Global Market Comments for December 9, 2008

Featured trades: (VLCCF), (NYX), (NDAQ), (CME), (ICE), (SYMC), (CHKP), (LFP)

1) The stock market is up nine out of the last 12 trading days, and the Dow is up 1,000 from the post jobs report Friday low. The worst financial crisis in 70 years is being met head on by the biggest reflationary effort in history, and reflation is winning.

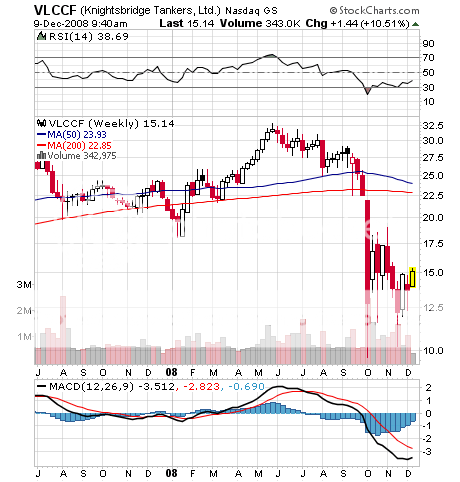

2) Tales of the global storage crisis are running rampant through the crude market, with the majors said to be chartering one to two tankers a day for storage 'on the water.' One potential play here is to buy Bermuda based Knightsbridge Tankers, Ltd. (VLCCF), which owns and operates very large crude carriers. The stock has soared 50% in a week.

3) The four main listed stock and commodity exchanges, which have been decimated this year, all had big bounces yesterday. These include NYSE Euronext (NYX), Nasdaq OMX Group (NDAQ), CME Group (CME), and the Intercontinental Exchange (ICE). These companies earn their money from fees for execution, clearing and settlement, and the provision of data services. The stocks are discounting a worst case scenario, despite seeing trading volume leap 54% this year. Investors are betting that the current stock market selloff will be followed by a nuclear winter of low volume range trading for years. NYX alone has seen its stock dive from $90 to $10, and its P/E multiple shrink from 59 times in 2006 to 6.4 times today. I think these stocks are all strong buys here. They have stable, low cost expenses, geographical diversification, well known brands, own no securities, and carry almost no debt. A certain outcome of the financial crisis will be to drive once opaque and murky derivatives trading, like credit default swaps, on to these listed exchanges, a boon for volumes. They also benefit hugely from the long term trends of globalization and the shift from analogue to electronic trading.

5) The mantle of capital markets bad boy will shift from hedge funds to private equity firms in 2009. These companies, which are unhedged super long leverage funds, employ the most delusional mark to model assumptions and the most generous deferred accounting practices. The sushi will hit the fan next year, when major public pension funds and endowments, who drank from this well too many times, announce horrific multibillion dollar losses. First will come bankruptcies of their many junk grade investments, then implosion of the private equity funds themselves, followed by widespread private equity layoffs. Young MBA's are about to become a dime a dozen.

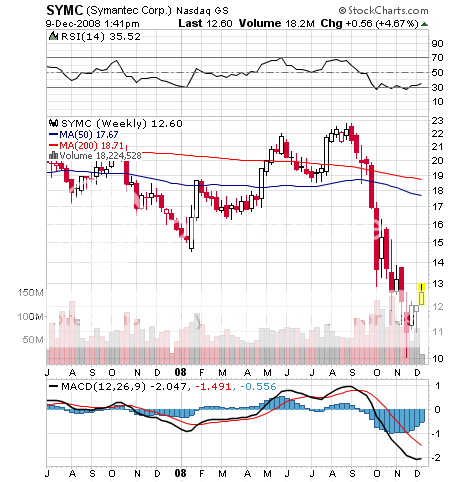

6) One group that doesn't get laid off in a recession is hackers and identity thieves, making security software companies good early recovery plays. They have low average selling prices, rapid returns on investment, large installed bases that have to be upgraded every year, no costs associated with large manufacturing operations, and IT departments that must buy them. Symantec (SYMC) offers end point security for desktops and laptops, and Check Point Technologies Software (CHKP) sells corporate firewall protection. Longtop Financial (LFT) offers the equivalent play in China.

QUOTE OF THE DAY

'Black Man Given Nation's Worst Job' was the headline given Obama's win by The Onion, a satirical publication. After winning 365 electoral votes for the Democrats, the most since the Lyndon Johnson win in 1964, maybe all of our future Presidential candidates will be black.