Global Market Comments

November 6, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or VINDICATION WEEK)

(SPY), (QQQ), (IWM), (NVDA), (BRK/B), (TLT)

It was truly vindication week for the bulls. All major Indexes clocked their best week of the year

The patience was rewarded. The S&P 500 (SPY) gained an impressive 6.09%, the NASDAQ ETF (QQQ) 7.35%, and the small-cap Russell 2000 (IWM) 8.64%. A recent favorite of mine, mortgage REIT lender Anally Capital Management (NLY) soared by an amazing 21%

Better yet, all of my Mad Hedge forecasts came true. Big tech led the charge, with our long in NVIDIA (NVDA) up a gob-smacking 16.67%. Another long in Berkshire Hathaway (BRK/B) gained 7.5%. And our long in US Treasury bonds (TLT) picked up a welcome $6.00, dropping ten-year yield from 5.0% to 4.52%.

The 60/40 stock and bond/portfolio came back with a vengeance. This time, everything went up.

The harder I work, the luckier I get.

The markets accomplished these feats against a geopolitical background that couldn’t be worse. The Gaza War is lurching from one tragedy to the next. The Ukraine War grinds on (but without me). Saber rattling continues in China.

It just goes to show how far out on a limb the shorts had gotten and the extent of buying demand that was pent up.

It all sets up a nice year-end rally. We may not reach the $4,800 target I expected at the beginning of 2023. But a $4,600 hit is within range. Don’t expect a straight line move there. The world is still a pretty unsettled place. It's definitely going to be a stock pickers market (NVDA), (BRK/B), and (TLT) and not an index one.

Particularly fascinating is how Berkshire Hathaway absolutely Knocked it Out of the Park, with a 41% gain in operating earnings from companies like BNSF Railroad, Geico, and Precision Castparts. But Warren Buffet was noted in his weekend earnings report more from what he didn’t own than what he did.

The Oracle of Omaha unloaded $5 billion worth of global stocks in Q3, taking his cash position up to a record $157 billion. He can now earn a staggering $8.6 billion in interest in the coming year. His explanation is that stocks never really got cheap this year and high rates were just too attractive. Keep buying (BRK/B) on dips. And buy the things he buys.

And with the number of new investment opportunities and sectors to chase that almost can’t be counted, I will prompt you to look at some oldies buy goodies.

PC stocks are back in play, namely Dell Computer (DELL) and Hewlett Packard (HPQ). How about those for a blast from the past? I think it’s been 30 years since I touched these legacy tech companies.

The fact is that AI is rapidly moving downstream as far down as your humble PC, which in the meantime has gotten cheaper and much more powerful. PCs are now the dumb end of a link that can access the AI superheroes of the day, like ChatGPT. It’s a lot like the old Quotron used to be the access point to the New York Stock Exchange mainframes for current price information.

Dell shares have already outperformed, up 57% in just six months, while HP is just getting started. You might take a look.

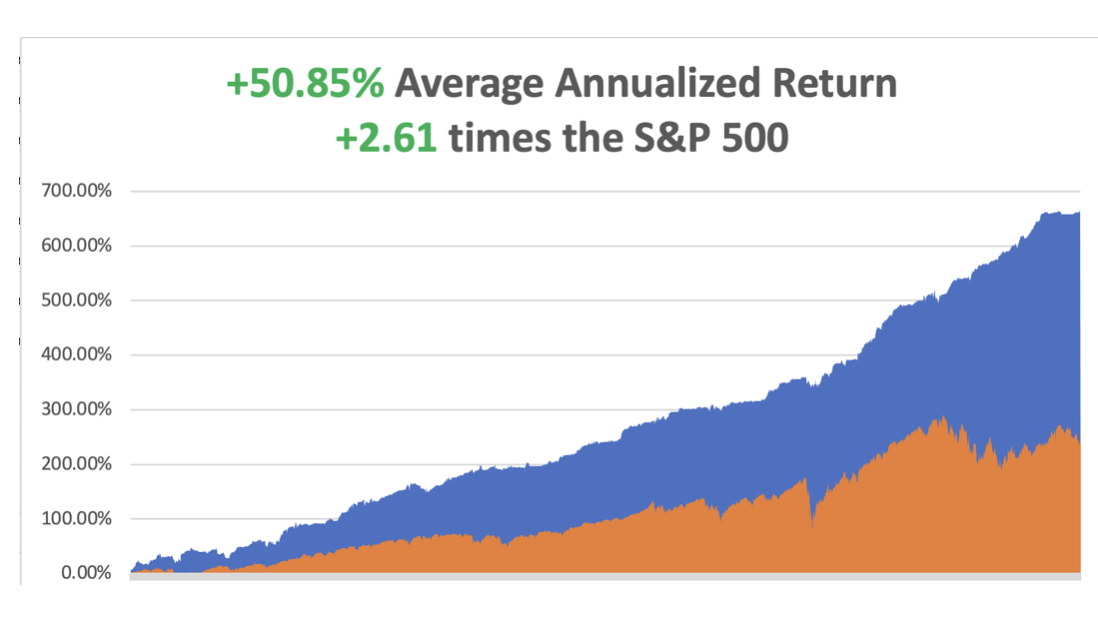

So far in November, we are up +1.97%. My 2023 year-to-date performance is still at an eye-popping +68.15%. The S&P 500 (SPY) is up +14.21% so far in 2023. My trailing one-year return reached +75.21% versus +25.62% for the S&P 500.

That brings my 15-year total return to +665.34%. My average annualized return has rocketed to +50.85%, another new high, some 2.61 times the S&P 500 over the same period. I am at maximum profit on all positions and am looking to add more on a dip.

Some 47 of my 52 trades this year have been profitable.

Fed Leaves Rates Unchanged. It’s not the end of high rates, nor the end of the beginning, but the beginning of the end. Powell may contemplate actual rate CUTS in six months, driven by the certain slowing of growth and inflation in the current quarter. Markets will start discounting that now as seen by the 30-basis point back off in rates this week. No surprise then that there is a short covering buying panic across the entire fixed income front today.

Palantir Rockets on New AI Demand, up 20% at the opening, even though its substantial government business slowed. The company announced the fourth consecutive quarter of profitability and highest earnings since its founding 20 years ago. The Denver-based data analysis company said Thursday it expects 2023 revenue of about $2.22 billion. Buy (PLTR) on dips.

Buying Panic Hits All Fixed Income Markets, with falling Fed interest rates appearing on the distant horizon. (TLT) is up $1.60, (JNK) $0.80, and (NLY) REITS up $0.45. This could be the trade of the decade, with (TLT) targeting $110 by early 2024.

Homebuyers are Pouring into ARMs, or adjustable-rate mortgages, shunning 30-year fixed rates at a mind-numbing 8.0%. ARMs could be had at 6.77% last week. Overall, mortgage applications are down 22% YOY.

Panasonic Says EV Demand is Sluggish, taking Tesla Shares down 5%, and off 35% from the recent high. Elon Musk says the Cybertruck will take a year to 18 months before it is a significant positive cash flow contributor. Full disclosure: I am on the waiting list. The Street expects Tesla to hit 2.3 million vehicle deliveries next year, an increase of about 500,000 year over year. Buy (TSLA) on dips.

Bank of Japan Eases Grip on Bond Yields, ending its unlimited buying operation to keep interest rates down. Japan is the last country to allow rates to rise. Expect the Japanese yen to take off like a rocket.

Hedge Fund Pour into Uranium, as the nuclear renaissance gains steam. Prices have gained 125% in three years. The International Energy Agency says demand will double by 2050. There are 440 nuclear power plants in the world that represent a non-carbon source of energy and China plans another 100 coming on line. Buy (CCJ) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 6 at 8:30 PM EST, the US Loan Officer Survey is out.

On Tuesday, November 7 at 2:30 PM, the US Imports and Exports are released.

On Wednesday, November 8 at 3:15 PM, the Fed Chair Jay Powell Speaks.

On Thursday, November 9 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 10 at 2:30 PM, the University of Michigan Consumer Sentiment is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I have been doing a lot of high-altitude winter mountain climbing lately, and with the warm spring weather, the risk of avalanches is ever-present. It takes me back to the American Bicentennial Everest Expedition, which I joined in 1976.

It was led by my old friend, instructor, and climbing mentor Jim Whitaker, who pulled an ice ax out of my nose on Mt. Rainer in 1967 (you can still see the scar). Jim was the first American to summit the world’s highest mountain. I tried to break a high-speed fall and an ice ax kicked back and hit me square in the face. If I hadn’t been wearing goggles I would have been blinded.

I made it up to 22,000 feet on Everest, to Base Camp II without oxygen because there were only a limited number of canisters reserved for those planning to summit. At that altitude, you take two steps and then break to catch your breath.

There is a surreal thing about that trip that I remember. One day, a block of ice the size of a skyscraper shifted on the Khumbu Ice Fall, and out of the bottom popped a body. It was a man who went missing on the 1962 American expedition. Everyone recognized him as he hadn’t aged a day in 15 years, since he was frozen solid.

I boiled my drinking water but at that altitude, water can’t get hot enough to purify it. So I walked 100 miles back to Katmandu with amoebic dysentery. By the time I got there, I’d lost 50 pounds, taking my weight to 120 pounds.

Jim was an Eagle Scout, the first full-time employee of Recreational Equipment Inc. (REI), and last climbed Everest when he was 61. Today, he is 92 and lives in Seattle, WA.

Jim reaffirms my belief that daily mountain climbing is a great life extension strategy, if not an aphrodisiac.

Mount Everest 1976

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

November 3, 2023

Fiat Lux

Featured Trade:

(NOVEMBER 1 BIWEEKLY STRATEGY WEBINAR Q&A),

(BRK/B), (TSLA), (LLY), (SNOW), (BIB), (BIB), (CCJ), (FXA), (FXB), (FXE), (EEM), (GLD), (SLV) (UNG), (LNG)

Below please find subscribers’ Q&A for the November 1 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Boca Raton.

Q: Earlier you said that the bull market should start from here—are you sticking to that argument?

A: Yes, there are all kinds of momentum and cash flow indicators that are flashing “buy right now.” The market timing index got down to 24—couldn’t break below 20. Hedge fund shorts: all-time highs. Quant shorts: all the time highs, creating a huge amount of buying power for the market. And, of course, the seasonals have turned positive. So yes, all of that is positive and if bonds can hold in here, then it’s off to the races.

Q: Do you have a year-end target for Berkshire Hathaway (BRK/B)?

A: Up. They have a lot of exposure to the falling interest rate trade such as its very heavy weighting in banks; and if interest rates go down, Berkshire goes up—it’s really very simple. You can’t come up with specific targets for individual stocks for year-end because of the news, and things can happen anytime. I love Berkshire; it's a very strong buy here.

Q: Tesla (TSLA) is not doing well; what's the update here?

A: It always moves more than you think, both on the upside and the downside. Last year, we thought it would drop 50%, it dropped 80%. Suffice it to say that, with the price war continuing and Tesla determined to wipe out the 200 other new entrants to the EV space, they’ll keep price cutting until they basically own that market. While that’s great for market share, it’s not great for short-term profits. Yes, Tesla could be going down more, but from here on, if you’re a long-term investor in Tesla, as you should be, you should be looking to add positions, not sell what you have and average down. Also, we’re getting close to Tesla LEAPS territory. Those have been huge winners over the years for us and I’ll be watching those closely.

Q: Any trade on the Japanese yen?

A: We broke 150 on the yen—that was like the make-or-break level. I’m looking at a final capitulation selloff on the yen, and then a decade-long BUY. The Bank of Japan is finally ending its “easy money” zero-interest-rate policy, which it’s had for 30 years, and that will give us a stronger yen when it happens, but not until then. So watch the yen carefully, it could double from here over the long term, especially if it’s the same time the US starts cutting its interest rates.

Q: What do you think about Eli Lilly (LLY)?

A: We love Eli Lilly; they’re making an absolute fortune on their weight loss drug, and they have other drugs in the pipeline being created by AI. This is really the golden age for biotech because you have AI finding cures for diseases, and then AI designing molecules to cure the diseases. It’s shortened the pipeline for new drugs from 5-10 years to 5-10 weeks. If you’re old and sick like me, this is all a godsend.

Q: Do you like Snowflake (SNOW)?

A: Absolutely, yes—killer company. Warren Buffet loves it too and has a big position; I’d be looking to buy SNOW on any dip.

Q: Would you do LEAPS on Netflix (NFLX)?

A: I would, but I would go out two years, and I would go at the money, not out of the money, Even then you’ll get a 100-200% return. You’ll get a lot even on just a 6-month call spread. These tech stocks with high volatility have enormous payoff 3-6 months out.

Q: Projection for iShares 20 Plus Year Treasury Bond ETF (TLT) in the next 6 months?

A: It’s up. We could hit $110, that would be my high, or up $25 points or so from here.

Q: Would you buy biotech here through the ProShares Ultra Nasdaq Biotechnology (BIB)?

A: Probably, yes. The long-term story is overwhelming, but it’s not a sector you want to own when the sentiment is terrible like it is now. I guess “buy the bad news” is the answer there.

Q: What did you learn from your dinner with General Mattis?

A: Quite a lot, but much of it is classified. When you get to my age, you can’t remember which parts are classified and which aren't. However, his grasp of the global scene is just incredible. There are very few people in the world I can go one on one with in geopolitics. Of course, I could fill in stuff he didn’t know, and he could fill in stuff for me, like: what is the current condition of our space weaponry? If I told you, you would be amazed, but then I would get arrested the next day, so I’ll say nothing. He really was one of the most aggressive generals in American history, was tremendously underrated by every administration, was fired by both Obama and Trump, and recently is doing the speaker circuit which is a lot of fun because there’s no question he doesn’t know the answer to! We actually agreed to do some joint speaking events sometime in the future.

Q: I have some two-year LEAPS now but I’m worried about adding too much. Could we get a final selloff in 2024?

A: The only way we could get another leg down in the market is number one if the Fed raises interest rates (right now, we’re positioned for a flat line and then a cut) or number two, another pandemic. You could also get some election-related chaos next year, but that usually doesn’t affect the market. But for those who are prone to being nervous, there are certainly a lot of reasons to be nervous next year.

Q: What iShares 20 Plus Year Treasury Bond ETF (TLT) level would we see with a 5.2% yield?

A: How about $79? That’s exactly why I picked that strike price. The $76-$79 vertical bill call spread in the (TLT) is a bet that we don’t go above 5.20% yield, and we only have 10 days to do it, so things are looking better and then we’ll see what’s available in the market once our current positions all expire at max profit.

Q: The first new nuclear power plant of 30 years went online in Georgia. Do you see more being built in the future?

A: It’s actually been 40 years since they’ve built a new plant, and it wasn’t a new plant, it was just an addition to an existing plant with another reactor added with an old design. I think there will be a lot more nuclear power plants built in the future, but they will be the new modular design, which is much safer, and doesn’t use uranium, by the way, but other radioactive elements. If you want to know more about this, look up NuScale (SMR). They have a bunch of videos on how their new designs work. That could be an interesting company going forward. The nuclear renaissance continues, and of course, China’s continuing to build 100 of the old-fashioned type nuclear power reactors, and that is driving global uranium demand.

Q: Would you hold Cameco Corp (CCJ) or sell?

A: I would keep it, I think it’s going up.

Q: How to trade the collapse of the dollar?

A: (FXA), (FXB), (FXE), and (EEM). Those are the quick and easy ways to do it. Also, you buy precious metals—gold (GLD) and silver (SLV) do really well on a weak dollar.

Q: Conclusion on the Ukraine war?

A: It will go on for years—it’s a war of attrition. About half of the entire Russian army has been destroyed as they’re working with inferior weapons. However, it’s going to be a matter of gaining yards or miles at best, over a long period of time. So, they will keep fighting as long as we keep supplying them with weapons, and that is overwhelmingly in our national interest. Plus, we’re getting a twofer; if we stop Russia from taking over Ukraine, we also stop China from invading Taiwan because they don’t want to be in for the same medicine.

Q: If more oil is released from the strategic petroleum reserve, what is our effect on security?

A: Zero because the US is a net energy producer. If our supplies were at risk, all we’d have to do is cut off our exports to China and tell them to find their oil elsewhere—and they’re obviously already trying to do that with the invasion of the South China Sea and all the little rocks out there. So, I am not worried. And also remember, every year as the US moves to more EVs and more alternatives, it is less and less reliant on oil. I would advise the administration to get rid of all of it next time we go above $100 a barrel. If you’re going to sell your oil, you might as well get a good price for it. If you look at the US economy over the last 30 years, the reliance of GDP on oil has been steadily falling.

Q: Are US exports of Cheniere Energy (LNG) helping to drive up prices here?

A: I would say yes, it’s got to have an impact on prices. We’re basically supplying Germany with all of its natural gas right now. We did that starting from scratch at the outset of the Ukraine war, and it’s been wildly successful. That avoided a Great Depression in Europe. Europe, by the way, is the largest customer for our exports. That was one of the arguments for us going into the United States Natural Gas (UNG) LEAPS in the first place.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2023 Krakow Poland

Global Market Comments

November 2, 2023

Fiat Lux

Featured Trade:

(THE SECOND AMERICAN INDUSTRIAL REVOLUTION),

(INDU), (SPY), (QQQ), (GLD), (DBA),

(TSLA), (GOOGL), (XLK), (IBB), (XLE)

(TESTIMONIAL)

Circulating among the country’s top global strategists this year, visiting their corner offices, camping out in their vacation villas, or cruising on their yachts, I am increasingly hearing about a new investment theme that will lead markets for the next 20 years:

The Second American Industrial Revolution.

It goes something like this.

You remember the first Industrial Revolution, don’t you? I remember it like it was yesterday.

It started in 1775 when a Scottish instrument maker named James Watt invented the modern steam engine. Originally employed for pumping water out of a deep Shropshire coalmine, within 32 years it was powering Robert Fulton’s first commercially successful steamship, the Clermont, up the Hudson River.

The first Industrial Revolution enabled a massive increase in standards of living, kept inflation near zero for a century, and allowed the planet’s population to soar from 1 billion to 7 billion. We are still reaping its immeasurable benefits.

The Second Industrial Revolution is centered on my own neighborhood of San Francisco. It seems like almost every garage in the city is now devoted to a start-up.

The cars have been flushed out onto the streets, making urban parking here a total nightmare. These are turbocharging the rate of technological advancement.

Successes go public rapidly and rake in billions of dollars for the founders overnight. Thirty-year-old billionaires wearing hoodies are becoming commonplace.

However, unlike with past winners, these newly minted titans of industry don’t lock their wealth up in mega mansions, private jets, or the Treasury bond market. They buy a Tesla Plaid for $150,000 with a great sound system and full street-to-street auto-pilot (TSLA), and then reinvest the rest of their windfall in a dozen other startups, seeking to repeat a winning formula.

Many do it.

Thus, the amount of capital available for new ideas is growing by leaps and bounds. As a result, the economy will benefit from the creation of more new technology in the next ten years than it has seen in the past 200.

Computing power is doubling every year. That means your iPhone will have a billion times more computing power in a decade. 3D printing is jumping from the hobby world into large-scale manufacturing. In fact, Elon Musk’s Space X is already making rocket engine parts on such machines.

Drones came out of nowhere and are now popping up everywhere.

It is not just new things that are being invented. Fantastic new ways to analyze and store data, known as “big data” are being created.

Unheard new means of social organization are appearing at breakneck, leading to a sharing economy. Much of the new economy is not about invention, but organization.

The Uber ride-sharing service created $50 billion in market capitalization in only five years and is poised to replace UPS, FedEx, and the US Postal Service with “same hour” intracity deliveries. Now they are offering “Uber Eats” in my neighborhood, which will deliver you anything you want to eat, hot, in ten minutes!

Airbnb is arranging accommodation for 1 million guests a month. They even had 189 German guests staying with Brazilians during the World Cup there. I bet those were interesting living rooms on the final day! (Germany won).

And you are going to spend a lot of Saturday nights at home, alone if you haven’t heard of Match.com, eHarmony.com, or Badoo.com.

“WOW” is becoming the most spoken word in the English language. I hear myself saying I every day.

Biotechnology (IBB), an also-ran for the past half-century, is sprinting to make up for lost time. The field has grown from a dozen scientists in my day 40 years ago, to several hundred thousand today.

The payoff will be the cure for every major disease, like cancer, Parkinson’s, heart disease, AIDS, and diabetes, within ten years. Some of the harder cases, such as arthritis, may take a little longer. Soon, we will be able to manipulate our own DNA, turning genes on and off at will. The weight loss drugs Wegovy and Ozempic promise to eliminate 75% of all self-inflicted illnesses.

The upshot will be the creation of a massive global market for these cures, generating immense profits. American firms will dominate this area, as well.

Energy is the third leg of the innovation powerhouse. Into this basket, you can throw in solar, wind, batteries, biodiesel, and even “new” nuclear (see NuScale (SMR)). The new Tesla Powerwall will be a game changer. Visionary, Elon Musk, is ramping up to make tens of millions of these things.

Use of existing carbon-based fuel sources, such as oil and natural gas, will become vastly more efficient. Fracking is unleashing unlimited new domestic supplies.

Welcome to “Saudi America.”

The government has ordered Detroit to boost vehicle mileage to an average of 55 miles per gallon by 2030. The big firms have all told me they plan to beat that deadline, not litigate it, a complete reversal of philosophy.

Coal will be burned in impoverished emerging markets only, before it disappears completely. Energy costs will drop to a fraction of today’s levels, further boosting corporate profits.

Coal will die, not because of some environmental panacea, but because it is too expensive to rip out of the ground and transport around the world, once you fully account for all its costs.

Years ago, I used to get two pitches for venture capital investments a quarter, if any. Now, I am getting two a day. I can understand only half of them (those that deal with energy and biotech, and some tech).

My friends at Google Venture Capital are getting inundated with 20 a day each! How they keep all of these stories straight is beyond me. I guess that’s why they work for Google (GOOGL).

The rate of change for technology, our economy, and for the financial markets will accelerate to more than exponential. It took 32 years to make the leap from steam engine-powered pumps to ships and was a result of a chance transatlantic trip by Robert Fulton to England, where he stumbled across a huffing and puffing steam engine.

Such a generational change is likely to occur in 32 minutes in today’s hyper-connected world, and much shorter if you work on antivirus software (or write the viruses themselves!). And don’t get me started on AI!

The demographic outlook is about to dramatically improve, flipping from a headwind to a tailwind in 2022. That’s when the population starts producing more big spending Gen Xers and fewer over-saving and underproducing baby boomers. This alone should be at least 1% a year to GDP growth.

China is disappearing as a drag on the US economy. During the nineties and the naughts, they probably sucked 25 million jobs out of the US.

With an “onshoring” trend now in full swing, the jobs ledger has swung in America’s favor. This is one reason that unemployment is steadily falling. Joblessness is becoming China’s problem, not ours.

The consequences for the financial markets will be nothing less than mind-boggling. The short answer is higher for everything. Skyrocketing earnings take equity markets to the moon. Multiples blast off through the top end of historic ranges. The US returns to a steady 5% a year GDP growth, which it clocked in the recent quarter.

What am I bid for the Dow Average (INDU), (SPY), (QQQ) in ten years? Did I hear 240,000, a seven-fold pop from today’s level? Or more?

Don’t think I have been smoking the local agricultural products from California in arriving at these numbers. That is only half the gain that I saw from 1982 to 2000, when the stock average also appreciated 17-fold, from 600 to 10,000.

They’re playing the same movie all over again. Except this time, it’s on triple fast forward.

There will also be commodities (DBA) and real estate booms. Even gold (GLD) gets bid up by emerging central banks bent in increasing their holdings to Western levels as well as falling interest rates.

I tell my kids to save their money, not to fritter it away day trading now because anything they buy in 2020 will increase in value tenfold by 2033. They’ll all look like geniuses like I did during the eighties.

What are my strategist friends doing about this forecast? They are throwing money into US stocks with both bands, especially in technology (XLK), biotech (IBB), and bonds (JNK).

This could go on for decades.

Just thought you’d like to know.

It’s Amazing What You Pick Up on These Things!

Hello John,

I find your multi dimensional approach to markets are devoid of the usual Blah Blah Blah of most market analysts. It is very worthwhile, and I look forward to you using a lot of common sense and awareness.

That being said, regarding myself : I started trading gold in the late sixties and bought my first seat IMM at the CME in 1975 to trade currencies. I Mostly trade in sterling and yen. I had private tutoring on technical analysis on my day off from my regular job (which I love and still do).

Thanks for all you do.

Robert

Northfield, Illinois

2023 in Bucha Ukraine

'Nowadays, people know the price of everything and the value of nothing,' said Irish playwright, poet, and novelist, Oscar Wilde.

Global Market Comments

November 31, 2023

Fiat Lux

Featured Trade:

(WHERE THE ECONOMIST BIG MAC INDEX FINDS CURRENCY VALUE),

(FXF), (FXE), (FXA), (FXE), (CYB)

(THE FALLING MARKET FOR KIDS)

With interest rates and inflation topic number one of the day, everyone has their favorite inflation indicator. The Fed has its, you have yours, and well, I have mine.

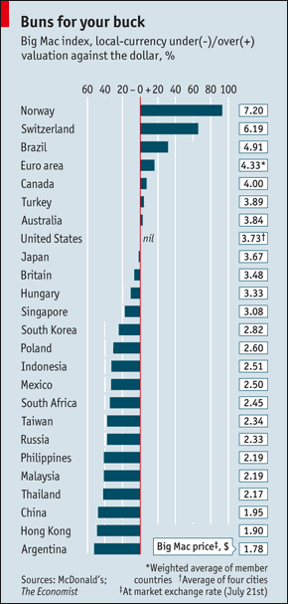

My former employer, The Economist, once the ever-tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its “Big Mac” index of international currency valuations.

Although initially launched as a joke four decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald’s (MCD) premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation.

What are its conclusions today? The Swiss franc (FXF), the Brazilian real, and the Euro (FXE) are overvalued, while the the Chinese Yuan (CYB), and the Thai Baht are cheap.

I couldn’t agree more with many of these conclusions. It’s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas.

I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my hip. Better to use it as an economic forecasting tool, than a speedy lunch.