Facebook's New Problem

A major catalyst exacerbating recent tech layoffs has been a decline in referral traffic to news publishers from Facebook (FB).

Blame the algos!

Referral traffic is a way of reporting visits coming from a site from sources outside of the original site.

When someone clicks on a hyperlink leading to a different website, data analytics classified this as a referral visit to the second site by tracking mechanisms.

The truth is that news publishers have a painfully smaller window to monetize content than ever before and this opinion is echoed by some of big media’s stalwarts such as Rupert Murdoch, the chairman of News Corp.

Facebook decided to give preference to content in the news feed that is shared between Facebook users over those by news organizations, ironically, the news is being stripped out of the news feed whether that seems logical or not.

Under the guise of protecting the platform, Facebook is applying this ploy to further cut off users from escaping its walled garden trapping them inside for the purpose of clicking around the Facebook website even more.

As the technology evolves, companies are becoming increasingly pedantic in finding any practical method of allowing users to escape to another part of the internet.

Diminishing user time equals fewer clicks followed by reduced digital advertising revenue.

Another shift in Facebook rules entails elevating and demoting media outlets by trust levels and credible content that ultimately Facebook makes the decision on.

The algorithms in this case would prop up the more renowned institutions and essentially cut out minnow news organization.

Algorithms are inherently biased, and sources of revenue are cut off or opened up by these algorithmic shifts.

The monopolistic status of Facebook has made it near impossible for stand-alone firms to develop organically and ramping up digitally means leveraging Facebook ads to lure new customers.

What does this all mean?

News publications are bracing themselves for an atrocious year.

The side effect from recent changes mean that Facebook will ultimately become the God of the news cycle choosing which news populates where on the news feed or if it shows up at all.

Being a left-leaning company, Facebook is likely to anoint left-leaning news organizations as “trustworthy” while demoting more right-wing news feeds pushing them further down the pecking order.

And for marginal start-up news companies praying for any exposure, this is effectively a death sentence because of the lack of footprint inside of Facebook’s current database.

Machine learning cannot account for new developments in the system, let alone system altering shifts causing this technology to be defective.

The technology handsomely rewards the entrenched that have cultivated a big footprint inside the database that decisions hinge on.

Its backward-looking nature to carry out a business that is forward-looking is utter nonsense.

Many third-party businesses attempt to stimulate Facebook users’ appetite in order to bridge them over and act as a stepping stone to their own website.

Small businesses should prepare for an era where this type of digital reach is stunted and at some point, completely disengaged.

Effectively, Facebook and the rest of the FANGs will do its best to cut off outside activity preferring to keep usership in-house.

News organizations are feeling the full brunt of these ripple effects with online media firms such as Vox Media and BuzzFeed cutting staff in response to these Facebook algorithm changes.

Which industry will get chopped down next?

Online travel aggregators.

TripAdvisor (TRIP) had a great winter quarter in 2018, but looking down the line, the business model could get bogged down by the algorithm problem.

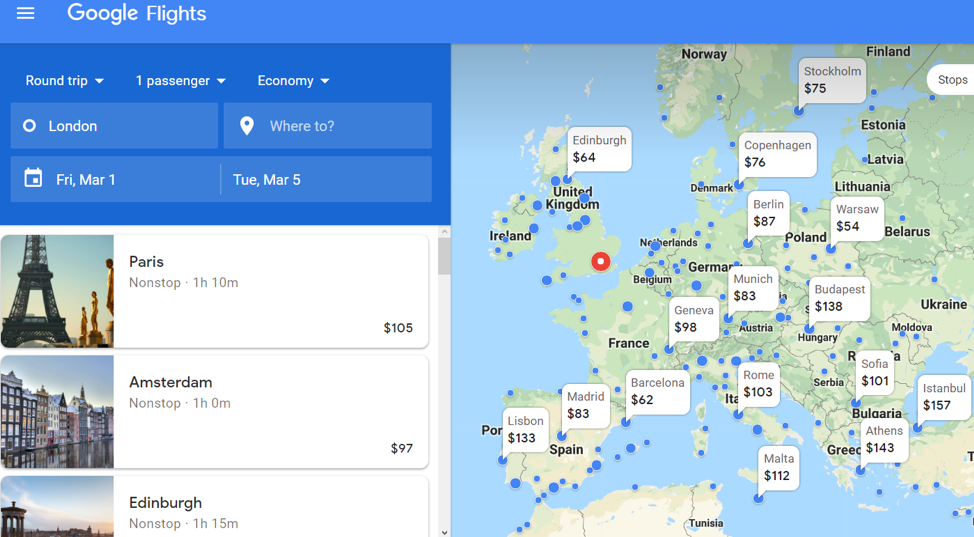

For instance, take the best flight purchase algorithm in the world Google Flights.

The United States Department of Justice Antitrust Division approved Google's $700 million purchase of ITA Software in 2011.

Within a few months, Google bent its algorithm into shape and reformulated it as Google Flights.

How does it stack up?

Easy to use, lack of digital ads, best of breed, and innovative are all ways I would describe this service.

That is why consumers prefer Google Flights over any other service.

It offers open-ended searches making the traditional flight search software seem pathetic.

Simply input the departure location and Google Flights will show the user every price to every location in the world on a visual map.

It’s travel transparency at its brightest and users can change trips in an instant if something attractive catches their eye.

The user can mix and match different destinations and dates until an optimal time and place can be calibrated along with a suitable price.

This gives the power back to the consumers.

Once in a while, dispersion between the Google Flight price and the official airline site price can be irritating, but the accuracy has improved over time.

Truth be told, it’s a waste of time to use a different flight search engine now after the existence of Google Flights.

Google is able to do this because they are masters at building algorithms and have an army of engineers at their disposal.

Online flight brokers such as Expedia (EXPE) and TripAdvisor are on a collision course for the beast that is the Google algorithm division.

This dovetails astutely with my overarching theme of technology destroying every broker industry because FANG algorithm teams do a way better job enhancing this segment of business than anyone else.

As you correctly guessed, I am bearish Expedia and TripAdvisor long term.

Travel fare aggregators can’t compete with Google and former CEO of Expedia Dara Khosrowshahi was smart to take the head job at Uber saving him from the future carnage.