Disaster Management Software Goes Ballistic

In a world where natural disasters and global war has never been more common, there is one tech company whose fortunes are directly correlated in this types of chaos.

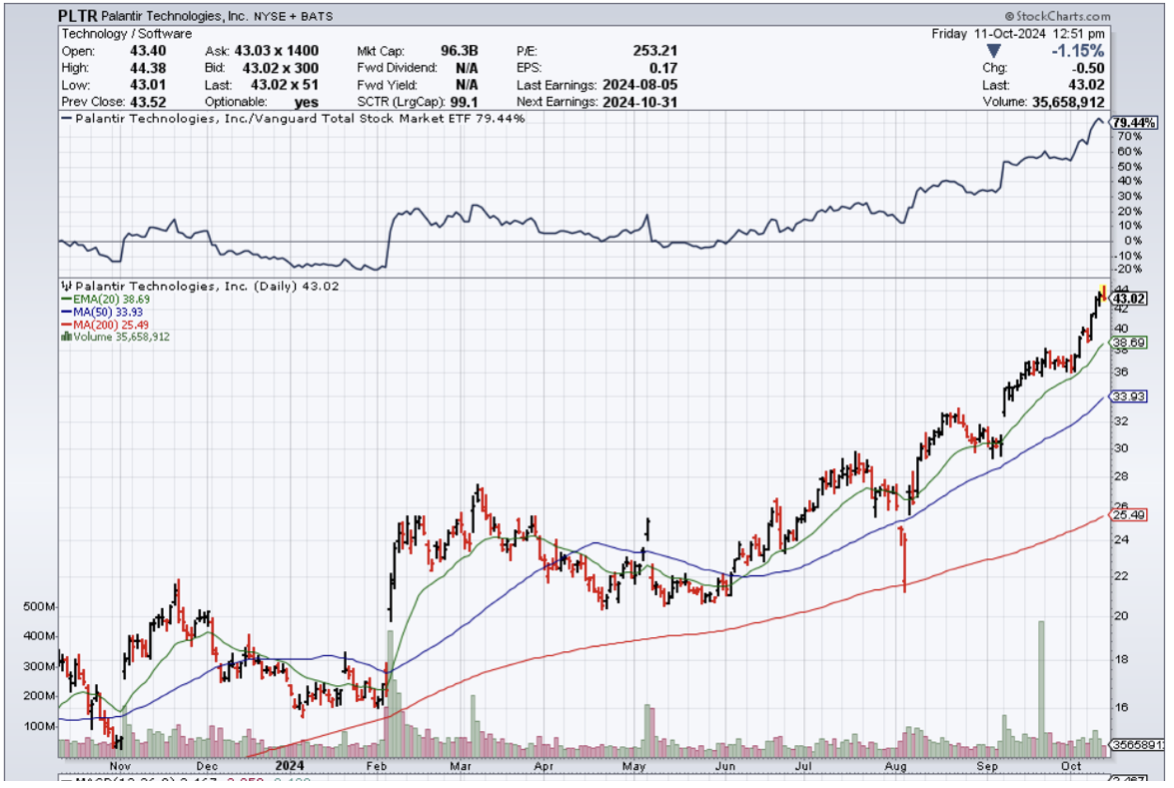

The tech firm and stock is Palantir (PLTR).

They specialize in disaster management software and even can sign contracts to prevent disaster management.

They apply unique software to deliver the best solutions for those they service, whether it is the U.S. military, a Fortune 500 company, or a state government looking at how to best allocate scarce resources during a torrid hurricane.

PLTR knows what to do, when to do it, and in what doses, and in 2024, that is a potent cocktail that has seen the company sign contract after contract.

It was only just a few months ago when PLTR was green lighted for a $99.8 million contract to extend access to the Maven Smart System to all military branches, including the U.S. Army, Air Force, Navy, Space Force, and Marine Corps.

The pact is a five-year firm-fixed price contract from the Army Combat Capabilities Development Command Army Research Laboratory aims to streamline access to current Maven Smart System capabilities, which utilize advanced artificial intelligence and machine learning.

Work is expected to enhance coordination between strategic and tactical operations, allowing the military to make informed decisions and fast actions.

Terms of the contract include support for AI-enabled battlespace awareness, global integration, force management, contested logistics, joint fires, and targeting workflows.

Combat vehicles from every military department will be outfitted by Maven to help them make the best decisions on the ground in real time.

The U.S. military and PLTR are also a common operational piece as part of its response efforts to aid in Hurricane Helene relief.

Maven specializes to facilitate battle space awareness, global integration, contested logistics, joint fires, and targeting workflows, but is being deployed to aid in the hurricane relief efforts.

While common operational tools and data systems have been used for disaster relief in the past, this marks the first time the Maven capability has been used for a hurricane.

The military is working to feed the data it is gathering directly to FEMA and other first responders. That includes general mapping data and data from various sensors that provide insights into things like road closures, communications, force movements, and which areas have yet to be serviced.

The system can also help with logistics by bringing in that data so that in real-time, based on the point of need and survey data from FEMA, food, water, medical supplies, or other goods can be reallocated to the best locations to serve citizens.

I’m not the one to wish ill on the populace, but it is almost a fact that the percentages of calamities that include natural disasters and kinetic wards have increased a great deal during the past 4 years.

There is not a company better positioned to take advantage of this through their best of breed software.

One thing I must note, management often dilutes shares by giving themselves vested shares, the stock tends to sell off big when these executives sell shares.

Wait for a big dip to jump in and ride the volatility higher.