Featured Trades: (THEY'RE SHOOTING ALL THE GENERALS),

(GS), (AAPL), (FCX), (GOOG)

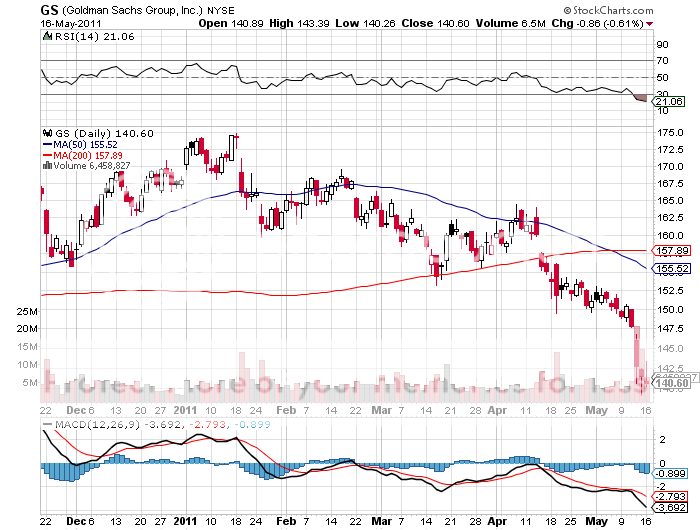

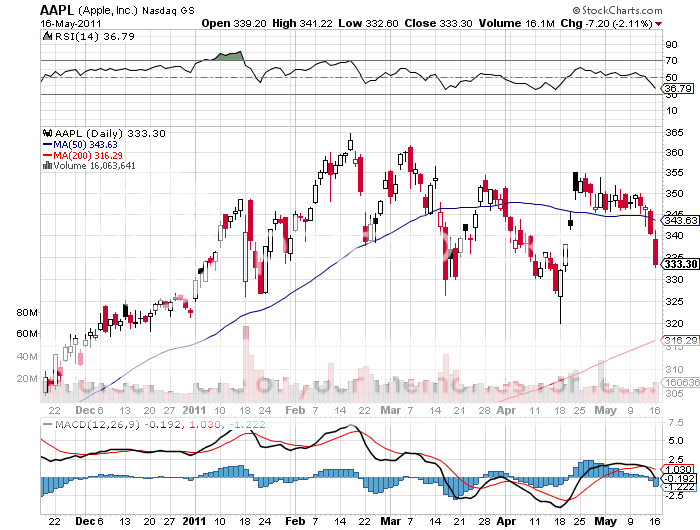

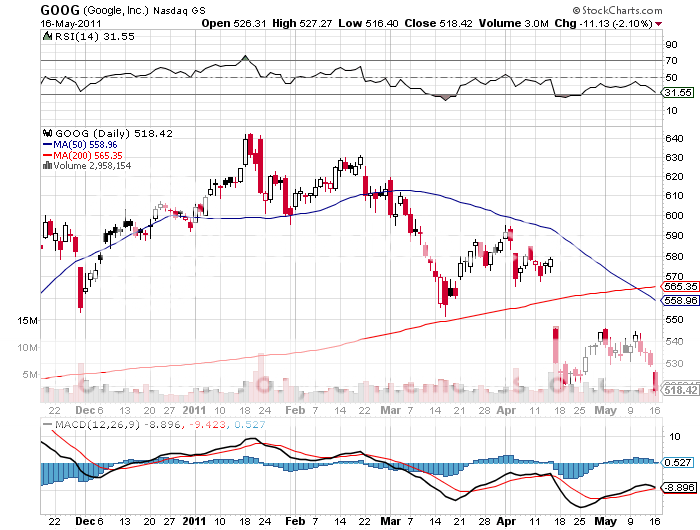

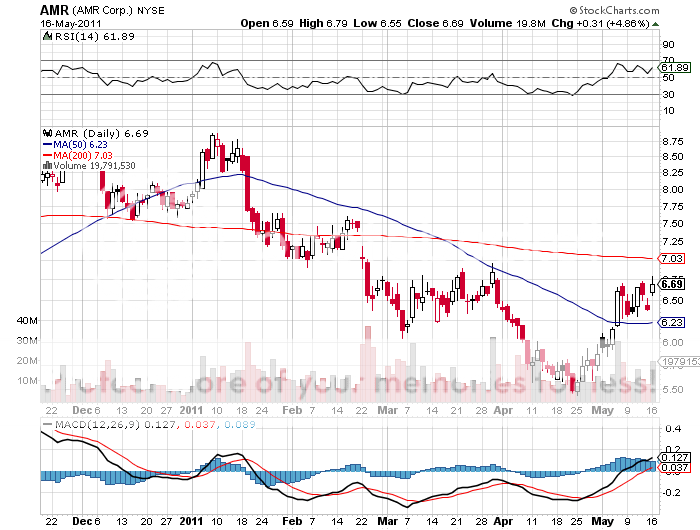

1) They're Shooting All the Generals. Those looking for guidance on the medium term trend in the market better take a look at the best of breed, benchmark stocks for the leading sectors; the companies traders call 'the generals'. I am talking about Goldman Sacks (GS), Apple (AAPL), Freeport McMoRan (FCX), and Google (GOOG). They are all telling us that the market peaked last February, not on April 29, as the indexes are suggesting.

When the charts for the stock prices of the best run companies in the most profitable industries are rolling over like the Bismarck, you know that it is time to bail out. That is why I have been a seller of rallies, not a buyer of dips for the past three months.

If you are one of those cynical, glass is half full, tough to convince investors, then take a look at the chart of the financials ETF (XLF). It also peaked in February and has been in a clear downtrend since. There is no way the S&P 500 can make progress when one of its heaviest sectors is suffering from Montezuma's revenge.

Still unconvinced? Check out the bottom chart of trend lines for the S&P 500, when I lifted from my friend, Dennis Gartman of The Gartman Letter. It indicates that we broke a steep trend line in February and are imminently about to break a much more shallow trend line this week.

The bottom line? The best case is that we are nearly three weeks into a 10% correction that will take us to the 200 day moving average for the (SPX) at 1,234; the worst case is that a new bear market has started. Look out below!

-

-

-

-

-