FireEye’s Last Line of Defense

A potential cataclysmic threat potentially wreaking havoc to our financial system is no other than cybercrime – that is one of the few gems that Fed Chair Jerome Powell delivered to the American public in a historic interview with 60 Minutes this past weekend.

Powell has even gone on record before claiming that Congress should do “as much as possible (against cybercrime), and then double it.”

The Fed Chair clearly has intelligence that retail investors wish they could get their hands on.

Digital nefarious attacks have been all the rage resulting in public blowups at Equifax (EFX) and North Korea’s state-sponsored hack on International Business Machines Corporation (IBM) just to name a few.

At the bare minimum, this means that cybersecurity solution companies will be the recipients of a gloriously expanding addressable market.

Powell’s testimony to the public was timely as it provides the impetus for investors to look at cybersecurity firms that will actively forge ahead and protect domestic business from these lurking threats.

Considering a long-term investment in FireEye Inc. (FEYE) at these beaten down prices could unearth value.

For all the digital novices, FireEye offers cybersecurity solutions allowing organizations to pre-emptively plan, prevent, respond to, and remediate cyber-attacks.

It offers vector-specific appliance, virtual appliance, and a smorgasbord of cloud-based solutions to detect and thwart indistinguishable cyber-attacks.

The company deploys threat detection and preventative methods including network security products, email security solutions, and endpoint security solutions.

And when you marry this up with my 2019 underlying thesis of the year of the enterprise software subscription, this company is on the verge of a breakout.

Last year was a year full of milestones for the company with the firm achieving non-GAAP profitability for the full year for the first time and generating positive operating and free cash flow for the full year.

The company was able to attract new business by adding over 1,100 new customers.

The cloud is where the company is betting all their chips and crafting the optimal subscription-as-a-service (SaaS) product is the engine that will propel the company’s shares higher.

The heart of their cloud initiative relies on Helix - a comprehensive detection and response platform designed to simplify, integrate and automate security operations.

This intelligence-led approach fuses innovative security technologies, nation-grade FireEye Threat Intelligence and world-renowned expertise from FireEye Mandiant into FireEye Helix.

By enhancing the endpoint products and email protection, sales of both products exploded higher by double digits YOY as FireEye successfully displaced incumbent vendors and legacy technology to the delight of shareholders.

As a result, the firm’s pipeline of opportunities continues to build.

As for network security, FireEye plans to extend the reach of their market-leading advanced threat protection capabilities further into the cloud with protection specifically aimed for cloud heavyweights Microsoft (MSFT) Azure, Amazon Web Services (AWS), Google (GOOGL) and Oracle (ORCL) Cloud.

They are collaborating with these major cloud providers on hybrid solutions that integrate seamlessly with their technologies so FireEye solutions will easily snap into a customer's cloud deployments.

Cloud subscriptions and managed services were the ultimate breakout performer highlighting the successful outsized pivot to (SaaS) revenue.

This segment increased 31% sequentially and 12% YOY, highlighting underlined strength in the segments of managed defense, standalone threat intelligence, Helix subscriptions, and cloud email solution.

The furious growth was achieved even though Q4 2017 billings included a $10 million plus transaction and if this deal is excluded, cloud subscriptions and managed services would have grown more than 30% YOY in Q4 2017 demonstrating the hard bias to the cloud has been highly instrumental to its success.

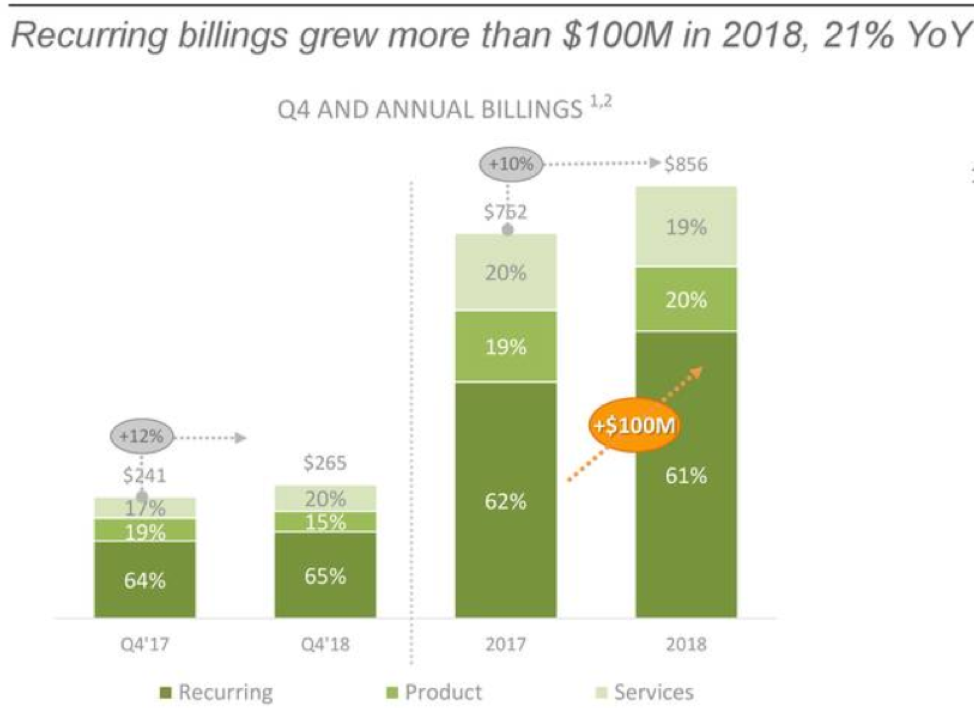

Recurring billings expanded 12% YOY, a small bump in acceleration from 11% in Q3, but if you remove that big deal in Q4 '17, recurring billings grew over 20% YOY in Q4 2018.

The growing chorus of product satisfaction can be found in the customer retention rate of 90%.

Transaction volume was at record levels for both deals greater than $1 million and transactions less than $1 million, signaling not only that customer renewals are expanding, but also explosion of new revenue streams captured by FireEye is aiding the top line.

This story is all about the recurring revenue and I expect that narrative to perpetuate throughout 2019 as an overarching theme to the strength of the firm’s revenue drivers.

The 10% billings growth last quarter paints a more honest trajectory of the true growth proposition for FireEye.

I believe the 6%-to-7% revenue guide for fiscal 2019 is down to the accounting technicals manifesting in the appliance revenue that is fading from the overall story.

The solid billings growth underpinning the overall business meshing with diligent expense control is conjuring up a massive amount of operating leverage.

Shares are undervalued and offer an attractive risk versus reward proposition.

If the company delivers on its core growth outlook, which I fully expect them to do plus more, shares should climb over $20 barring any broad-based market meltdowns.

I am bullish FireEye and urge readers to wait for shares to settle before putting new money to work.