February 3, 2010

February 3, 2010Featured Trades: (SPX), (QQQQ), (COPPER),

(COPA), (TM), (WEEKLY JOBLESS CLAIMS)

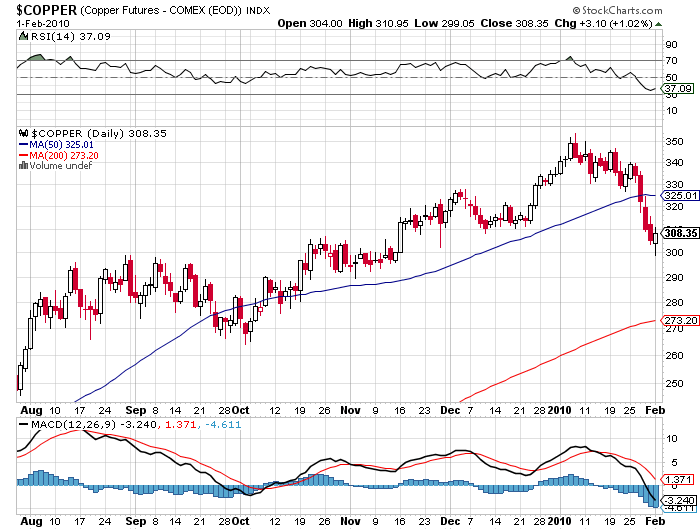

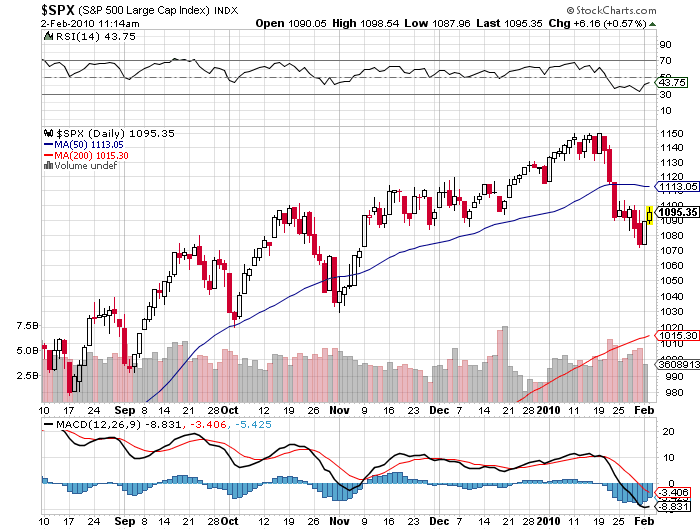

1) Groundhog Punxutawney Phil poked his nose out of his hole and saw his shadow this morning, predicting six more weeks of winter. The Mad Hedge Fund Trader poked his reddened proboscis out the door this morning, saw a substantially larger and longer shadow, and forecast at least six more weeks of crappy markets, and maybe a lot more than that. Looking at the charts this morning, it?s clear that risk taking by managers around the world did a sudden about turn on January 11, and now is in full flight.? The ?carry trade? has suddenly become the ?drop trade.? The S&P 500 (SPX) is off 7% from its high, copper has plunged a puke inducing 55 cents to $3.00, crude evaporated $8, and NASDAQ (QQQQ) has rolled over like the Bismark, shattering 50 day moving averages everywhere. Make no mistake; we have definitely flipped from ?buy the dip? mode to ?sell the rally? mode. Please reread the section in my January 4 Annual Asset Allocation Review entitled I?d Rather get a Poke in the Eye with a Sharp Stick than Buy Equities . For my warning on copper, the only commodity that has a PhD in economics, click here ). The best performers are having the biggest drops. Despite having truckloads of free money dumped upon them, traders are turning up their noses and reeling in risk everywhere. A zero return is suddenly looking like a great option. What is scarier is that I don?t see any potential sudden surprises out there than can reverse this sorry state of affairs any time soon. Put on your foul weather gear, don your life jacket, and man the pumps.

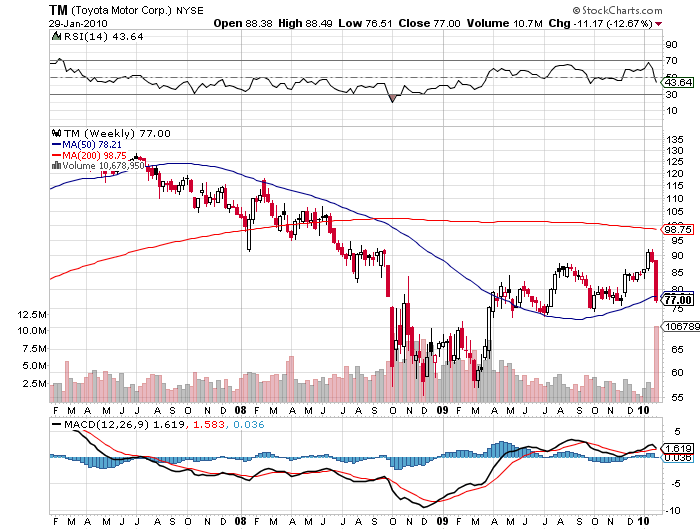

2) Nearly 40 years ago, when I was starving in Japan while waiting for the financial journalism thing to start paying off, I took a weekend job in Hakone to teach managers at Toyota Motors (TM) how to speak English. As we approached the hotel I saw a dozen men lined up out front wearing cheap suits, white shirts, and conservative ties. Each one took turns picking up a baseball bat and beating the daylights out of a severely shredded dummy on the ground before them, screaming a maniacal samurai scream. I asked my driver what the hell was going on. He deadpanned: ?They?re beating the competition.? This was back when Toyota made laughably tiny cars that looked like a giant ostrich eggs on wheels and had to get a running start to get up a freeway onramp. By 2006, the company had seized 18% of the US car market, and GM and Chrysler were wearing a toe tags. Today Toyota, the world?s largest car maker, has been slammed by the perfect storm that has taken its share down to 14.7%. They took eight years to find a defect in an American made accelerator component that caused thousands of accidents, and dozens of deaths, forcing a worldwide recall of 8 million vehicles. Unsurprisingly, the ADR?s here plunged 17% in a heartbeat, to $73. To me, this all adds up to a ?BUY.? You can start with the recall, the largest in history, covering eight models, which promises to be speedy, lavish and generous. It prompted a production shut down, an unprecedented measure in auto history. The company is going all out to reinforce customer loyalty. Toyota still makes great cars. And let?s face it, many people would rather die than drive an American car, this author included. It?s usually a great idea to buy when there is blood in the streets, and in the auto industry it doesn?t get any worse than this. I know the management, the philosophy, and the strengths of this company intimately, and they will come roaring back. Let the ruckus over the recall burn out, and add Toyota to your ?buy on dips? list.

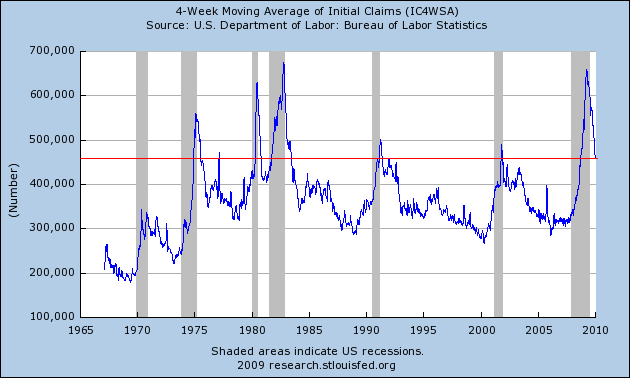

3) Someone once asked PIMCO?s bond king, Bill Gross, if he were stranded on a desert island and could get only one statistic on which to base investment decisions, what would it be? He didn?t hesitate. Initial claims for unemployment insurance, released by the Labor Department every Thursday at 8:30 am EST, gives the best real time snapshot of economic activity. With traders on tenterhooks regarding the near term outlook for jobs, and a fractious midterm election looming, these data are about to become more important than ever. During the first half of 2009, more than 600,000 new claims a week were common. Since then, they have dropped to a still serious 450,000/week, indicating, at best, a tepid recovery. When claims drop below 400,000, the unemployment rate will stop rising, below 350,000 a recovery is in progress, and below 300,000 the boom times are back. The US is unique in seeing a large amount of job switching, even in good times. Keep those eyeballs glued to your screens on Thursday mornings.

QUOTE OF THE DAY

?The investor in America sits t the bottom of the food chain,? said John C. Bogle, founder of the Vanguard Group of index funds.