February 16, 2011 - The Collapse of the Yen: The Big Beak is Near

SPECIAL END OF JAPAN ISSUE

Featured Trades: (JAPANESE YEN), (FXY), (YCS)

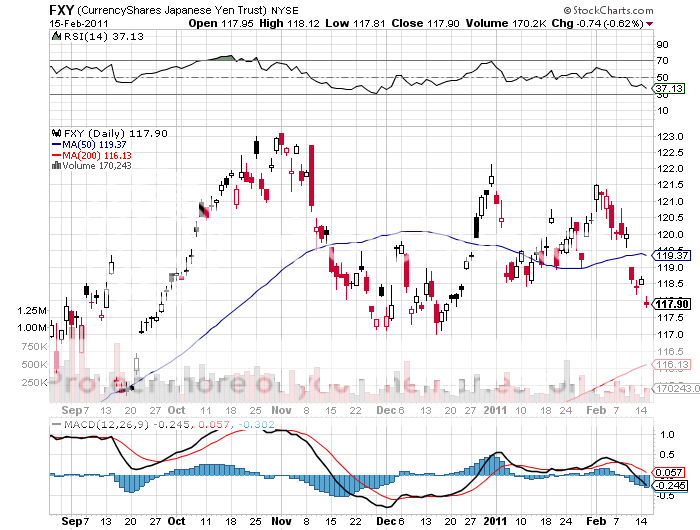

1) The Collapse of the Yen: The Big Beak is Near. 'Oh, how I despise the yen, let me count the ways.' I'm sure Shakespeare would have come up with this line of iambic pentameter if he were a foreign exchange trader. I firmly believe that a short position in the yen (FXY) should be at the core of any hedged portfolio for the next decade.

To remind you why you should hate the Japanese currency, I'll refresh your memory with this short list:

* With the world's weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world's worst demographic outlook that assures its problems will only get worse. They're not making enough Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt approaching 200% of GDP, or 100% when you net out inter agency crossholdings, Japan is at the top of the list.

* The Japanese long bond market, with a yield of a scant 1.25%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country's beleaguered exporters.

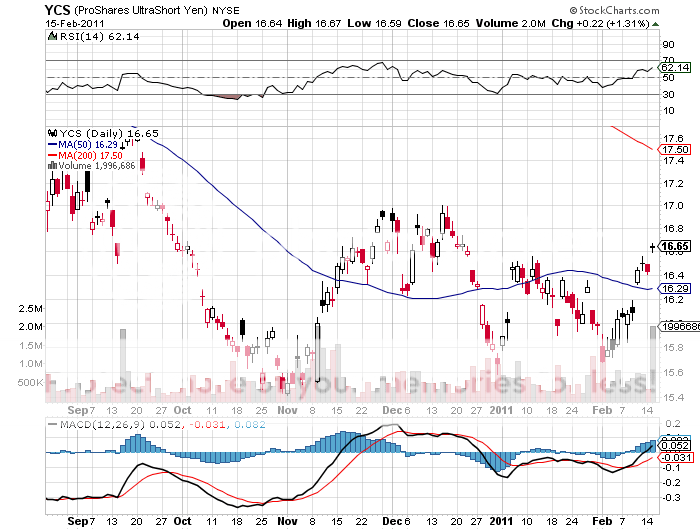

When the big turn is inevitably confirmed, we're going from today's print of ?83.80 to the initial target of ?85, then ?90, ?100, ?120, eventually ?150 (remember to think in inverse terms). That means that the 200% short play on the yen (YCS), could soar from $16.65 today to as high as $40, a potential gain of 250%. But it might take a few years to get there. The Japanese government has come on my side with this trade, not that this is any great comfort. Four intervention attempts have so been able to weaken the Japanese currency only for a few nanoseconds.

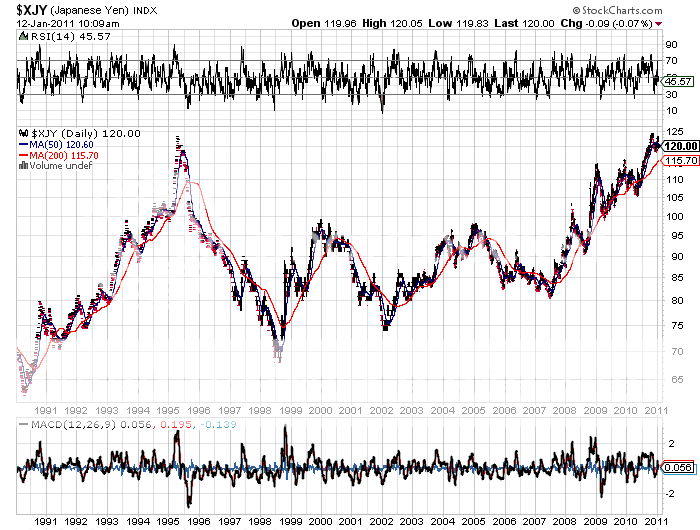

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me, the ?83 I see on my screen today is unbelievable.? If the recent high print of ?80.20 is the top of the current move, then we have just made a neat 15 year double top on the charts, a technical analysts dream come true. Sell the yen on rallies, with a ?79.40 stop for insurance. From here on, I will be selling rallies in the yen much more aggressively.

-

-

-

A 15 Year Double top on the Charts to Die For