Don?t Touch the Coal Bubble

What has been the top performing asset class so far in 2016?

Is it gold (GLD), oil (USO), or collectable French postage stamps?

If you said ?coal,? you win the kewpie doll. In fact, the 19th century energy source is the best performing commodity of the year by a large margin.

Indeed, the Van Eck Coal ETF (KOL) has picked up an eye popping 130% since it printed its $5 low in the first week of? January.

As a result, I have recently been deluged by readers asking if it is time to buy this prehistoric energy source.

My answer is no, not ever, and not even with Donald Trump?s money.

However, my answer relies more on basic market dynamics, rather than any environmental sympathies I might have.

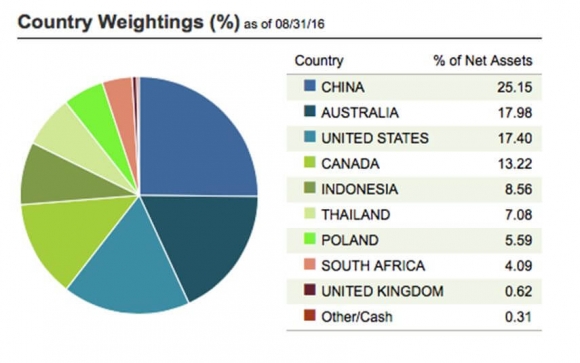

It all has to do with China.

The Beijing government is manipulating its domestic coal industry to prevent it from defaulting on hundreds of billions of dollars worth of loans to local banks.

So it has cut back the number of days the industry can operate from 330 to 276 days a year.

Then the Chinese economy started to improve.

What happens when you restrict supply and increase demand? Prices go through the roof, as they have done smartly.

It gets better.

In August, the Middle Kingdom was hit with rainstorms of biblical proportions, flooding many mines and forcing them to close. The sushi hit the fan.

That forced major consumers, the big steel producers and electric power plants, to resort to the international spot market, or the ?seaborne market? to cover shortages to avoid shutting down themselves.

Who is the world?s largest supplier to the seaborne market?

That would be BHP Billiton (BHP), the largest capitalized company in Australia, which has seen its shares appreciate by 65% since January.

I have been following coal for 45 years, ever since I was the coal correspondent for the Australian Financial Review (AFR) during the 1970s.

I had to write a mind-numbing five pieces a week on coal (the AFR was a daily). So it?s safe to say that I know which end of a lump of coal to hold upward.

For a start, you never want to invest in an asset that is dependent on government fiat for rising prices. They can change their minds at any time. The loans in question could get paid off.

And you can count on the world market to suddenly find new supplies whenever of commodity price doubles.

Remember the Rare Earths' bubble, where we were active players? After a hyperbolic bubble, prices fell by 90%. Rare earths turned out to be not so rare. Only the cheap labor to extract them was exempt from environmental regulation.

So you can count on the current coal bubble to deflate fairly quickly. The perfect storm is about to run in reverse.

That leaves us with the long term fundamentals of coal which are bleak, to say the least.

China is far and away the world?s largest coal consumer at 49%, followed by the US at 11%.

China is making every effort to reduce reliance on this cheapest form of energy, thanks to the blinding, choking smog alerts besetting its largest cities.

It is only still using coal because with an economy growing at 6% a year plus, it has to rely on every energy form just to keep the lights only. Power brownouts can lead to political instability.

Coal consumption in the US has been in a death spiral for years, falling from 50% to 33% of electric power generation over the past decade. That led to the bankruptcy of several of its largest players such as Arch Coal (ACI) and Peabody Energy (BTU).

The collapse of natural gas prices to $2/btu made a cleaner burning alternative cost competitive. And gas lacks the nitrous and sulfur oxides and particulate pollution prevalent in coal.

Read the prospectus of any electric power company and you will find them besieged by lawsuits from consumers claiming that the coal they burned caused their cancers. Utility companies would love to be rid of it.

Any reluctance by US companies to dispense with coal were blown away last year when the Environmental Protection Agency classified carbon dioxide as toxic waste. That put a big fat bulls eye on the remaining coal companies.

If Hillary Clinton wins the presidency, you can expect restrictions to worsen. She hates coal and makes no bones about it. She has told me so personally.

And then there?s solar energy. This week, California Governor Jerry Brown signed the nation?s toughest climate legislation mandating a cut in the state's greenhouse gas emissions to 40% below 1990 levels by 2030.

While ambitious, the target is viewed as doable. Solar energy, which now accounts for 5% of the state?s power output, will do the heavy lifting.

Many other states are expected to follow suit. No coal here.

The United Kingdom has already taken this path. It says a lot that a country that ran a coal-based economy for 300 years announced the closing of its last mine which it did a few months ago. It will replace the power output with alternatives.

Having lived in England during the violent miner?s strikes during the early 1980?s, it was quite a revelation.

So the writing is on the wall. Another major producer, Anglo American (NGLB.BE), is now in contract to sell two major mines in Australia.

Coal is an energy source whose time has clearly come and gone. So will the price of coal.