Global Market Comments for January 13, 2009

Featured Trades: (PTEN)

1) The 'all clear' signal given by the markets last week has been cancelled. All of the 'feel good' trades, like stronger crude, gold, commodities, and Dow, have all viciously reversed in lockstep. The 'feel bad' trades like a stronger yen, euro yen, and Treasuries have once again reared their ugly poxy heads. There are basically only two trades in the world right now: 'things are getting better' and 'things are getting worse.' Only corporate bonds have held up because they are the cheapest thing out there, and will be the earliest to recover. I have a feeling that this kind of choppy, frustrating, range trading will continue for another six months. Things will become even more difficult to trade when the economic data evolves from all bad, to some good, some bad, later in the year. If you want to trade the market, lie down and take a long nap first. Like until September.

2) Hybrids now account for 2.4% of the severely diminished US car market, and 125,000 of these, or half, are accounted for by Toyota's Prius. The Japanese car maker has been developing this vehicle for more than a dozen years, and has had a competitively priced product on the market that consumers love for eight years. The just launched 2009 model is bigger, more powerful, with better mileage, for the same price. And the company's plug in version, now in fleet testing, which will enable drivers to live a largely carbon free existence, will be available in the US in 2010. Listening to Detroit and its apologists promise Congress they can save their industry with a ground up design of an inferior, later, and more expensive product, shows you how delusional they really are.

3) If you don't like the way the markets have been behaving lately, blame sun spots, which have been appearing in the fewest numbers since 1913. Many days this autumn saw no sun spots at all! Many economic historians are convinced of the validity of this theory. Fewer sun spots correlate with colder winters and agricultural failures, which feed into the economic cycle. Higher wheat and soybean prices this month are already starting to reflect this.

4) After last year's carnage, you can expect the remnants of the hedge fund industry to split in two. One group will inherit large, illiquid fixed income positions, like convertible bonds and subprime CDO's, and evolve into private equity funds, which they should have been all along. The rest will retreat to trading large liquid global positions that did well during the nineties, offering investors quarterly redemptions they now demand. Fees will fall across the board. This is how hedge funds will cope with a new world that is transitioning from excess capital to a capital shortage.

5) The world is drowning in crude. The spot/June contango is now up to an unbelievable $12. This means that you can buy crude today at $38, store it, and resell it for June delivery for $50. The trade has filled 75% of the world's storage capacity, and the balance can be had only for an enormous premium. There are so many dislocations going on in the world economy today that it is hard to keep track of them all.

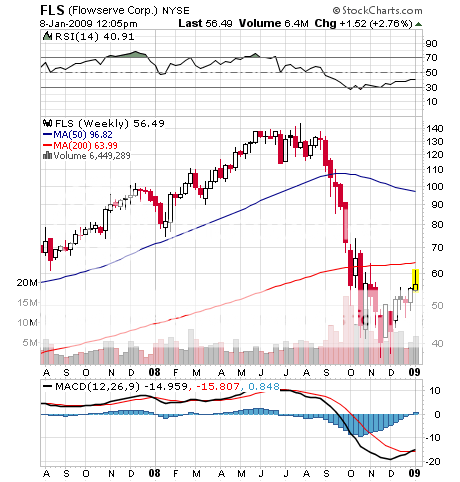

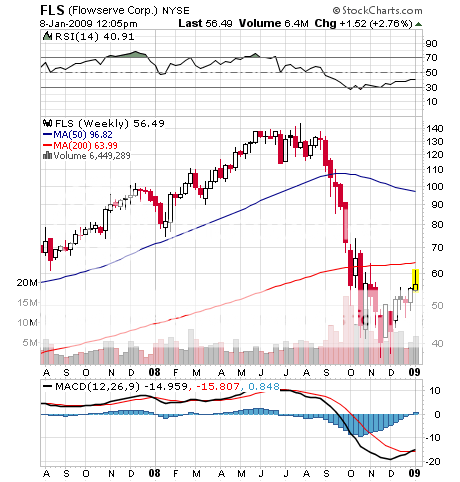

6) I continue to feel like a kid in a candy store with these oil service stocks because I believe they have one more good crude spike in them. Look at Patterson-UTI Energy (PTEN), which operates 403 rigs for oil and gas drilling in the Midwest. The stock has been truly trashed by the oil glut, so the PE is now down to 5 X, and the dividend stands at a generous 5.5%. At its book value you are buying a rig for $5 million, which costs $15 on the open market. This means that it is now cheaper to drill on the floor of the New York Stock Exchange than in an oil field. I did business with these guys in my wildcatting days and they are a standout bunch.

QUOTE OF THE DAY

'Sometimes the end of an old technology is more exciting than the beginning of a new technology,' says comic Jay Leno of his new 650 horsepower SLR McLaren Mercedes.

5) Governor Blagojevich was impeached, the vote coming in at 114-1. Thank you, thank you, People of Illinois, for making California no longer appear as the worst run state in the country!

5) Governor Blagojevich was impeached, the vote coming in at 114-1. Thank you, thank you, People of Illinois, for making California no longer appear as the worst run state in the country!

2) Yesterday, Morgan Stanley led a jumbo 30 year, 7% bond issue for GE credit which was oversubscribed. This is 400 basis points through Treasuries, and is good news for all corporate borrowers. The credit thaw continues, even though stock traders can't see it. 3) The real estate disaster once known as Las Vegas, where 27,000 homes are for sale, continues to probe new lows. Hotel vacancy rates have hit 18%, and you can now get a four day weekend at a top hotel there, including flights from San Francisco, for $200! Construction has halted on the $5 billion Echelon Resorts for lack of financing, leaving a major eyesore on the city's skyline. MGM Mirage's massive City Center complex continues, only because of credit from Dubai. Sitting pretty is the Palms, which is just being completed, but sold out all of its condos two years ago when the market fever was still alive. While 10% of the buyers have walked away from their deposits, the owners are converting these to luxury hotel rooms. 4) The crude market continues to reel after yesterday's stunning inventory figures, with prices down another 5% to $40. The US should buy the fleet of tankers at sea storing crude, and add it to the Strategic Petroleum Reserve at these prices. With unlimited financing, the government is the only entity which can exploit the incredible 40% contango now present in the crude market. While this opportunity is screaming out to every junior trader in the energy pits, it is oblivious to Washington, where, in any case, we are leaderless. It was government buying for the SPR at $140 which put the top in for the crude market.

2) Yesterday, Morgan Stanley led a jumbo 30 year, 7% bond issue for GE credit which was oversubscribed. This is 400 basis points through Treasuries, and is good news for all corporate borrowers. The credit thaw continues, even though stock traders can't see it. 3) The real estate disaster once known as Las Vegas, where 27,000 homes are for sale, continues to probe new lows. Hotel vacancy rates have hit 18%, and you can now get a four day weekend at a top hotel there, including flights from San Francisco, for $200! Construction has halted on the $5 billion Echelon Resorts for lack of financing, leaving a major eyesore on the city's skyline. MGM Mirage's massive City Center complex continues, only because of credit from Dubai. Sitting pretty is the Palms, which is just being completed, but sold out all of its condos two years ago when the market fever was still alive. While 10% of the buyers have walked away from their deposits, the owners are converting these to luxury hotel rooms. 4) The crude market continues to reel after yesterday's stunning inventory figures, with prices down another 5% to $40. The US should buy the fleet of tankers at sea storing crude, and add it to the Strategic Petroleum Reserve at these prices. With unlimited financing, the government is the only entity which can exploit the incredible 40% contango now present in the crude market. While this opportunity is screaming out to every junior trader in the energy pits, it is oblivious to Washington, where, in any case, we are leaderless. It was government buying for the SPR at $140 which put the top in for the crude market.