February 2, 2024

(FUND OPTIONS IN THE MARKETPLACE)

February 2, 2024

Hello everyone,

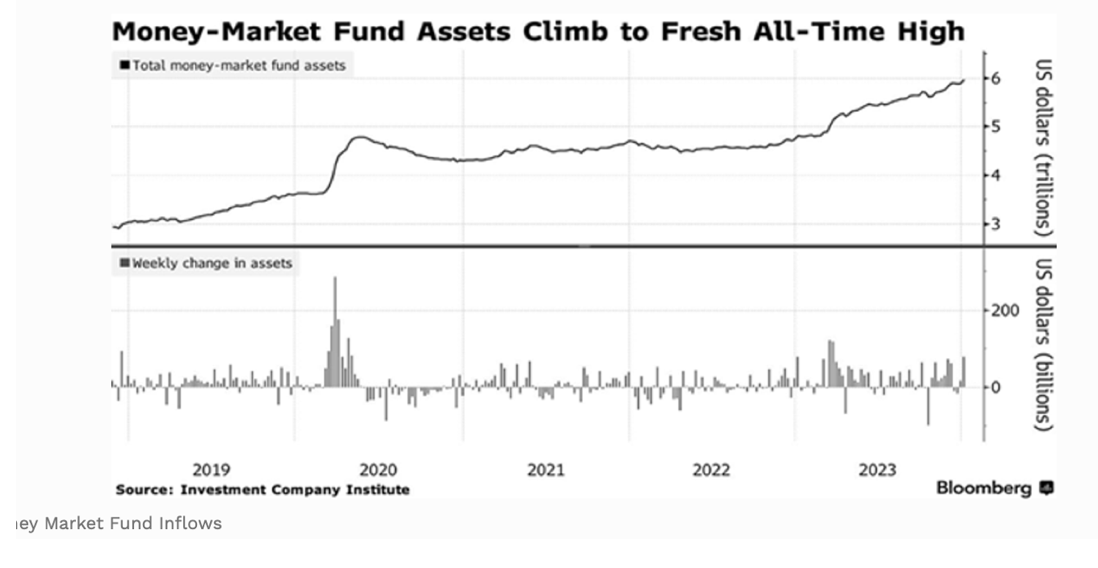

Money market funds are awash with money.

The 2022 sell-off and rapid rise in interest rates in 2023 caused money-market balances to soar, doubling from where they were just five years ago – a far bigger increase than the historical trend. Investors didn’t necessarily want their money to grow but rather keep it safe.

That’s a lot of cash.

And the likelihood that much of that cash will flow into stocks, given the market’s more optimistic mood these days, is why we’re unlikely to see a sharp pullback soon, as counterintuitive as that seems given the markets’ big move of late. Although, I hasten to add that the Magnificent Seven are definitely overstretched.

$6 trillion on the sidelines is a big deal. This pot of money is looking for a home in stocks, bonds, and real estate. Having that much dry powder means there is room left for stocks to fly a little higher before we can call this a bubble.

So, what’s the best way for us to profit in a market like this, other than scaling into stocks on down days and buying LEAPS?

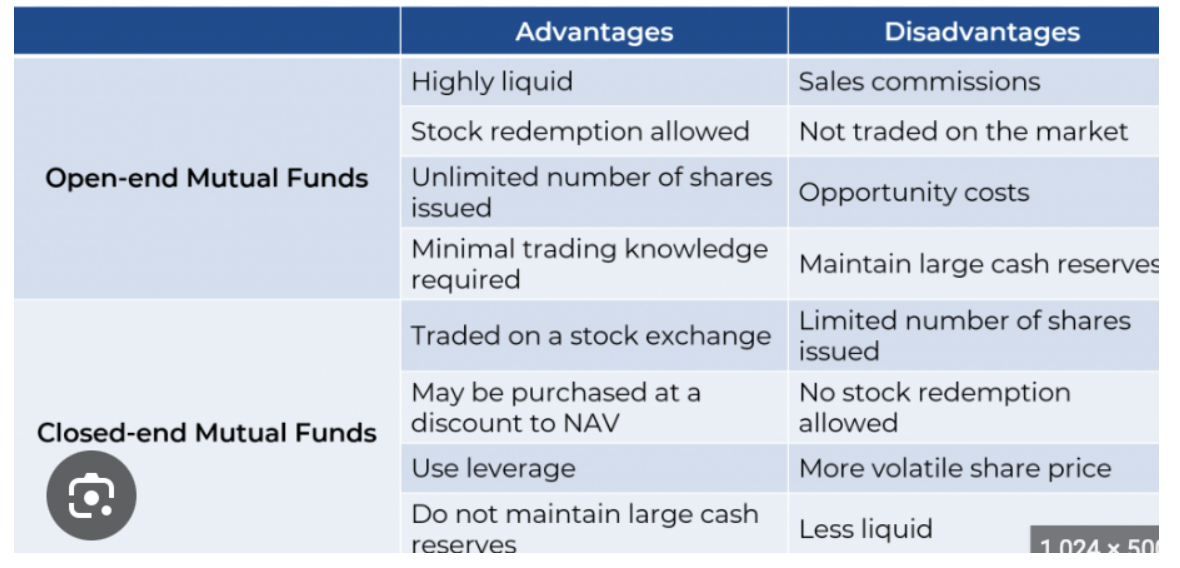

One option is investing in a mutual fund. This type of fund is one that many companies offer to workers in their 401 (k) plans. The problem here is that many of those funds perform poorly. And there is a kickback play taking place on the employers’ side as the latter receive benefits from the high fees charged by the fund managers that run them. I believe it’s called keeping the status quo. Here is an example.

Clearbridge Sustainability Leaders Fund (CBSLX) This fund has an environmental, social, and governance mandate (ESG) that has weighed on its returns, even though it holds many S&P500 standouts, like Apple (AAPL) and Microsoft (MSFT).

Another popular option is an index fund, like the SPDR S&P 500 ETF Trust (SPY), which holds the entire S&P500 and tracks the index. Buffett has often advised investors and anyone willing to listen to buy an index fund – not necessarily the one above – and just keep adding to it on dips.

But how much does it yield?

Only 1.4%. You would need $7.1 million invested to receive $100,000 in passive income from this fund. But it’s a solid fund and over time it will increase in value.

How about a closed-end fund (CEF) called the Liberty All-Star Equity Fund (USA).

This fund (current yield: 9.7%) holds many of the same stocks as SPY, like Microsoft and Apple, as well as United Health Group (UNH), Visa (V), and Capital One Financial (COP). What’s more the fund (USA) has delivered a solid 661.5% return in the last 15 years. So, its appeal is twofold: it returns the profits of the broader stock market in a well-diversified fund and two, it delivers a large slice of those profits as dividends.

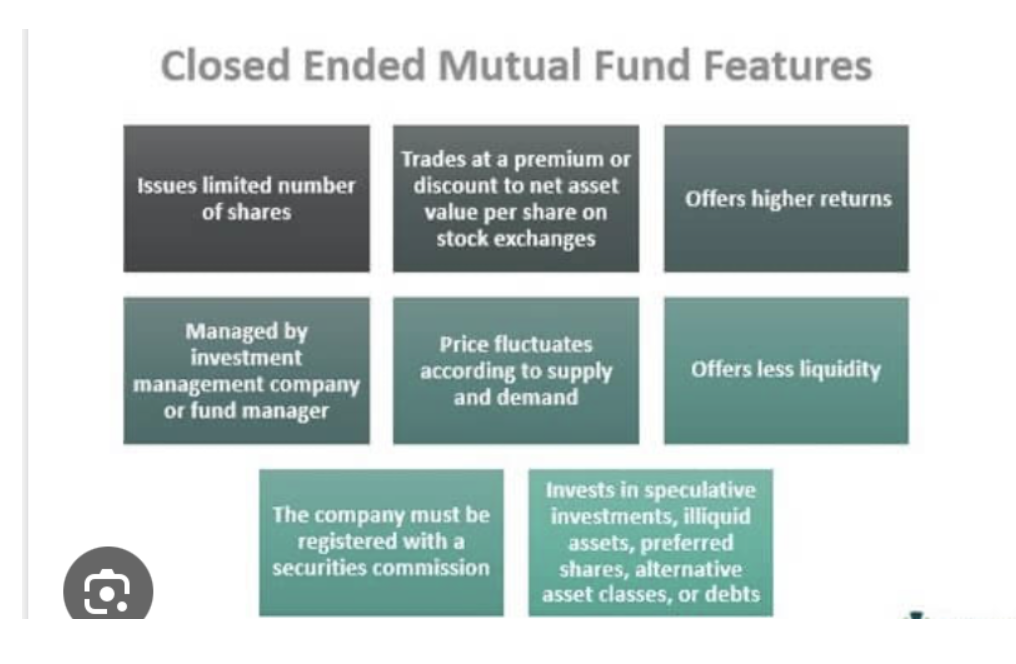

What are CEFs:

They are like mutual funds or ETFs in that they pool money from investors, which the fund’s managers then use to buy a basket of stocks, bonds, real estate investment trusts (REITS), or other investments, depending on the CEF’s mandate.

The fund managers then buy and sell over time, handing profits over to investors as dividends. CEFs trade on public exchanges and can be bought and sold, just like a stock.

CEFs are heavily regulated. They must account for their operations and file statements with the SEC every quarter.

Being publicly traded means CEFs are liquid. If you need cash, just sell your shares during market hours, Monday through Friday from 9:30 a.m. to 4 p.m. Eastern time.

The (USA) yield of 9.7% will provide you with a $100,000 annual passive income with $1,030,928 invested.

And this payout will probably grow in the future. All-Star Funds has a policy of paying out 10% of its net asset value (NAV or the value of its underlying portfolio as dividends every year, and the fund’s total NAV return has been 12.6% per year on average over the last 15 years. (With CEFs, per-share NAV returns often differ from a fund’s market price–based returns, in part because CEFs have more or less the same share count for their entire lives.) That means (USA) has earned 121% of its payouts during this period, which also suggests it can sustain its dividend for a long time.

Investors can also look forward to some upside generated by the fund’s discount to net asset value (NAV). Right now, the shares trade for around 3% below NAV, under the five-year average of a 0.9% discount. Not a wide gap, but as it closes it will give the market price an extra push.

This Post has provided you with a brief introduction to closed-end funds, featuring the Liberty All-Star Equity Fund (USA). The discussion here is designed to educate you about what is on offer in the financial marketplace. Always do your own research and make sure you are aware of all the risks.

Cheers,

Jacquie