February 9, 2010

Featured Trades:

(THE MAD HEDGE FUND TRADER?S STRATEGY LUNCHEONS), (DEMOGRAPHIC TRENDS),

(CYB), (EEM), (USO), (GLD), (SHREVE?S), (?SNOWMAGEDDON?)

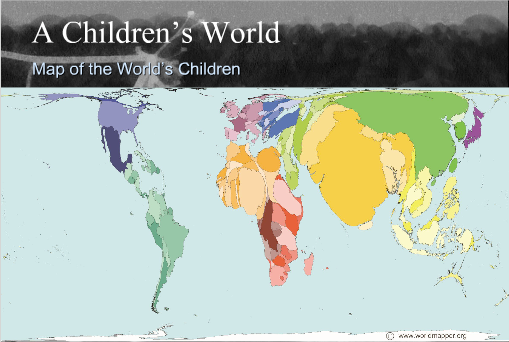

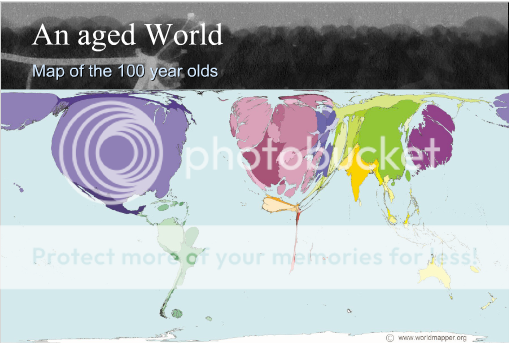

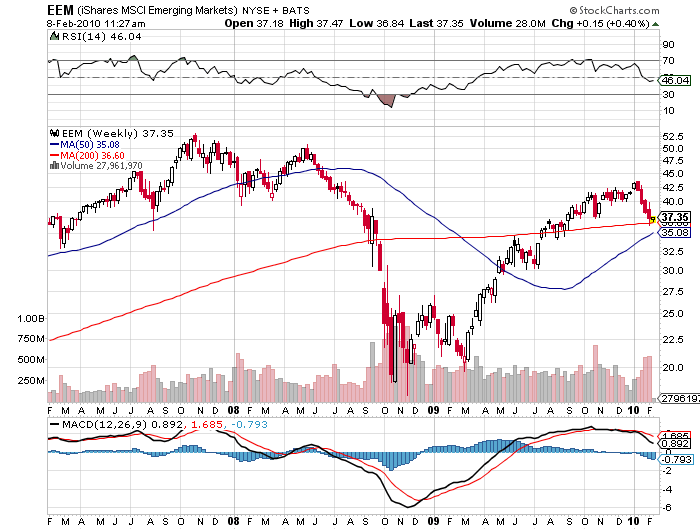

2) You can never underestimate the importance of demographics in shaping long term investment trends, so I thought I?d pass on these two maps, which I pulled off of Paul Kedrosky?s Infectious Greed website. The first shows a map of the world drawn in terms of the population of children, while the second illustrates the globe in terms of its 100 year olds. Notice that China and India dominate the children?s map. Kids turn into consumers in 20 years, stay healthy for a long time, and power economic growth. The US, Japan, and Europe shrink to a fraction of their actual size on the children?s map, so economic growth is in a long term secular downtrend there. There is more bad news for the developed world on the centenarian?s map, which show these countries ballooning in size to unnatural proportions. This means higher social security and medical costs, plunging productivity, and falling GDP growth. The bottom line is that you want to own equities and local currencies of emerging market countries, and avoid developed countries like the plague. This is why we saw a doubling, tripling, and quadrupling of emerging stock markets (EEM) last year, and why there is an irresistible force pushing their currencies upward (CYB). (see my Yuan revaluation piece by clicking here

3) A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, who shall remain nameless. Suffice to say, she has a sports stadium named after her. The bids soared to $6,000, $7,000, $8,000. After all, it was for a good cause. But when it hit $10,000, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $9,000.?? I said ?no thanks.? $8,000, $7,000, $6,000? I passed. The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,200, oil (USO), from $35 to $80, and the (FXI) from $20 to $40, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again. And no, I never did find out what happened to that date.

4) While Obama?s White House staff is digging out from ?snowmageddon,? a potential nightmare is giving him sleepless nights. Let?s say we spend our $2 trillion in stimulus and get a couple of quarters of decent growth. The ?V? is in. Then once the effects of record government spending wear off, we slip back into a deep recession, setting up a classic ?W.? Unemployment never does stop climbing, reaching 15% by year end, and 25% when you throw in discouraged job seekers, jobless college graduates, and those with expired unemployment benefits. This afflicted Franklin D. Roosevelt in the thirties. So Congress passes another $2 trillion reflationary budget. Everybody gets wonderful new mass transit upgrades, alternative energy infrastructure, smart grids, and bridges to nowhere. But with $4 trillion in extra spending packed into two years, inflation really takes off. The bond market collapses, as China and Japan boycott the Treasury auctions. The dollar tanks big time, gold breaks $2,300, and silver explodes to $50. Ben Bernanke has no choice but to engineer an interest rate spike to dampen inflationary fires and rescue the dollar, taking the Fed funds rate up to a Volkeresque 18%. %. The stock market crashes, taking the S&P well below the 666 low we saw in March. Housing, having never recovered, drops by half again, wiping out more bank equity, and forcing the Treasury to launch TARP II. The bad news accelerates into the 2012 election year. Obama is burned in effigy; Sarah Palin is elected president, and immediately sets to undoing all of his work. Republicans, reinvigorated by new leadership, and energized by a failing economy, retake both houses of congress. National health care is shut down as a wasteful socialist mistake, boondoggle subsidies for alternative energy are eliminated, and the savings are used to justify huge tax cuts for high income earners. We invade Iran, and crude hits $500. If you?re over 50, and all of this sounds vaguely familiar, it?s because we?ve been through it all before. Remember Jimmy Carter? Remember the ?misery index,??? the unemployment rate plu

s the inflation rate, which hit 30, and catapulted Ronald Reagan into an eight year presidency? A replay is not exactly a low probability scenario. This is why credit default swaps live at lofty levels. It?s also why the investing public is gun shy, favoring bonds over stocks by a 15:1 margin. Are the equity markets pricing in these possibilities? Not a chance. The risk of economic Armageddon is still out there. Personally, I give it a 50:50 chance. Batten the hatches, and please pass the Xanax.