February 21, 2011 - Reflections on Morgan Stanley's 75th Anniversary

Featured Trades: (MORGAN STANLEY), (MS)

1) Reflections on Morgan Stanley's 75th Anniversary. The three elder statesmen I saw on TV ringing the opening bell at the NYSE couldn't have been more representative of the evolution of Morgan Stanley (MS) over the past three quarters of a century. When I joined just after the 35th anniversary, it was a small, white shoe private partnership with a lock on the cream of investment banking clients like IBM, AT & T, and General Motors.

A great nephew of the original JP Morgan still worked there, was his spitting image, and was trotted out to impress admiring clients. Neatly framed on the wall in the chairman's office was US Steel (X) share certificate No.1, signed by Andrew Carnegie himself, which the firm's antecedents midwifed into existence. One of the first deals I worked on was the breaking up of Ma Bell into the baby bells.

Parker Gilbert was chairman, the son of one of a handful of men who rebuilt the firm from the wreckage of the Great Crash and the passage of the Glass Steagle Act. I knew him well as one of the blue bloods who ran the firm, a genteel, polished, Ivy Leaguer, who exuded fine breeding and confidence. I once spent an afternoon with him in the back of a Daimler limousine driving around London, shopping for thousands of dollars' worth of high end fishing gear, so he could accept an invitation to a Scottish private estate perfectly appointed. If Parker hadn't landed the top job at MS, he probably would have been running another exclusive gentleman's club, like the Jockey Club or the New York Yacht Club.

John Mack was one of a new generation of brash, street fighting, in your face, bare knuckled traders who forced the firm, kicking and screaming all the way, to make a fortune in proprietary trading. Mack, known internally as 'Mack the Knife', was of Lebanese origin, and could not have been more at odds with Morgan Stanley's elitist origins. He once lured a star trader away from Solomon Brothers, and then fired him on the first day. The few female employees we had then cried in his mercurial presence. But there is no doubt that the profits Mack reeled in saved the firm from a takeover down the road, rescuing it from the fate of Solomon Brothers, Kidder Peabody, Dillon Read, and Drexel Burnham, assuring its place in the big league today.

I was one of the few who bridged the two generations, comfortable from my journalism days with moving in Olympian circles, but coming from humble, rural origins. We took the 1987 crash in stride, but during the dark days of the financial crisis, when the share price plunged below $6, it seemed the firm was out for the count. Mack saved the firm a second time, successfully demanding a huge equity infusion from the Mitsubishi Group in Japan (great move, John!), while simultaneously holding at bay the wolves from Wall Street and Washington. What better year to have a junkyard dog as CEO than 2008?

James Gorman joined well after I left, and appears to be a modern day 'suit'. A professional and talented manager to be sure, but lacking the flash, the panache, and the balls of earlier generations. He is symbolic of the class of professional administrators who have been brought on board to run what has essentially become a gigantic utility.

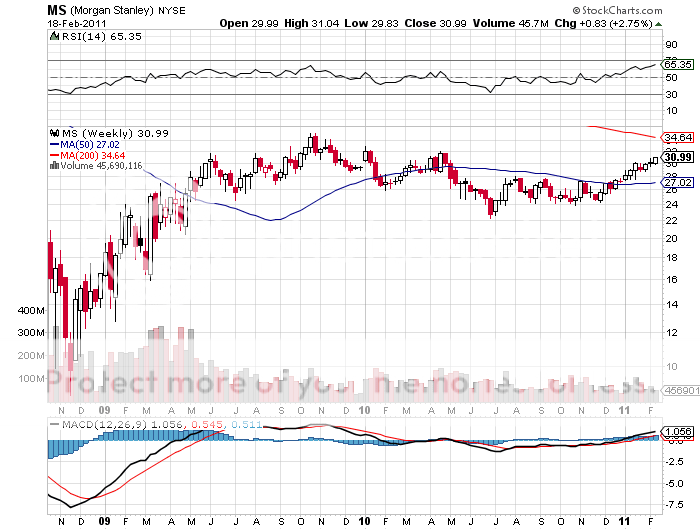

I have seen MS grow from 1,000 to 60,000 employees. The dividend today is more than the total market capitalization of the company back then. Parker summed it up all nicely when he said his 'mind was blown' by the present size of the firm and how far it has gone. I have no doubt Morgan Stanley will be around for another 75 years. And if you believe in the continued existence of Wall Street, as I do, as I do, this would be a great stock to own for your grandkids' 529 educational investment plans.

-