Forget The Casino, Invest In The House

I've always had a soft spot for healthcare innovation. But let me tell you, picking winners in this sector is trickier than trying to nail jello to a wall. You've got regulatory hurdles, fierce competition, and funding risks that'd make a Vegas bookie sweat.

That's why I'm a big fan of buying the arms dealers in this war on disease. I'm talking about the suppliers. These companies are calmly sitting pretty, ready to cash in on the general need for innovation without getting their hands too dirty.

Enter Thermo Fisher Scientific (TMO), the Waltham, MA-based behemoth that's supplying everyone from big pharma to your local hospital. They're slinging lab equipment faster than a short-order cook at a greasy spoon, and business is booming.

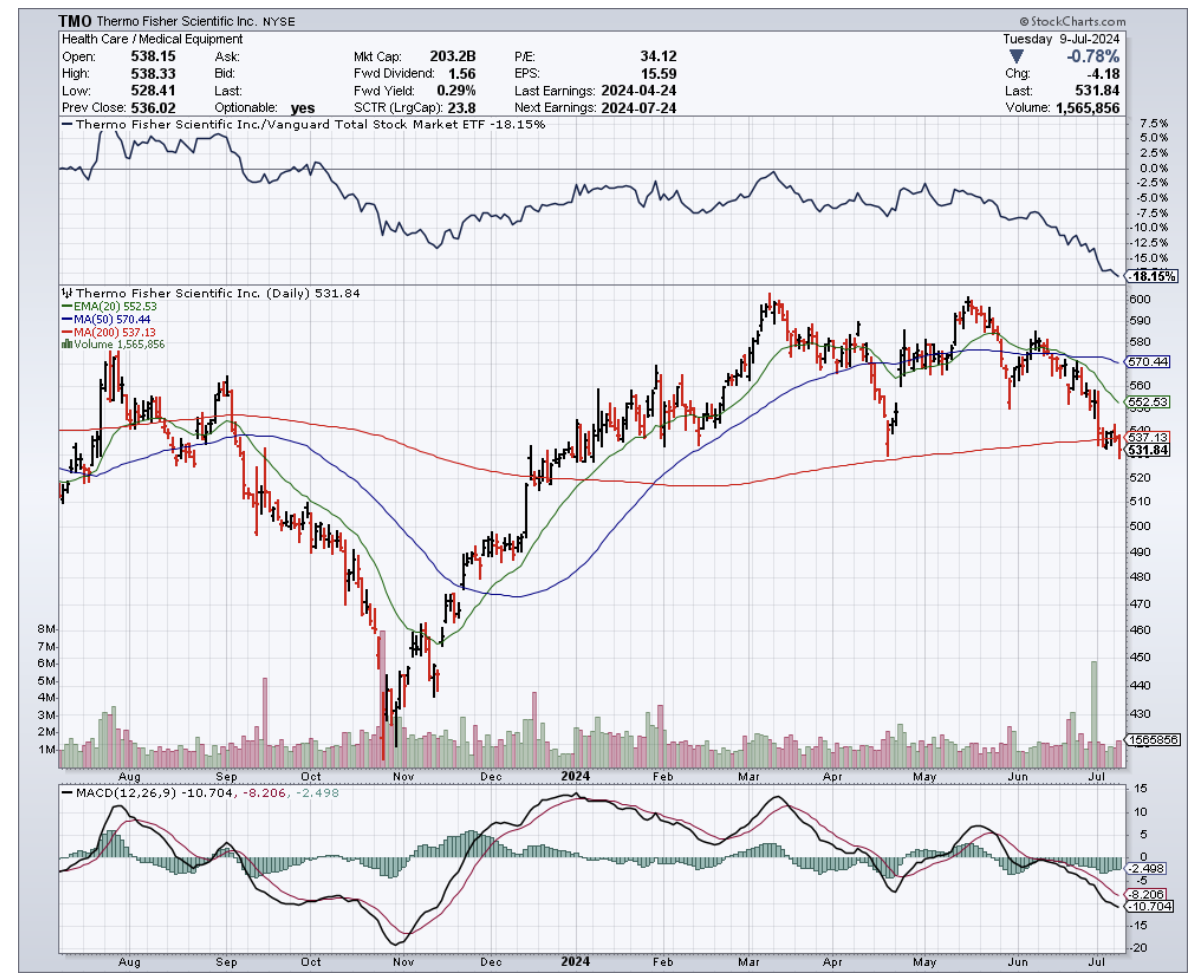

Just look at the numbers. Over the past decade, TMO's delivered a 400% total return. That's not just beating the S&P 500 – it's leaving it in the dust by 170 points.

And recently, Thermo Fisher just got the green light from those sticklers at the UK antitrust office to close a $3.1 billion deal for Olink, a Swedish outfit that's cooking up some serious magic in protein analysis.

We're talking about technology that can analyze hundreds of proteins faster than you can say "proteomics."

Speaking of proteomics, for those of you who slept through biology class, it's the study of proteins in biological systems. These little buggers are the muscle behind everything your body does.

While DNA is the blueprint, proteins are the construction crew that brings that blueprint to life. Figuring out how these microscopic workers operate is the golden ticket to a treasure trove of new drugs and therapies.

It's a growing field, with the global market expected to explode from $32.8 billion in 2023 to a whopping $161.9 billion by 2035. That translates to a compound annual growth rate of 14.2%.

As expected, Thermo Fisher isn't the only player in this game. You've got heavyweights like Bio-Rad Laboratories (BIO), Danaher Corporation (DHR), and Agilent Technologies (A) all jockeying for the top position.

But thanks to this recent Olink acquisition, Thermo Fisher's looking to pull ahead like a thoroughbred at the Kentucky Derby.

For better context, let's break down what this means for TMO's bottom line. Their mass spectrometry business, already a cash cow, could see a 5% bump in market share.

We're talking about an extra $475 million in revenue by 2028, with profit margins that'd make a hedge fund manager blush.

And that's just the tip of the iceberg. Their protein assays and kits business could see a 10% boost in market share, translating to another $450 million in revenue.

Despite these, Thermo Fisher isn't resting on its laurels. They're also partnering up with the likes of Bayer (BAYRY) to develop next-generation sequencing tools.

Next, let's talk dividends. I know, I know, a 0.3% yield isn't going to have you popping champagne. That's barely enough for a value meal at McDonald's. But don't let that fool you.

This company's been growing its dividend faster than a beanstalk on Miracle-Gro, with a five-year CAGR of 15.5%. It's not TMO's fault their stock price keeps outrunning their dividend.

Looking ahead, Thermo Fisher is projected to reach a 12% EPS growth in 2025 and 11% in 2026. It's like watching a rocket take off in slow motion.

Before you jump aboard though, I'll be honest with you.

At a P/E ratio of 26.6x, TMO isn't exactly on the bargain rack. It's priced like a fine wine, not a box of Franzia. But hey, quality costs money, and this is a company that's been delivering returns of 16.7% per year since 2004.

So, what's the takeaway here? Well, it’s clear that Thermo Fisher Scientific is a powerhouse in the healthcare and biotech sectors.

But, it's not going to give you the cheap thrills of a biotech startup that might cure cancer or go belly-up next week.

Instead, it's the steady Eddie that's going to keep chugging along, supplying the tools that make those moonshots possible.

If you're looking for income, well, this ain't your horse. But if you want growth with a side of stability, Thermo Fisher might just be the ticket. It's got more potential than a kid with a 4.0 GPA and a mean fastball.