Dinner with Ben Bernanke

You would never guess Dr. Ben Bernanke was once one of the most powerful men in the world, indeed in all of human history.

There he sat across the table from me in a popular San Francisco Italian restaurant wearing a poorly made grey suit and a cheap pair of shoes, with rubber soles.

Only the occasional interruption from an autograph seeker belied his true importance.

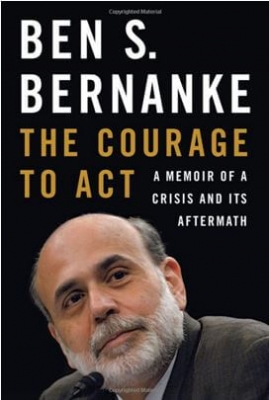

I managed to snare Ben for a couple of hours on his national book tour promoting his just released "The Courage to Act." Out only days, it was already at the top of the New York Times Best Seller list.

Ben is a different guy now. For a start, you can now call him "Ben" instead of "Governor."

Remember those carefully parsed, measured, and deliberate words he used to use to explain Federal Reserve monetary policy and his future intentions? That guy is long gone.

The new Ben is funny, in a subtle, but wickedly clever manner. He is also instructional, thoughtful, even professorial. At the end of the day, Ben Bernanke is now your favorite faculty member.

Ben's big revelation to me was that there were no potential triggers out there for another 2008-09 type financial crisis.

American banks have been recapitalized to the extent that they now have a stronger safety net with which to weather any future volatility. US banks are bigger than ever.

The big global concern right now is with emerging markets, where trillions of dollars worth of US dollar-denominated debt have been borrowed, collateralized by depreciating local currencies.

Another worry is the perceived "Fed put," which is allowing investors to get complacent with their risk-taking.

Bernanke believes that rising income inequality is the biggest structural problem we face. It means that not all are benefiting from an improving economy, a goal of Fed policy.

This has been unfolding for 40 years, and won't be solved in a day, as several presidential candidates are promising.

As a result, the "Horatio Alger" effect, whereby the poorest can rise to success through brains, hard work, and thrift, is now much less likely to occur than in the past.

Bernanke himself is a perfect example of that phenomenon.

Ben and I spoke at length about the dark days of the crash, and he remembered the emails I used to pepper his staff with proposing fixes or patches on an almost daily basis.

Regulation dating from the 1930s had become outmoded and was woefully out of touch with modern-day finance. It was far too lax in the run-up to the crisis.

For example, insurance giant AIG was monitored by the Office of Thrift Supervision, which was utterly clueless when it came to pricing mathematically complex derivatives.

Bernanke warned President Bush as early as 2005 that real estate prices were getting too high and that a crash was coming.

His predecessor, Alan Greenspan, had cautioned during the 1990s that Fannie Mae and Freddie Mac had a flawed business model that would eventually blow up and take down the financial system with it.

In the end, every major financial institution was tottering on the edge.

Bernanke had the benefit of completing his Ph.D. thesis on the causes and mistakes of the Great Depression, once an arcane area of economic study.

Thanks to the laissez-faire philosophy of the 1920s, the Fed let the money supply collapse, and one-third of all banks went under, some 8,000 in total. This froze the entire credit system.

Eight decades later, Ben, therefore, saw the answer to another looming depression in an inflated money supply, which we saw with QE 1, 2, 3, and 4.

He also helped engineer the $700 billion TARP that bailed out the 20 biggest banks, which he described as "the most successful, but most hated government policy in history."

When it was wound down, the US Treasury made a $15.3 billion profit on the program.

Part of the problem in selling the TARP, and later, President Obama's 2009 $831 billion stimulus budget, was that while the crisis started in New York and Washington, it was slow to reach the hinterlands.

One Republican congressman in Iowa called local car dealers in his district and asked what the big deal was. Ben said, "Just wait," and General Motors filed for bankruptcy months later.

I asked Ben who was his favorite president, as he was appointed by both George W. Bush and Barack Obama. He confirmed that he liked working for the two men, but that Bush was the natural practical joker.

When Chairman of the Council of Economic Advisors, Bernanke was required to give a weekly briefing on the state of the economy. Once he committed the grievous sartorial error of wearing tan socks with his trademark grey suit.

Bush complained, stating that the White House had dress standards to maintain.

Bernanke answered that he thought the Bush administration was one of fiscal responsibility, and that he had bought a four-pack of the controversial socks at the Gap for only $10.

When Ben attended the next meeting a week later, he wore the required grey socks with his grey suit. He couldn't help but notice that everyone else at the meeting was wearing tan socks with their navy suits, including the president.

When Bush met Bernanke to discuss his appointment as Chairman of the Federal Reserve in 2006, he asked if he had any political experience.

Bernanke replied that he had served two terms on the Montgomery County, Maryland Board of Education. Bush said, "that was fine."

Bernanke is an extremely intelligent man. You can almost hear the wheels whirring when he is thinking.

I asked him my "gotcha" question.

Wasn't quantitative easing just a means of bridging the demographic chasm of the 2010s, when 85 million baby boomers are retiring? Isn't it just a way to pull growth forward from the 2020s?

He paused for a moment, and then changed the subject.

Finally, I had to ask if Bernanke ever got a chance to read The Diary of a Mad Hedge Fund Trader while Fed Chairman. He diplomatically responded that the "Fed takes great pains to take in all views."

Touch?

To learn more about Ben Bernanke's amazing, "only in America" rise from obscurity, please click the titles "Who Is Ben Bernanke," and "Why Ben Bernanke Hates Me".

To buy "The Courage to Act" at discount Amazon pricing, please click here.