February 11, 2009

Global Market Comments for February 11, 2009

Featured Trades: (IWM), (LSE-AJG), (BAC)

1) After the passage of an $800 billion in stimulus, and another bank bailout package, I don't see any market boosting events on the horizon. Hence the Dow's 400 point swan dive yesterday. The market is not going to wait until the end of the year for all of this stuff to work. Until then, we only have Obama moaning about the Republican caused train wreck of an economy he inherited, and Congress highlighting how incompetent and crooked our financial leaders are. This isn't exactly going to inspire investors to rush out and buy stocks. Look for new lows.

2) I always hate listening to Barney Frank's House Financial Services Committee hearings. Bank of America (BAC) CEO Ken Lewis took an eight hour train ride from North Carolina to attend. Talk about the blind leading the one eyed. I can't believe how much Morgan Stanley's CEO John Mack has aged. I'd rather listen to someone scratch their fingernails across a chalk board. And our fate is in their hands! Sheesh. No wonder gold hit a new high for the year of $948. The people are voting with American Eagles.

3) More than 48 million Americans own shares in the top five banks.

4) Some 90% of all mortgage lending is now coming from the government. The balance is being made by large banks to borrowers with FICO scores of 800 or better, or by small regional banks you never heard of that never got into the securitization business.

5) According to one recent poll, 44% of the workforce is worried about losing their jobs. These people aren't going to be trading up to new houses anytime soon.

6) These are indeed dark days for Silicon Valley's venture capital industry. With the exit door slammed shut for years to come, new money is staying away, avoiding the high risk multiyear lock up. Angel investors have gone back to heaven. The deterioration of the economy has been so rapid that the rationale for many start ups is no longer there. Many web 2.0, next generation models for social networking sites, video sharing sites, wikis, blogs, and folksonomies never made it to profitability, and will be swept away. Expect a lot of once hard to get office space to become available for cheap on Sand Hill Road soon.

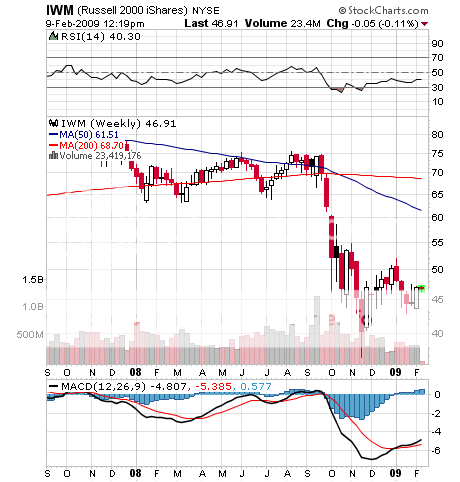

7) This is a great time to buy small cap stocks in any equity market, including Japan. This sector was one of the worst hit in the recent melt down, but historically it outperforms by a large margin in the first 12 months after the end of a recession. Once their survival is no longer in doubt, these often debt dependent stocks rocket on any improvement in the economic trend. This is the only time I ever hire outside managers, because I haven't the patience, the manpower, or the expertise to scour over the balance sheets and earnings statements of hundreds of obscure little niche companies. I have always been a big cap player because I have always dealt with investors who had to get $100 million to work in the market in a hurry, an impossibility in the small cap arena. In the U.S., buy the iShares Russell 2000 Index ETF (IWM). For the Japan play, buy the closed end Atlantis Japan Growth Fund (LSE-AJG) traded in London, managed by my old friend Ed Merner, at $8.05, a bargain basement 27% discount to its NAV of $11.04, if you are lucky enough to find shares to buy.

Atlantis Japan Growth Fund

QUOTE OF THE DAY

'Necessity never made a good bargain,' said Benjamin Franklin.