Dominating The Battery Market In Europe

In a sign of the times, the world’s most important EV battery maker is now a Chinese company that is dominating Europe.

It also shows how far Chinese technology has come in terms of value-added products in such a short time.

Europe and Tesla are falling asleep at the wheel and need to figure out how to combat the Chinese from taking over the EV and EV battery industry.

Contemporary Amperex Technology (CATL) is the name, and they plan to expand rapidly in Europe to avoid paying any tariffs on products coming from China.

Circumventing tariffs is the game, and the Chinese are very good at it.

CATL unveiled new technologies and products for heavy-duty vehicles and ships, including a battery with a 15-year and 2.8 million-kilometer lifespan.

The company is already partnering with several European manufacturers, including Daimler Truck Holding, Volkswagen Commercial Vehicles, and Volvo.

It’s involved in early-stage product design as well as research on the infrastructure needed for broader adoption of electrified commercial transport.

CATL is expanding its commercial-vehicle battery business in Europe as the continent moves to slash carbon emissions from trucks, buses, and ships.

It is definitely cheaper to use batteries exported from China, given the maturity of the supply chain there, but the company could ramp up production in Europe based on clients’ needs and other local production requirements.

It already has a plant in Germany, which kicked off production in 2022, and it’s building another in Hungary.

Much like the smartphone business, with every type of technology that the Chinese master, they solve the economies of scale problem and are able to manufacture these products for significantly less than their competitors.

This is why they can sell great driving EVs for $10,000 per vehicle.

Very few companies can compete with China on cost alone.

With inflation staying stubbornly higher and burning a hole in the consumer wallet, many strapped buyers are opting for Chinese substitutes instead of Tesla’s or German EVs.

This is a harbinger for things to come as many lucrative manufacturing jobs in Germany could be lost and replaced by a lower-paid Chinese EV job.

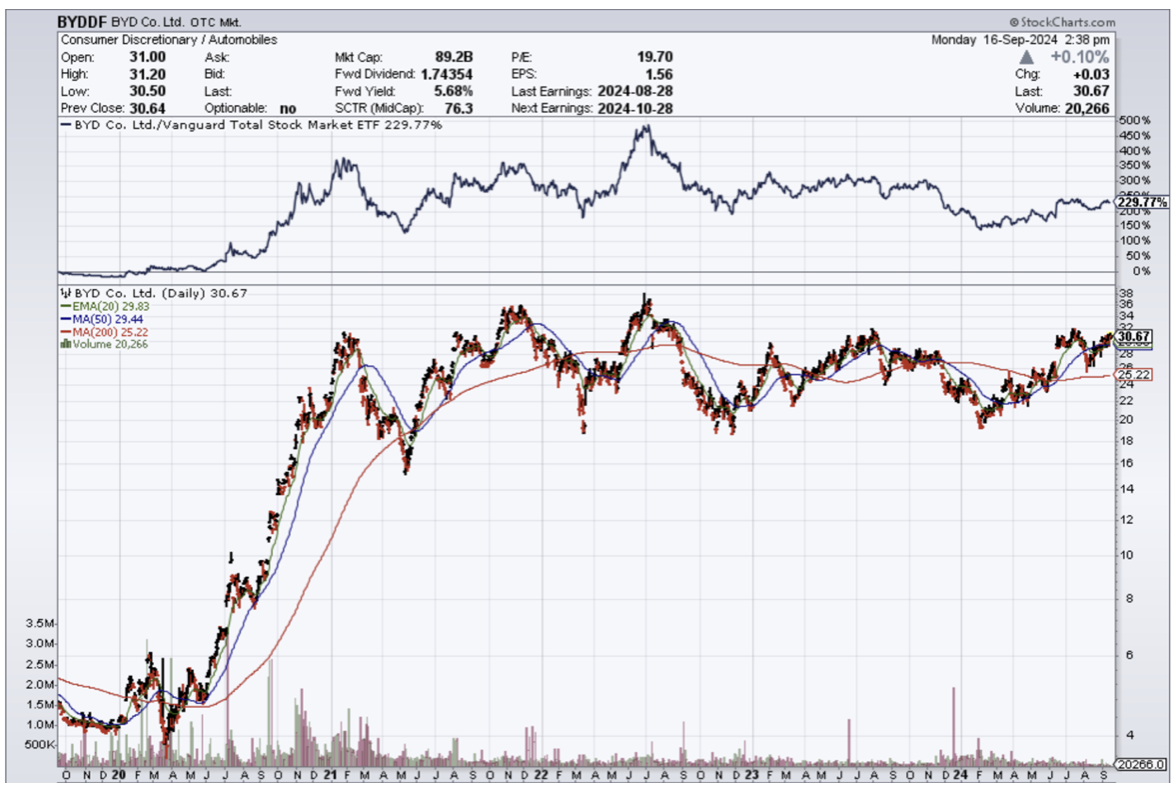

My guess is that BYD and CATL, both Chinese companies, are about to muscle out the competition in Europe before they go back to the drawing board to figure out how to do the same in the United States.

BYD has also signaled its strategy to get its cars into the US by building a factory in Mexico.

They plan to tell us publicly their Mexico strategy after the US election is over.

One area that is under consideration was around the city of Guadalajara. That region has emerged over the past decade as a technology hub sometimes described as Mexico’s Silicon Valley. BYD sent a delegation to the area in March.

I do believe the entire world, and not just the Global South, should start getting comfortable with driving Chinese EVs with Chinese-produced batteries.

Many are still are shocked that the Chinese were able to corner the EV market so quickly after Tesla’s first mover advantage kept them top dog for many years.

Although this would not be a reason to bet on the Chinese economy, it would be a good reason to stay out of Tesla shares and to even short companies like Rivian and other small firms such as Nikola.

Unfortunately, BYD and CATL are listed on an exchange in Shenzhen, China, so I would steer clear of that and focus on the knock-on effects on companies in more investable nations.