February 18, 2011 -My Near Miss With Cisco

Featured Trades: (MY NEAR MISS WITH CISCO)

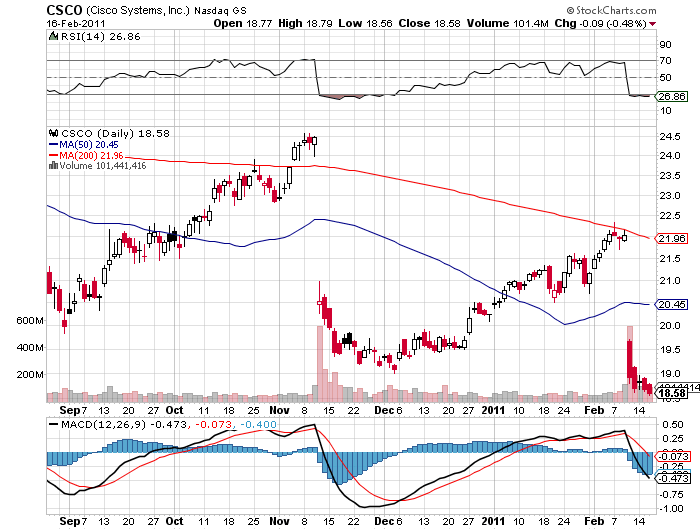

2) My Near Miss With Cisco. My predatory instinct as a scavenger and bottom feeder is coming to the fore once again. After building up expectations for a blowout quarter, Cisco Systems disappointed once again, prompting traders to trash the stock by 15% in one day. Call me greedy, but my risk averse nature prompted me to take the double that I had on by March $20-$22 bull call spread three weeks earlier. If you wonder why I am still cautious in one of the most Teflon resistant bull markets of all time, this is a good reason.

All of which sets up the exact same trade again. It was actually a decent report, as earnings came in near expectations. But in this unforgiving world analysts saw only the glass half empty and couldn't head for the door fast enough.

This is still one of the world's preeminent technology companies, and is one of the few American ones that makes stuff that people still want to buy. Some 70% of its global sales are to foreigners. Ownership of the router market is nothing to sneeze about, especially when the planet is making the leap to streaming video, causing demand for the company's products to soar tenfold in coming years.

I know CEO John Chambers personally and frequently bump into him at high end charity functions in San Francisco, and a better manager there never was. With a forward price earnings multiple of only 7, it is not often that you get to buy a growth company at a value price, and a Dow stock at that! An announcement of a new 1%-2% dividend is thought to be imminent. They will automatically suck in an entire new class of pension fund investors.

The way to play this is to wait for another haymaker to pop the stock on the nose. That could come in the form of a long awaiting market correction, which could take the broader index down 5%, and (CSCO) down more. Below that, the company's well publicized stock buyback program kicks in. Not only does Cisco benefit from a Bernanke put, it offers investors own free put as well.

I am not the only genius that has figured this out. None other than hedge fund managers George Soros, Eddie Lampert, and Whitney Tilson are similarly accumulating their own long positions in this stock. Watch this space, and I'll pop out a quick trade alert when I see a window open to get in.

-

A Near Miss is Better Than No Miss At All