February 11, 2008

1) Toll Brothers is seeing a 61% cancellation rate for Florida condos. The market is so bad that a family feud has erupted within the company. Even Bruce Toll's daughter, Wendy, has defaulted of the purchase of a $2.5 million unit there.

2) Amazon has announced a $1 billion share buy back.

3) Yahoo has rejected Microsoft's bid, saying it won't consider anything less than $40 a share. Microsoft will probably raise its bid to $35. The company has so much cash that it can pretty much do whatever it wants. Yahoo has 500 million users worldwide.

4) Dow Jones is rebalancing the Dow Jones index, taking out Altria (the old Phillip Morris) and Honeywell , and adding Chevron and Bank of America.

5) In the last two weeks the futures markets for euro interest rate futures has moved from no chance of a cut, to a certain cut of 0.75%. This is why the euro has backed off from $1.49 to $1.45.

6) Today's disaster d' jour is AIG which announced $5.2 billion in sub prime losses.

7) One stock I want to follow is Harley Davidson, partly because I like the ticker symbol (HOG). The luxury brand retailer has seen its stock fall from $72 to $35 since June. However, it may be a little early to go into high end consumer discretionaries.

8) CNBC has been running a series on the history of Nike. Nike paid a student at Portland State $35 to come up with the swoosh logo which became one of the most famous in the world. It was so successful that ten years later the company felt guilty and gave her some stock and a diamond ring.

TRADE RECOMMENDATION

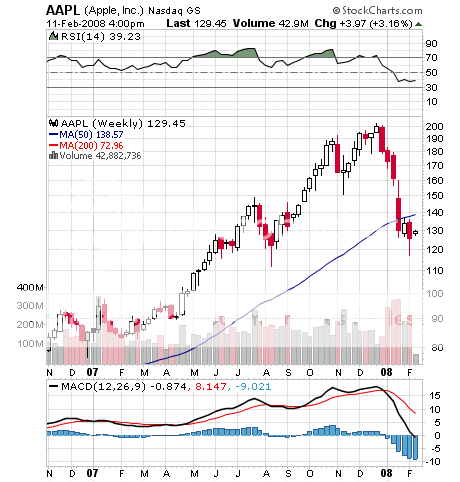

Apple (AAPL), one of the four horsemen of 2007, is now selling for only $119 with a PE multiple of 20. If you ignore all of the hype, PR, and media manipulation about the Iphone, the IPOD, etc. the stock is worth buying at this price for the Imac business alone. A new category of stock has emerged, the value growth stock, i.e. a growth stock selling at value price levels and this is one of them. The stock is a screaming buy here, a rare opportunity to buy a best of bread company at a fire sale price. Load the boat!