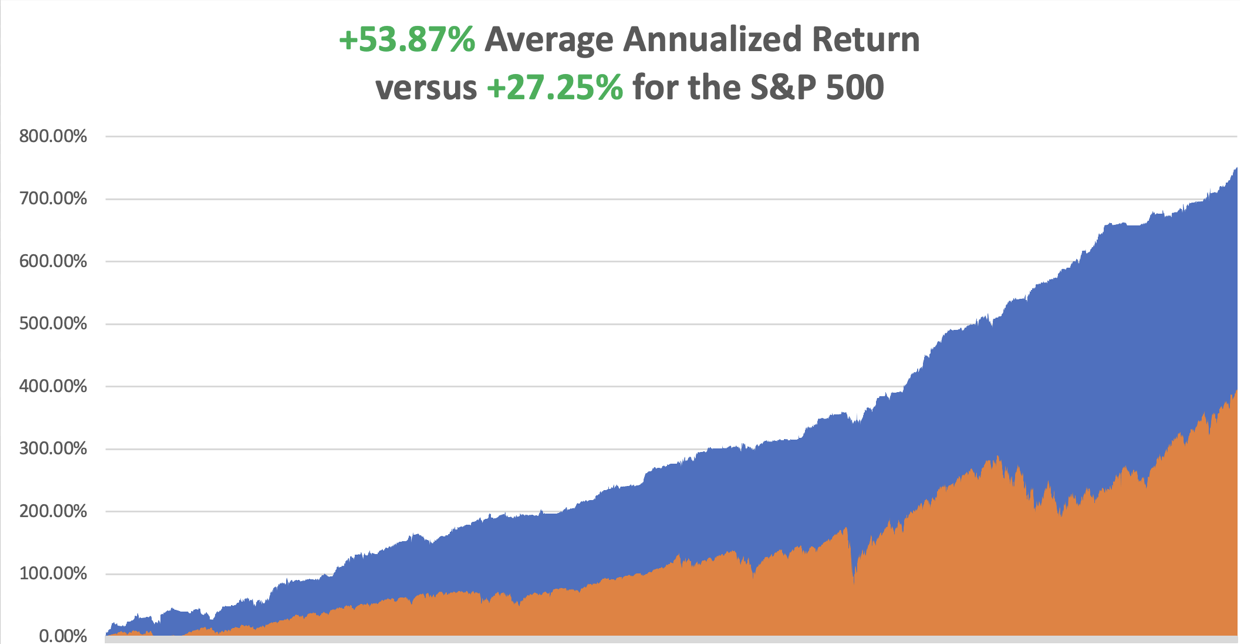

In December, we have gained +1.10%. November proved to be our best month of the year, up +18.96%. My 2024 year-to-date performance is at an amazing +73.10%. The S&P 500 (SPY) is up +24.73% so far in 2024. My trailing one-year return reached a nosebleed +77.04%. That brings my 16-year total return to +749.73%. My average annualized return has recovered to an incredible +53.87%.

I maintained a 100% long-invested portfolio, betting that the market doesn’t drop below pre-election levels. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK) and a triple long in (TSLA). We are now so far in the money with all of our positions we can safely run them until the December 20 option expiration in 9 trading days, thanks to a Santa Claus rally, time decay, and falling volatility.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten Year View – A Reassessment

When we have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, December 9 at 8:30 AM EST, the Consumer Inflation Expectations is out.

On Tuesday, December 10 at 8:30 AM, the NFIB Business Optimism Index is published.

On Wednesday, December 11 at 8:30 AM, the Consumer Price Index is printed.

On Thursday, December 12 at 8:30 AM, the Producer Price Index is announced.

On Friday, December 13 at 8:30 AM, US Import and Export Prices are published. At 2:00 PM, the Baker Hughes Rig Count is printed.

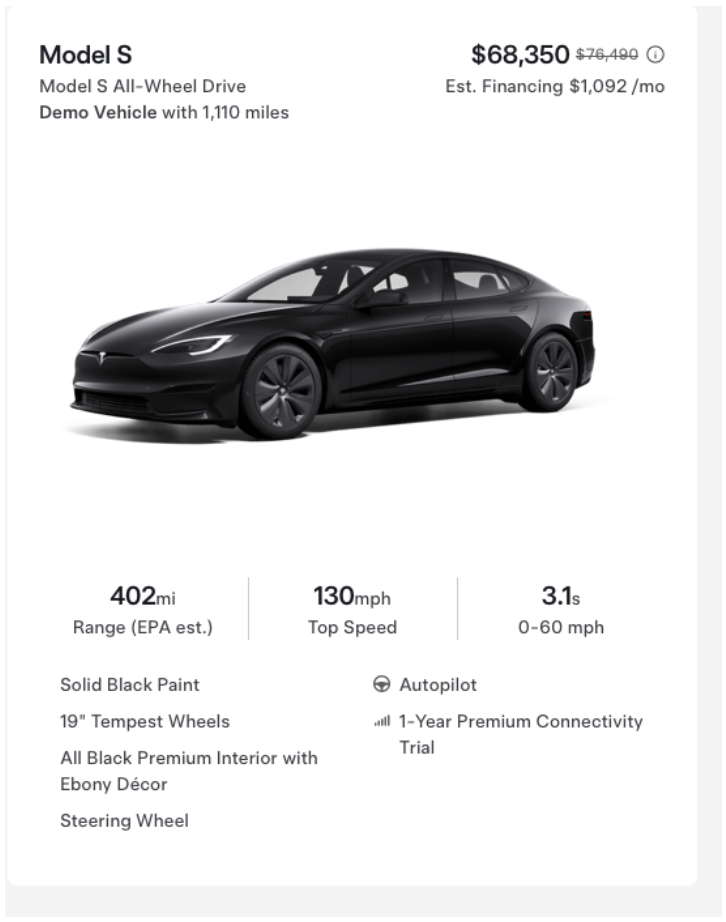

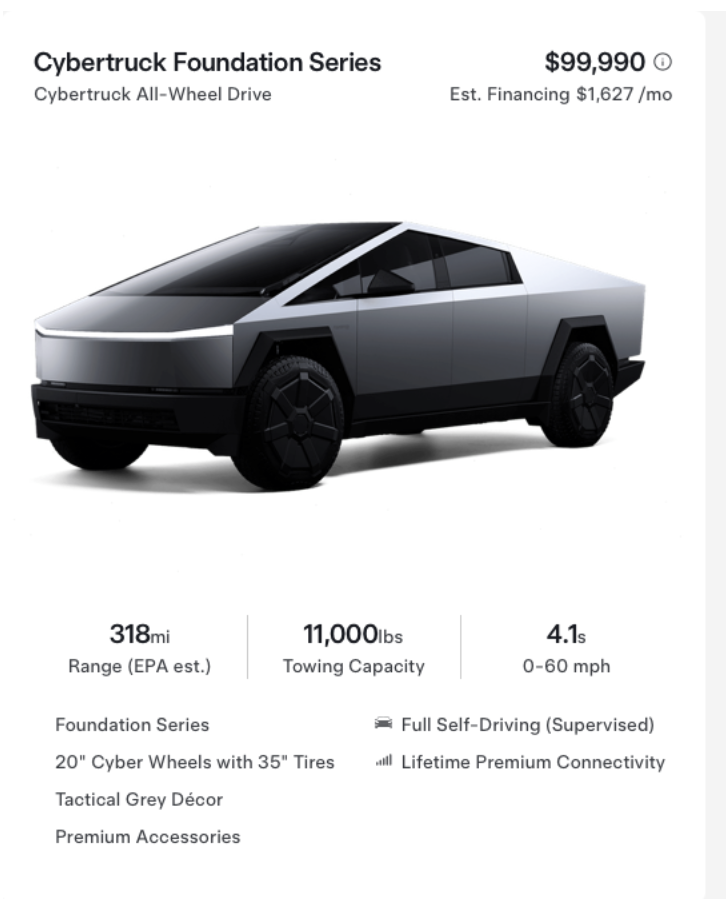

As for me, I have proven yet again that if you buy Tesla shares, you get the car for free. That is the result of the triple-long-in-the-stock I egged followers into right after the election.

So when is the best time to buy a Tesla? That would be right now.

To meet yearend goals, Elon Musk always offers the best deals of the year every December. See below the offers I received yesterday of rock bottom prices, 0% financing, and free recharging. You can get the brand new Cybertruck for $99,990 and the slick Model S for a bargain $68,350.

The Tesla Model S1 (TSLA) has been rated by Consumer Reports magazine as the best car ever built, grabbing a covered 99 score out of 100. It has been ranked by the US Government Department of Transportation as the safest car ever built. Even competitors love the car.

So I decided to see if these vaunted claims were true and crash-test my own $162,500 high-performance Model X P100 on public streets.

Actually, it wasn’t I who made the decision. It was the harried housewife with four screaming kids in the back seat speaking on a cell phone while driving who made that call. She drove her GMC Silverado quad cab pickup truck straight into the side of my Tesla.

All I heard was a loud horn and a big slam as my car spun around 360 degrees. It was like going through aerobatic pilot school all over again.

I jumped out and asked if everyone was alright. They were. All I found were four deadly silent boys and a woman crying over the phone to her husband about how his brand-new truck had just gotten a small dent on the front bumper. I inspected the damage, took pictures (see below), and calculated that her repairs would run about $1,500.

Bottom line on the safety issue? I didn’t even know that I had been in an accident. The vehicle is essentially a giant crumple zone. But it comes at a high price.

All four ultra-thin racing tires tore off the wheels during the spin (expensive). That meant the custom-painted 21-inch wheels had to scrape along the pavement, destroying them (more expensive). After teaching the AAA tow truck guy how to drive it, he hauled it away.

It was then that I learned about the arcane world of fixing Teslas. Since the car is made out of aluminum, no neighborhood body shop can work on it, as it melts at a much lower temperature than steel. Standard welders are not allowed. There are, in fact, only three specialized niche repair shops in the entire San Francisco Bay Area that can work with this ultra-lightweight metal.

Brooks Auto Body of Oakland is one of them. When I stopped by to talk about the job, the owner, a 6-foot 6-inch Korean guy, was in too much of a good mood. I would find out why later. Behind him were 16 other Teslas in varying states of assembly.

News flash: These things are not cars. They are more like giant computers, with an 18-inch screen and a 1,100-pound battery. None of the components looked anything like car parts. Only the wheels belied any connection with transportation.

It took two months to finish the repairs. Since Tesla would only sign off on the car when it was perfect, it was sent back to the factory in Fremont three times for additional realignment and recalibration. The final bill came to $32,000. The good news is that my lithium-ion battery was fine, which would have cost an extra $30,000 to replace.

The really humiliating thing about the entire experience was that I had to drive a KIA Optima loaner until the Tesla was back in action. So, for eight weeks, my life was dull, mean, and brutish. Driving on the freeway, every nut and bolt made its presence felt. And I had to buy gas at those ugly places that sell cigarettes, chewing tobacco, and condoms! Yuck! Once you’ve had electric, you never go back.

All of which brings me to Tesla’s share price, which has just nearly tripled from $140 to $390 as hot money poured into the big momentum names. Let me tell you that the revolutionary vehicle is still wildly misunderstood, and the company has done a lousy job making its case.

The electric power source is, in fact, the least important aspect of the car. Here are 15 reasons that are more important:

1) The vehicle has 75% fewer parts than any other, massively reducing production costs. The drive train has 11 parts, compared to over 1,500 for conventional gasoline-powered transportation. Tour the factory, and it is eerily silent. There are almost no people, just a handful who service the German robots that put these things together.

2) No maintenance is required, as any engineer will tell you about electric motors. You just rotate the tires every 6,000 miles.

3) This means that no dealer network is required. There is nothing to fix.

4) If you do need to repair something, usually, it can be done over the phone. Rebooting the computer addresses most issues. If not, they will send a van to do an onsite repair for free.

5) The car runs at room temperature, not the 500 degrees, in standard internal combustion cars. This means that the parts last forever.

6) The car is connected to the Internet 24/7. Once a month, it upgrades its own software when you are sleeping. You jump in the car the next morning, and a message appears on your screen saying, “We just upgraded the following 20 Apps.” This is the first car I ever owned that improved itself with age, as I do myself.

7) This is how most of the recalls have been done as well, over the Internet while you are sleeping.

8) If you need to recharge at a public station, Tesla has the world’s largest charging network. Tesla has its own national network of superchargers that will top you up in 20 minutes and allow you to drive across the country. (I can’t wait to try out the one in Winnemucca, Nevada, on my next trip to Chicago). But hotels and businesses have figured out that electric car drivers are the kind of big-spending customers they want to attract. So, public stations have been multiplying like rabbits. When I first started driving my Nissan Leaf in 2010, there were only 25 charging stations in the Bay Area. There are now over 1,000. They even have them at Costco.

9) No engine means a lot more space for other things, like storage. You get two trunks, a generous one behind and a “frunk” in front.

10) Drive an electric car, and you can drive in the HOV commuter lanes as a single driver. This also won’t last forever, but it’s a nice perk now.

11) There is a large and growing market for all American-made products. Tesla has a far higher percentage of US parts (100%) than any of the big three (GM is only at 70%).

12) Since almost every part is made on the side at the Fremont factory, supply line disruptions are eliminated. Most American cars are over-dependent on Asian supply lines for parts and frequently fall victim to disruptions.

13) There are almost no controls, providing for more cost savings. Except for the drive train, windows, and turn signals, all vehicle controls are on the touch screen, like a giant iPhone 5s.

14) A number of readers have argued that Tesla really runs on coal, as this is still the source of 16.2% of the US power supply. However, if you program the car between midnight and 7:00 AM (one of my ideas that Tesla adopted in a recent upgrade), you are using electricity generated by the utilities to maintain grid integrity at night that otherwise goes unused and wasted. How much power is wasted like this in the US every night? Enough to recharge 150 million cars per night.

15) Oh yes, the car is good for the environment, a big political issue for at least half the country.

No machine made by humans is perfect. So, in the interest of full disclosure, here are a few things Tesla did not tell you before you bought the car.

1) There is no spare tire or jack, just an instant repair kit in a can.

2) The car weighs a staggering 3 tons, so conventional jacks don’t work. Lithium is heavy stuff.

3) The car is only 8 inches off the ground, so only a scissor jack works.

4) The 21-inch tires on the high-performance model are a special order. Get a blowout in the middle of nowhere, and you could get stranded for days. So if you plan to drive to remote places, Like Lake Tahoe, as I do, better carry a 19-inch spare in the “frunk” to get you back home.

5) If you let some dummy out in the boonies jack the car up the wrong way, he might puncture the battery and set it on fire. It will be a decade before many mechanics learn how to work with this advanced technology. The solution here is to put a hockey puck between the car and the jack. And good luck explaining what this is to a Californian.

6) With my Leaf, I always carried a 100-foot extension cord in the trunk. If power got low, I just stopped for lunch at the nearest sushi shop and plugged in for a charge. Not so with Tesla. You are limited to using their own 20-foot charging cable, or it won’t work. I haven’t found anyone from the company who can tell me why this is the case.

And guess what? Detroit is so far behind in developing this technology that they will never catch up. My guess is that they eventually buy batteries and drive trains from Tesla on a licensed basis, as Toyota (for the RAV4) and Daimler Benz (for the A-Class) already are. All of Detroit’s existing hybrid technologies are older versions similarly purchased from the Japanese (I bet you didn’t know that).

You might also go out and buy a Model S1 for yourself as well. It’s like driving a street-legal Formula 1 racecar and is a total blast. Just watch out for drivers of Silverado’s speaking on cell phones.

Good Luck and Good Trading,

]

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Not Much of a Wait at the Vacaville Supercharger

$1,500 Worth of Damage

$32,000 Worth of Damage

But the Motor Was Fine