Global Market Comments

March 5, 2013

Fiat Lux

Featured Trade:

(THE GREAT YAWN OF 2013),

(INDUSTRIES THAT YOU WILL NEVER HEAR FROM ME ABOUT)

The focus of this letter is to show people how to make money through investing in fast growing, highly profitable companies which have stiff, long-term macroeconomic winds at their backs. That means I ignore a large part of the US economy whose time has passed and are headed for the dustbin of history. According to the Department of Labor's Bureau of Labor Statistics, the eight industries listed below are least likely to generate positive job growth in the next decade. As most of these stocks are already bombed out, it is way too late to short them. As an investor, you should consider this a 'no go' list. I have added my comments, not all of which should be taken seriously. 1) Realtors - Despite a halving of prices, and therefore commissions, the number of realtors is only down 10% from its 1.3 million peak in 2006. This business is dying? for a major rationalization. 2) Pharmaceuticals - With a number of blockbuster drugs seeing patents expire soon and going generic, the downsizing at the major firms has been ferocious. The survivors will merge to cut costs, sending more masses to the unemployment office. 3) Newspapers - these probably won't exist in five years, save the Wall Street Journal and the New York Times, as five decades of hurtling technological advances have already shrunk the labor force by 90%. Go online, or go away. 4) Airline employees - This is your worst nightmare of an industry, as management has no idea what interest rates, fuel costs, or the economy will do, which are the largest inputs into their business. Pilots will eventually work for minimum wage just to keep their flight hours up. 5) Big telecom - Can you hear me now? Nobody uses landlines anymore, leaving these companies with giant rusting networks that are costly to maintain. Since cell phone market penetration is 90%, survivors are slugging it out through price competition, cost cutting, and all that annoying advertising. 6) State and Local Government - With employment still at levels private industry hasn't seen since the seventies, firing state and municipal workers will be the principal method of balancing ailing budgets. Expect class sizes to soar to 80, to put out your own damn fires, and to keep the 9 mm loaded and the back door booby-trapped for home protection. 7) Installation, Maintenance, and Repair - I have explained to my mechanic that the electric motor in my new Tesla S-1has only five moving parts, compared to 300 in my old clunker, and this won't be good for business. But he just doesn't get it. The winding down of our wars in the Middle East is about to dump a million more applicants into this sector. The last refuge of the trained blue-collar worker is about to get cleaned out. 8) Bank Tellers - Since the ATM made its debut in 1968, this profession has been on a long downhill slide. Banks have lost so much money in the financial crisis, they can't afford to hire humans any more. It hasn't helped that 283 banks have closed during the recession, with many survivors merging to cut costs (read fire more people). Your next bank teller may be a Terminator.

Out With the Old

And in With the New

Global Market Comments

March 4, 2013

Fiat Lux

Featured Trade:

(MARCH 6 GLOBAL STRATEGY WEBINAR),

(THE DEATH OF GOLD, PART II),

(GLD), (GDX), (GDM), (FXE), (UUP), (FXB), (GBB), (USO), (CU),

(THE REAL ESTATE MARKET IN 2030),

(TESTIMONIAL)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

GOLD MINERS INDEX (GDM)

CurrencyShares Euro Trust (FXE)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares British Pound Sterling Tr (FXB)

iPath GBP/USD Exchange Rate ETN (GBB)

United States Oil (USO)

First Trust ISE Global Copper Index (CU)

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings. However, I believe that 'forever' may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let's back up for a second and review where the great bull market of 1950-2007 came from. That's when a mere 50 million members of the 'greatest generation', those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1949, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer's who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 35% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 42 million homes. Don't count on selling your house to your kids, especially if they are still living rent free in the basement.

The good news is that the next bull market in housing starts in 20 years. That's when 85 million Millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer's. By then, house prices will be a lot cheaper than they are today in real terms. The next interest rate spike will probably knock another 25% off real estate prices. Think 1982 again.

Fannie Mae and Freddie Mac will be long gone, meaning that the 30 year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

For you millennials just graduating from college now, this is a best case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25-year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That's what people told me when I bought my first New York co-op in 1982 at one tenth its current market price.

Just remember to sell by 2060, because that's when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

Global Market Comments

March 1, 2013

Fiat Lux

Featured Trade:

(TRADE ALERT SERVICE CLOCKS 26% GAIN IN 2013)

(A CONVERSATION WITH THE BOOTS ON THE GROUND),

(DINNER WITH NOBEL PRIZE WINNER JOSEPH STIGLITZ)

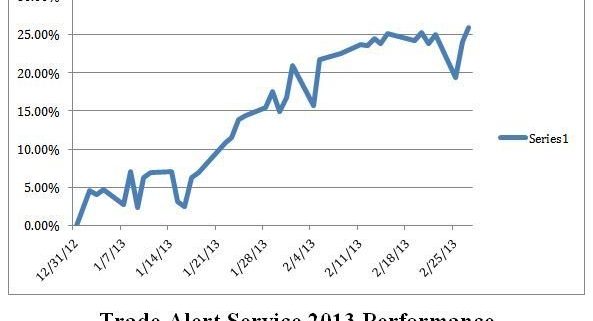

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 26.01% profit year to date, taking it to another new all time high. The 26-month total return has punched through to an awesome 81.06%, compared to a miserable 15% return for the Dow average during the same period. That raises the average annualized return for the service to 36%, elevating it to the pinnacle of hedge fund ranks.

My bet that the stock markets would move sideways to up small during the month of February has paid off big time, as I continued to run sizeable long positions in the S&P 500 and the Russell 2000 (IWM). In the end, the Dow gained only 80 points for the month, an increase of only 57 basis points. My substantial short volatility positions are contributing to profits daily. I booked nice profits from holdings in American International Group (AIG) and copper producer, Freeport McMoRan (FCX). I also prudently doubled up my short positions in the Japanese yen.

It has truly been a month where everything is working. Even my short positions in deep out of the money calls on the (SPY) are substantially contributing to my P&L. While the (SPY) has been going up, it has not been appreciating fast enough to hurt the position. In the meantime, I have been able to dodge the bullets that have been killing off other hedge funds, including those in gold (GLD), oil (USO), and commodities (CORN), (CU).

All told, the last 18 consecutive recommendations of the Trade Alert Service have been profitable. I have eight trades to go to beat this record. Watch this space.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

I have spent many hours speaking at length with the generals who ran our wars in the Middle East, like David Petraeus, James E. Cartwright, and Martin E. Dempsey. To get the boots on the ground view, I attended the graduation of a friend at the Defense Language Institute in Monterey, California, the world's preeminent language training facility.

As I circulated at the reception at the once top-secret installation, I heard the same view repeated over and over in the many conversations swirling around me. While we can handily beat armies, defeating an idea is impossible. With the planet's fastest growing population, Muslims are expected to double from one to two billion by 2050, the terrorists can breed replacements faster than we can kill them. The US will have to maintain a military presence in the Middle East for another 100 years. The goal is not to win, but to keep the war at a low cost, slow burn, over there, and away from the US.

I have never met a more determined, disciplined, and motivated group of students. There were seven teachers for 16 students, some with PhD's and all native Arabic speakers. The Defense Department calculates the cost of this 63-week, total emersion course at $200,000 per student.

They are taught not just language, but also the history, culture, and politics of the region as well. I found myself discussing at length the origins of the Sunni/Shiite split in the 7th century, the rise of the Mughals in India in the 16th century, and the fall of the Ottoman Empire after WWI, and this was with a 19 year old private from Kentucky whose previous employment had been at Wal-Mart! I doubt most Americans her age could find the Middle East on a map. Students graduated with near perfect scores. If you fail a class, you get sent to Afghanistan, unless you are in the Air Force, which kicks you out of the service completely.

As we feasted on hummus and other Arab delicacies, I studied the pictures on the wall describing the early history of the DLI in WWII, and realized that I knew several of the participants. The school was founded in 1941 to train Japanese Americans in their own language to gain an intelligence advantage in the Pacific war. General 'Vinegar Joe' Stillwell said their contribution shortened the war by two years. General Douglas McArthur believed that an army had never before gone to war with so much advance knowledge about its enemy. To this day, the school's motto is 'Yankee Samurai'.

My old friends at the Foreign Correspondents' Club of Japan will remember well the late Al Pinder. He spent the summer of 1941 photographing every Eastern facing beach in Japan, successfully smuggled them out hidden in a chest full of Japanese blow up dolls and sex toys. He then spent the rest of the war working for the OSS in China. I know this because I shared a desk in Tokyo with Al for nearly ten years. His picture is there in all his youth, accepting the Japanese surrender in Korea with DLI graduates.

I Guess I Should Have Studied Harder

Global Market Comments

February 28, 2013

Fiat Lux

Featured Trade:

(SUNDAY WITH PRESIDENT JIMMY CARTER)

When I heard that our 39th president, former governor of Georgia, and Nobel Peace Prize winner, Jimmy Carter was coming to town, I moved heaven and earth to meet him.

I served in the White House Press Corps as the The Economist correspondent during the latter part of his term, and was dying to get answers to issues that were then classified, or unknowable.

It was tense and politically charged, but a highly productive time. He signed a treaty handing back the Panama Canal, brokered the Camp David accords between Israel and the Palestinians, signed the SALT II Treaty limiting nuclear weapons with the Soviet Union, and normalized diplomatic relations with China.

Then the good will created by these accomplishments went up in smoke when Iran seized 52 hostages by storming the American embassy in Tehran, an ordeal that lasted 444 days. It was a national nightmare and a very dark time for America. That smashed his reelection chances in 1980, and paved the way for Ronald Reagan to ascend to the presidency.

During the seventies, his administration was looking for an American who spoke fluent Japanese and knew Japan?s steel industry inside out. It turned out that I was the only one, having covered the industry on a daily basis for the Sydney based? Financial Review.

I was offered an appointment as Deputy Assistant Secretary of the Treasury for International Affairs, which I turned down because the pay was too low ($15,000 a year for a G-14). It was the biggest mistake I ever made, leaving millions of future potential lobbying fees on the table. Such are the errant ways of youth.

Carter showed up to our meeting in a modest grey suit, red tie, and a thinning mane of pure white hair. He was animated, with a relaxed sense of humor, but answered his questions with rapid-fire succession. Not only was he fully briefed on developments in every country of the world, he personally knew the leaders of many. Touch on issues he deeply cared about, and he responded with fire and brimstone.

One of the great things about interviewing old ex-presidents is that either the events in which they have confidential knowledge have passed their statute of limitations, or they can?t remember if they were classified or not. So having an extended conversation can be very interesting, to say the least. Such was the case with my two hour talk with Jimmy Carter. I will try to summarize what he said.

The former president argues that the United States is now the most unchallenged superpower in history. It is not only the most powerful nation on earth, but in all of human history.

However, despite this unprecedented strength, the country is pulling back from the ideals that made it great in decades past. Once the leader on the environment, we now lag far behind Europe. By using drones to assassinate Americans abroad, we are disavowing the Geneva Convention. Our commitment to human rights has wavered. Half of the 160 prisoners at Guantanamo Bay have never been charged, and are effectively serving life sentences. We now have the largest prison population in the world, up sevenfold in 30 years.

We are the most warlike nation in modern history, and have almost continuously been involved in combat for the past 70 years. The long list of adversaries includes Korea, Lebanon, Vietnam, Cuba, Cambodia, Laos, Grenada, Panama, Nicaragua, Iraq, Serbia, Kosovo, Afghanistan, Iraq again, Somalia, Libya, and most recently Yemen. Next on the menu are Syria, Iran, and Mali. The leadership of many countries live in terror of us. Such a long history of conflict reflects a serial lack of desire to negotiate on our part.

We have retreated from our domestic principles as well. The concentration of wealth at the top continues unabated, with the top 1% seeing a 400% rise in net worth, while the rest of us have seen declines. College tuition has soared from 4% to 10% of family income. Poverty has risen by 31% in just the past five years.

Massive infusions of money into the political system have created a hopeless gridlock in the government, making it impossible to do anything about our problems. His own presidential campaign in 1980 cost nothing, as it was entirely financed with public money. In 2012 both parties spent $6 billion.

Most of this money went into negative TV advertising that so poisons the atmosphere that the winners refuse to talk to each other when they get to Washington. Carter thinks that the Supreme Court?s Citizens United decision, open the way for unlimited anonymous corporate donations, was ?stupid.?

The native of Plains, Georgia said that it was not clear that Iran had decided to develop nuclear weapons, but they certainly had the means to do so. Even if they had such an offensive capability, it is unlikely they would ever use it. Israel has over 200 operational nukes, and the slightest hostile move by Iran would result in them being wiped off the face of the earth. Iran has no desire to commit national suicide.

Nor does North Korea, which has to face America?s 5,000 nuclear bombs. The Clinton administration had a peace treaty written up and ready to sign with Kim Il Sung in the late nineties, ending 45 years of hostilities. Then George W. Bush got elected president and he threw it in the trash. That panicked the North Koreans into a crash program to develop nuclear weapons and intercontinental missiles. The first successful test occurred in 2006.

Carter is a regular traveler to the Hermit Kingdom in order to keep back channels open, where he sees starving children as the cruel face of our economic sanctions. He still believes that North Korea would dump its nukes if we reoffered the peace treaty, when the proper initiatives were taken.

Carter has been visiting China since 1949, when his sub made a brief stop just before the Nationalist collapse. He personally knows the new leader, Xi Jinping, well, and thinks the Middle Kingdom will never pose a military threat to the US. The Carter Center has monitored elections in 650,000 towns and villages there for the past 15 years, where the communist party is not active.

He sees our largest trading partner moving towards full democracy over time. He is assisting in implementing the country?s first Freedom of Information Act. In fact, China has the world?s most rapidly growing Christian population today, with total numbers soon to exceed 100 million. They are also the planet?s largest publisher of the Bible.

The former president is discouraged about developments in Israel, where the Benjamin Netenyahu administration seems hell bent on colonizing the West Bank as quickly as possible. This eliminates the possibility of a two state solution, which the Palestinians and every other country in the Middle East have already said they would sign on to.

Carter sees the Arab Spring as a hugely pro-American development, as every country in which it has unfolded has moved from dictatorship to democracy. But don?t expect every country to elect a leadership in our image. Of course, Egypt is going to choose the Muslim Brotherhood, a country that is 90% Muslim! The new Mohammed Morsi government was the most moderate of several alternatives, and should work well with the US. (He has a PhD in engineering from one of my alma maters, the University of Southern California).

What makes Carter such an interesting person to speak to today is that he has become the most active and hard working ex-president in history. For the last 31 years he has run the Carter Center , a well funded non profit that promotes global peace, advances public health, monitors international elections, and promotes women?s rights.

The Carter Center has just monitored its 93rd foreign election, in the West African country of Sierra Leone. It has almost completely eliminated Guinea Worm, cutting the number of global cases from 3.5 million to only 542. It has treated 75 million cases of trachoma and 12.8 million cases of river blindness.

Despite his strong anti-war stance, Carter insists that he is not a pacifist. He has served on two battleships and three submarines, and came to office with more military experience than any other modern president after Eisenhower.

Jimmy Carter grew up on a farm in rural Georgia during the Great Depression. Childhood diversions included raising a great number of different birds and animals, and searching for pottery fragments left by ancient Indians who once inhabited the land.

He wanted to become a naval officer from the age of five, following in the footsteps of an admired uncle in the US Asiatic Fleet of the twenties and thirties. That led him to Georgia Tech, Annapolis, and eight years in the Navy. His specialty was nuclear engineering, and he served on the Seawolf, America?s second nuclear submarine.

Carter?s memory for numbers was nothing less than stunning for someone born in 1924. When he was growing up in Plains, his father charged him with managing the black tenant farmers. He became a second son to many families, often sleeping over in ramshackle shacks sharing bed bug bites.

He paid daily wages of $1 for a man, 50 cents for a woman, and 25 for a child. Finally, the workers went on strike because they were starving. His father threatened to fire everyone to show that organizing labor was futile. But he gave them the quarter raise they needed after the following New Year so they could eat. It was definitely another time and another place. When I told Carter I wanted to be like him when I was 88, he laughed.

I had to ask him about Argo, the Iran hostage rescue movie nominated for Best Picture at the Academy Awards. He said that it greatly overplayed the role of the Americans. After being turned away by the British embassy, the Canadians ended up doing 90% of the work, and bore most of the risk in the effort to spirit six Americans out of the country.

If it were discovered they were hiding Americans, they too would have been overwhelmed and taken prisoner. To observe the letter of the law, the Canadian Parliament met in secret for the only time in its history to give the approval. The facts aside, Carter said Argo was a wonderfully entertaining movie.

That was spoken like a true diplomat.

Global Market Comments

February 27, 2013

Fiat Lux

Featured Trade:

(WHY THE MARKETS COULD CARE LESS ABOUT SEQUESTRATION),

(BE CAREFUL WHO YOU SNITCH ON)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.