Reading the Tech Tea Leaves

Logistics company FedEx, although not a tech company, offers a fascinating insight into the health of the economy and the current state of the tech world.

Unfortunately for tech readers, the shipping company rang the alarm on the rapidly deteriorating state of the economy in August.

It’s my job to tell you how it will shake out for tech stocks.

FedEx’s earnings report disappointed signaling that tech stocks too, could be on the chopping block. I would agree with that too.

This debunks the myth of the “soft landing” that the US Central Bank likes to refer to with their challenge of high inflation. I believe the soft landing is priced into tech stocks, but not a hard landing yet.

The result is possibly more downside price action to tech stocks.

CEO Raj Subramaniam painted a gloomy picture of what to expect in terms of lower volumes.

FedEx could be the canary in the coal mine signaling ugly earnings for other large tech companies that do business around the world.

The tech companies that come to mind are Apple, Google, Facebook or Meta (META), and Snapchat (SNAP).

Raj is not the only executive who is spooking the tech market.

CEO of Alphabet or Google Sundar Pichai had his own gloomy opinion that adds insult to injury to the already negative sentiment prevailing in trader sentiment.

He said he feels “very uncertain” about the macroeconomic backdrop, and he is one of the few who has deep insight into the different layers of this complicated US economy.

He also warned that layoffs could be in the cards as the company seeks to boost its efficiency by 20% while staving off fierce economic headwinds and antitrust investigations.

A large element of such downbeat forecasts by executives is the roaring price hikes from everything like diapers to salami.

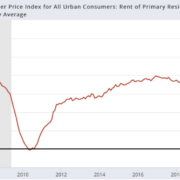

The one ironic tidbit that I took away from the last inflation report was that the recent explosion in inflation has been in rental housing.

If this is the case, then high-income individuals, who mostly own rental real estate, are passing on inflationary costs to their tenants who are strapped with a worse financial profile.

This means that high-income individuals still harness the resources to spend, spend, spend.

Why not go lease a new Maserati or Aston Martin?

If that’s the case, we could see this group pick up the slack and power spending all the way until Christmas which is a net negative for tech stocks because it delays the Fed pivot.

Warnings from Subramaniam and Pichai indeed have weight to them, but keep in mind that these businesses are optimized for scale and reflect the general situation of Americans, not just rich people.

High net worth individuals reloading the consumer bazookas don’t move the needle for the entire US economy, but they do have enough gunpowder to trigger another bout of inflation or rental increases to build on the already high inflation existing in US prices.

Short-term traders should focus on selling rallies in poor tech stocks as upside momentum cannot be sustained in the face of anticipated interest rate rises.