Featured Trades: (IS QE3 BACK FROM THE DEAD?)

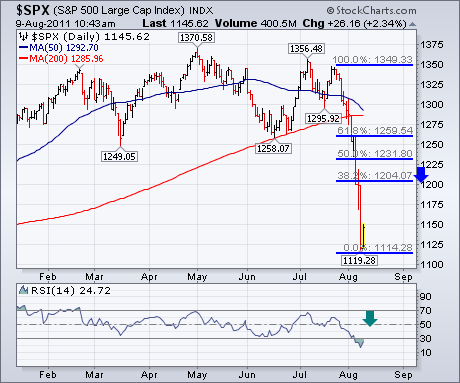

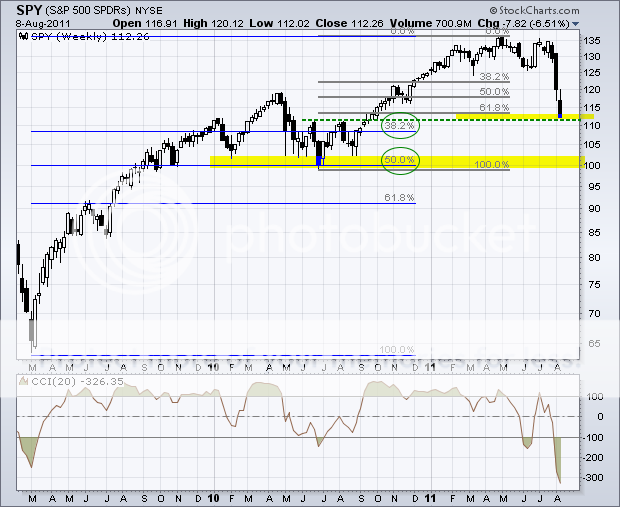

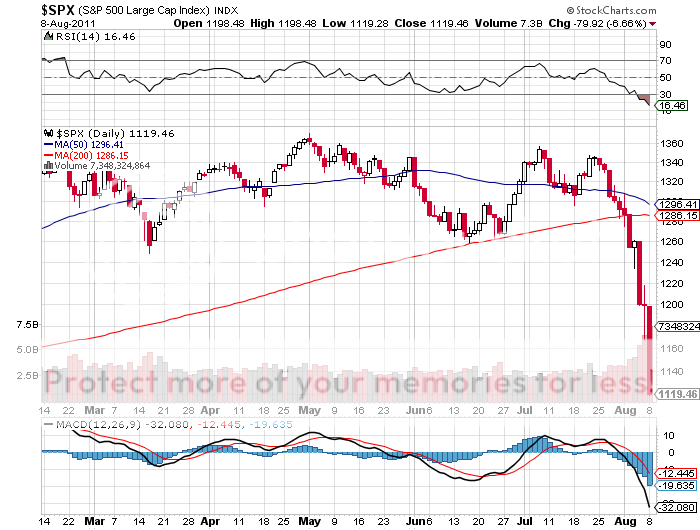

2) Is QE3 Back From the Dead? When I went to bed late last night, the (SPX) was trading down 30 points, and I was thinking 'here we go again'. When I woke up, the market was up 30 points, and I had to blink hard. The overnight range was an unprecedented 60 points, or 560 Dow points. From the July high to the Asian low, the (SPX) has fallen 23% in 12 trading days.

When QE2 ended on June 30th, I argued that there was zero chance of Ben Bernanke moving straight into another quantitative easing program. But as my recent performance has convincingly testified, I can be wrong. Will the market swan dive cause the Federal Reserve to change its mind? Will QE3 come back from the dead?

I still think it unlikely. Remember that a substantial number of Fed hawks, like Richard Fisher, were opposed to QE2, and are even less likely to vote for a QE3. All of the $2.8 trillion in QE1 and QE2 is still out there. The problem is that it is not being used at all. So there is no point in pumping more liquidity into an economy that clearly doesn't want it.

The Fed has a few other tools on its belt that can be put to work. The most obvious one is keep rolling over the existing quantitative easing by taking the proceeds from maturing Treasury bonds and using them to buy new ones. That postpones any Fed tightening. Call this QE2.1.

The Fed can also cut the interest rate that the Fed pays banks for reserve deposits from the current 25 basis points to zero. I am surprised that the Fed hasn't done this already. Of course, this would take away the free lunch that the banks have been feasting on for the last three years.

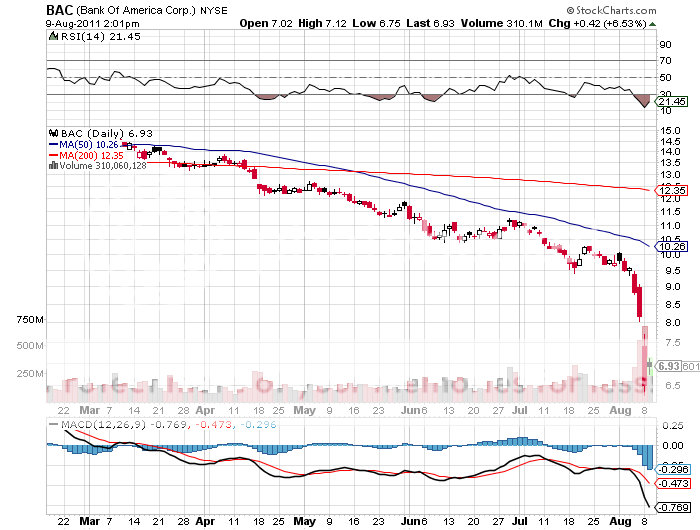

This is one of the reasons why I recommended that readers short Bank of America (BAC) at $12.31 in my April 22 Fox Business Interview (click here for the link). Yesterday, it hit $6.40. By the way, in that interview, I predict a four month sell off in all risk assets that bottoms in August.

Next, the Fed can massage the language in its statements to indicate that it will maintain its accommodative policy for an extended period of time. This could deliver a zero cost confidence boost the markets need. This could happen as early as today.

More extreme measures are unlikely. It could announce that it was buying $1 trillion in mortgage securities to boost the housing market. It could peg the yield for five and ten year Treasury bonds a low level. This is what the ten year Treasury yield at 2.30% is hinting at.

The Fed could also buy equities. I convinced the Hong Kong monetary authorities to do this during the Asian financial crisis in 1998, back when the Hang Seng was trading at 4,000. It was hugely successful, and the government ended up making a huge killing in the market. A similar effort in Japan, which I had nothing to do with, failed.

But the political firestorm this would ignite makes this an outlier. I can already hear the 'government picking winners and losers' arguments. In fact, there is a risk that extreme measures of any kind would signal to the markets that the economy is far worse than it actually is, sending the markets back into free fall.

-

-

Is QE3 Back from the Dead?