I’m not in favor of breaking up the large banks. But if push comes to shove and there is no other way to eliminate the “too big to fail” problem, which is getting worse, and not better, I would be in favor of breaking up the big banks,” said former Federal Reserve chairman, Alan Greenspan.

Global Market Comments

April 6, 2023

Fiat Lux

Featured Trade:

(REITERATION OF MY $1,000 TARGET)

(TSLA)

CLICK HERE to download today's position sheet.

When I heard that the February 28 Tesla Investors Day in Austin, TX was boring, I was highly suspicious. I thought that might be a journalist’s snap judgment with a strong background in creative writing.

Engineers and scientists might have a different take, I thought. So, I listened to the entire 3 ½ hours and copied all the important charts.

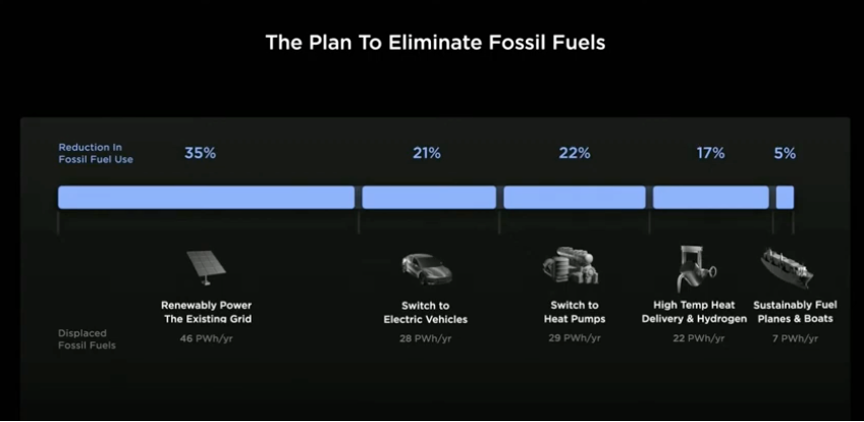

What I heard was nothing less than earth-shaking, groundbreaking, and revolutionary, and won’t cost more than we would spend otherwise. All we have to do is spend more intelligently.

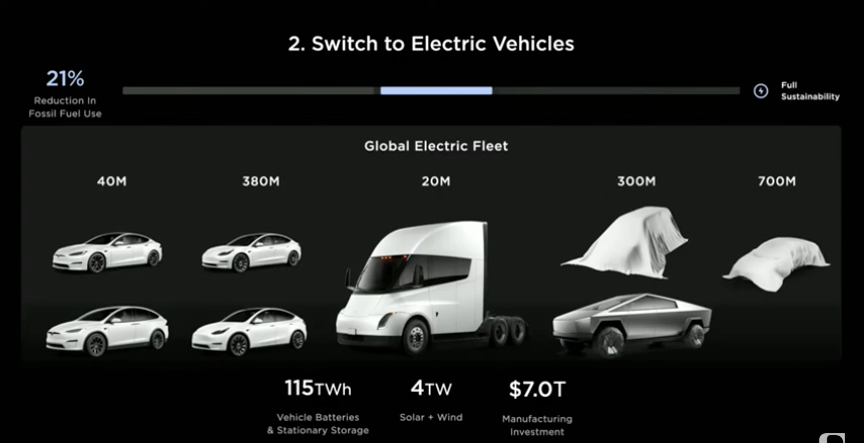

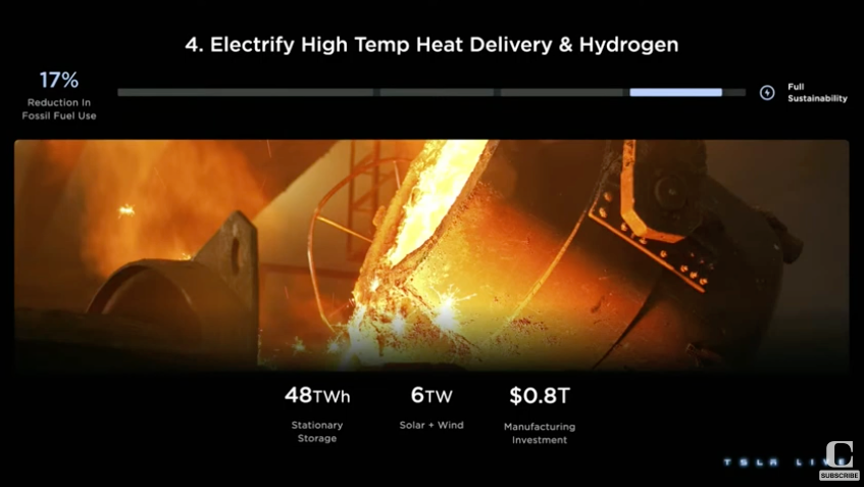

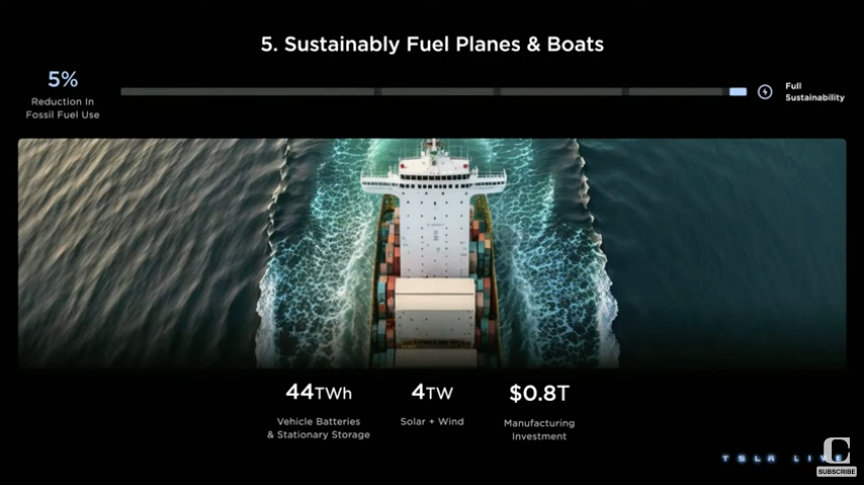

Elon Musk unveiled his Master Plan 3 and unleashed a cornucopia of new data which only an immense amount of research can produce. This will require all forms of transportation to be electric powered within 20 years, except for interplanetary rockets.

As anyone who has been through an advanced physics course can tell you, internal combustion engines are woefully inefficient, converting only 25% of their energy into forward motion, and 20% if you include materials energy costs. But then, that was the best the 19th century could do and it worked for 151 years (Nicolaus Otto built the first gasoline-powered internal combustion engine in Germany in 1872).

Electric motors in Teslas operate closer to a 50% efficiency rating, cutting energy demand by half right there.

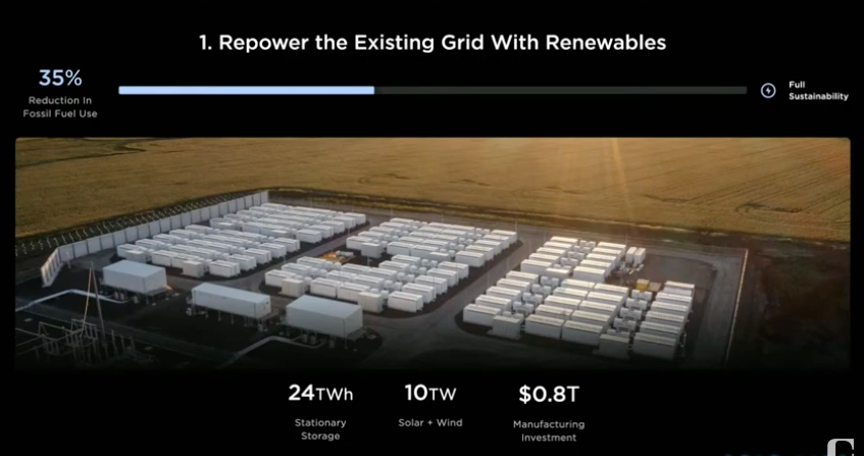

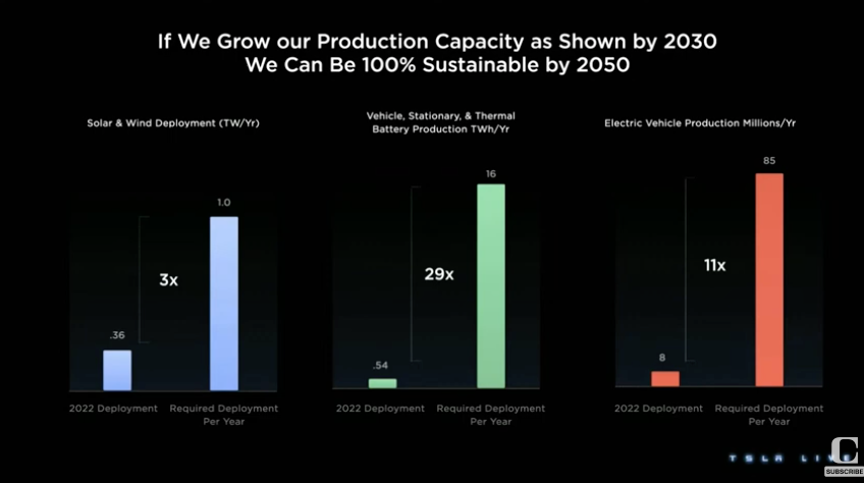

To move the world to an all-electric economy will cost about $10 trillion, or about 10% of world GDP. Average that out at 0.5% per year and it will take about 20 years. Adding up car and storage batteries, that means 24 terawatts worth of batteries will need to be manufactured. There are one trillion watts per terawatt.

By comparison, the sun produces 1 gigawatt of energy per square kilometer per day, or 509,600 terawatts. That means an all-electric economy dependent on batteries equivalent to less than 0.1% of the sun’s daily output. In other words, it’s miniscule.

In fact, the world is already decarbonizing far faster than people realize.

There are currently 2 billion cars and trucks in the world, 85 million a year are manufactured, and some 16 million in the US. Global EV production came to 10.6 million vehicles in 2022, an increase of 22%.

Some 60% of new electricity generation installed last year came from alternatives. That’s because in terms of power output alternatives are 40% cheaper than oil, coal, or natural gas. That’s being generous as it does not include the health care costs of carbon-based energy, which make several hundred thousand people per year ill in the US alone (asthma, lung cancer, etc.).

This means that a heck of a lot of lithium is going to be needed. Soft, white lithium is number three on the periodic table (you’re talking to a chemist here), is a great oxidizer, and is anything but rare. What IS rare? Environmental controls and cheap labor.

This is why the bulk of lithium is produced by China and South America where it literally sits on the surface. This is all easily scalable to meet future demand. In fact, moving to an alternatives-based world uses far less mining than the existing conventional one.

The shortage is not in lithium supply but in lithium processing. The world’s largest lithium consumer should know. Musk recently announced they would move into lithium processing.

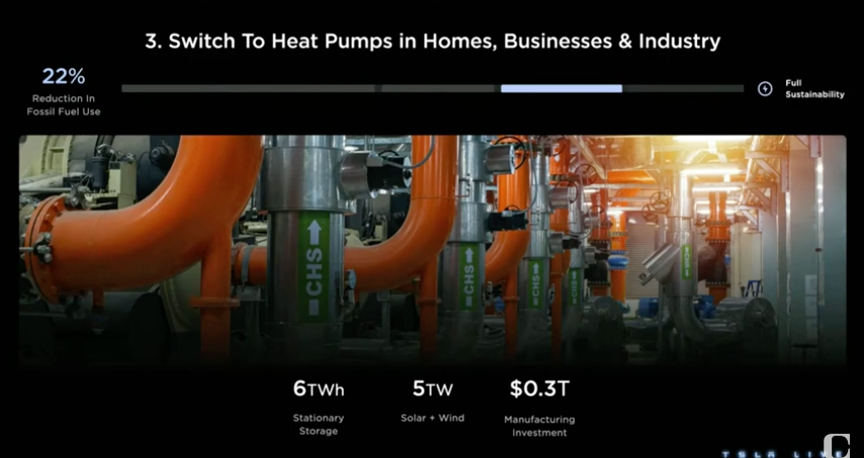

Home heating is another challenge. Existing heat pumps, which I have, do a great job heating in winter and cooling in summer in southern and western states where the weather is mild. These use only one-third of the energy used to heat homes with oil and natural gas. States facing subzero temperatures are another story. This problem can be solved with a fundamental redesign of the heat pump hardware.

Here was a big surprise for me. EVs are not going to create an exponential demand for lithium. Once you get up to a total installed base of 40 million batteries, recycling becomes the primary source of lithium as batteries age out. They can then be reprocessed into new batteries. This eventually caps lithium demand. Future cars will use far less silicon carbide, further reducing its demand by 75%, saving $1,000 a car.

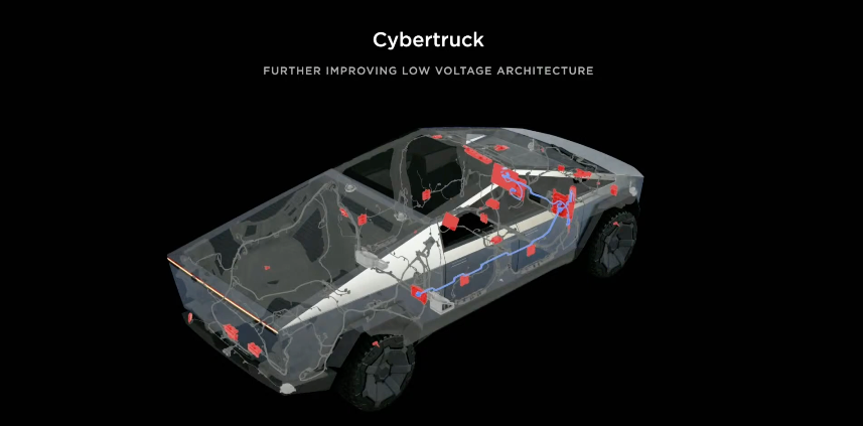

Musk is dumping the traditional 12-volt lead acid battery all Teslas have now which accounts for 87% of all start failures. Instead, he is adding a second small lithium-ion one and redesigning the electrics to take 48 volts. This means lighter weight cables can handle more power at less cost. Musk hopes to force the entire auto industry to move to a 48-volt standard, which should have been done decades ago.

The world’s 4 million Teslas now drive 123 million miles a day and represent the largest AI neural network on the planet. If a car in Florida makes a left turn, all the cars in the rest of the country learn from that experience.

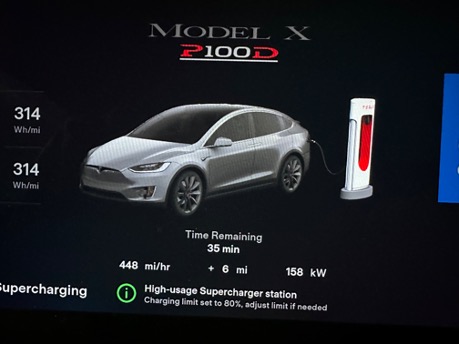

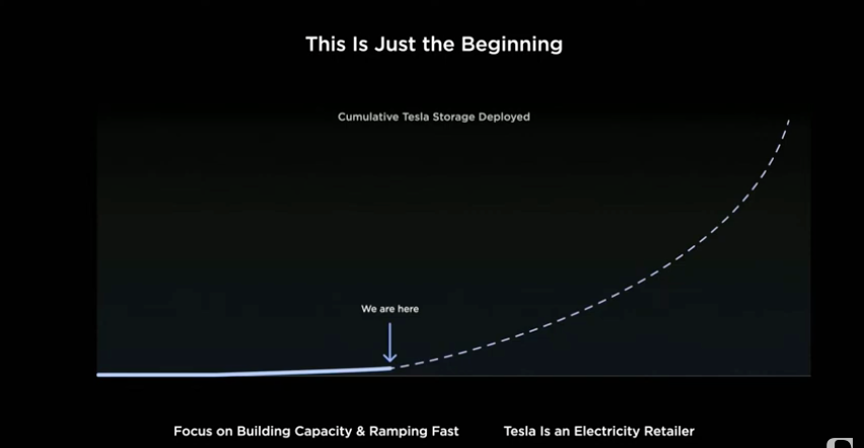

Tesla now has 80,000 chargers in the US, including 40,000 superchargers, which can charge up 450 miles per hour and give you a full charge in 40 minutes. Tesla charged cars with 7 terawatts of power in 2022 and per kilowatt costs have dropped by 40%, with charge times down 30%. Tesla is well on its way to becoming the largest electric power utility in the United States.

Tesla’s current manufacturing capacity is 2 million cars a year across four factories (Fremont, CA, Austin, TX, Berlin, Germany, and Shanghai, China). While it took Tesla 12 years to make its first million vehicles, the 4th million took only seven months. As of today, it is cheaper to own a Tesla than the world’s biggest selling car, the Toyota Corolla, given their total lifetime costs. Work out the cost of charging a Tesla and you are paying the equivalent of 25 cents a gallon for gasoline unless you are at my house, in which case it is free.

The Gigafactory in Sparks, NV, which mass produces lithium-ion battery packs, is currently being doubled in size. In Texas, Tesla is buying wind power from the grid and offering Tesla owners a flat rate for charging of $30 a month because the cost is so low.

There are great hopes for the Cybertruck, for which Tesla has 1.5 million orders, myself included. The final price for the three-motor version will be about $100,000, the same as for a model X. The Cybertruck will have a brand new third-generation platform on which all future Tesla models will be based. It will also include the 48-volt electrical design.

Tesla’s price cuts have been wildly successful, allowing it to gain market share at its competitors' expense. Tesla is really just passing on the recent collapse in commodity prices. So far in 2023, Lithium prices have fallen by 20% and copper 15%. Tesla prices will continue to fall, especially when the new $25,000 Model 2 is brought to market in 2024. That will really decimate the competition.

Tesla has also taken the plunge into the insurance industry, charging drivers on their actual driving history, which they already collect. If you drive like a little old lady, it can run as little as $180 a month. If you drive like Mad Max, it’s more, but not as much as a conventional car insurance company.

Rates change monthly depending on your driving record. Parked in a garage gives you a perfect score of 90 and it drops from there. It’s all about reducing the total cost of a Tesla car. Not such a bad deal if you let their computer do all the driving.

What will Tesla disrupt next?

All in all, it was a breathtaking presentation, which Elon delivered coolly and calmly. It is with the greatest enthusiasm that I reiterate my $1,000 per share price target.

To watch the Tesla Investor Day in its entirety on YouTube, please click here.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 5, 2023

Fiat Lux

Featured Trade:

(THE CODER BOOM)

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD)

(AAPL)

CLICK HERE to download today's position sheet.

For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted a training video on How to Execute a Vertical Bull Call Spread.

This is a matched pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down a small amount in price over a defined limited period of time.

It is the perfect position to have onboard during markets that have declining or low volatility, much like we experienced in 2014, and will almost certainly see again.

I have strapped on quite a few of these across many asset classes this year, and they are a major reason why I am showing positive performance numbers for 2016.

To understand this trade, I will use the example of an Apple trade, which I executed on July 10, 2014. I then felt very strongly that Apple shares would rally into the release of its new iPhone 6 on September 9, 2014.

The same play kicked in again for the iPhone 12 release last October.

So followers of my Trade Alert service received text messages and emails to add the following position:

Buy the Apple (AAPL) August 2014 $85-$90 in-the-money bull call spread at $4.00 or best

To accomplish this, they had to execute the following trades:

Buy 25 August 2014 (AAPL) $85 calls at...............$9.60

Sell short 25 August 2014 (AAPL) $90 calls at......$5.60

Net Cost:...............................................................$4.00

This gets traders into the position at $4.00, which cost them $10,000 ($4.00 per option X 100 shares per option contract X 25 contracts).

The vertical part of the description of this trade refers to the fact that both options have the same underlying security (AAPL), the same expiration date (August 15, 2014) and only different strike prices ($85 and $90).

The breakeven point can be calculated as follows:

$85.00 - Lower strike price

+$4.00 - Price paid for the vertical call spread

$89.00 - Break even Apple share price

Another way of explaining this is that the call spread you bought for $4.00 is worth $5.00 at expiration on August 15, giving you a total return of 25% in 26 trading days. Not bad!

The great thing about these positions is that your risk is defined. You can't lose any more than the amount of capital you put up, in this case, $10,000.

If Apple goes bankrupt, we get a flash crash, or suffer another 9/11 type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like spreads so much.

As long as Apple traded at or above $89 on the August 14 expiration date, you would have made a profit on this trade.

As it turns out, my read on Apple shares proved dead-on, and the shares closed at $97.98 on expiration day or a healthy $8.98 above my breakeven point.

The total profit on the trade came to:

($1.00 profit X 100 shares X 25 contracts) = $2,500

This means that the position earned a 25% profit on your $10,000 investment in a little more than a month. Now you know why I like Vertical Bull Call Spreads so much. So do my followers.

Occasionally, these things don't work and wheels fall off. As hard as it may be to believe, I am not infallible.

So, if I'm wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a lot, you will lose money. On those rare occasions when that happens, I'll shoot out a Trade Alert to you with stop-loss instructions before the damage gets out of control.

That stop loss is usually at the lower strike price when there is still a lot of time to run to expiration, as the position still has a lot of time value remaining, and the upper strike price when there are only a few days left until expiration.

The most I have ever lost on paper with one of these vertical bull call spreads was 50% of my capital, or $5,000 on a $10,000 investment. That’s because the trade was with both long and short options which maintain time value, no matter what the market does. I also never put more than 10% of my portfolio into a single position, so the paper loss on the entire capital was only 5%.

But that was on one of the worst days in market history when the Dow Average opened down 1,300 points. As it turned out, I kept my position and ended up making the maximum profit by expiration day.

To watch the video edition of How to Execute a Vertical Bull Call Spread, complete with more detailed instructions on how to execute the position with your own online platform, please click here.

Vertical Bull Call Spreads Are the Way to Go in a Crazily Oversold Market

“If Carnival Cruise Lines (CCL) can raise $4 billion in the debt markets, why can’t American (AA) or United (UAL) do the same? Why stick it to the taxpayer?” asked my old friend, famed short-seller Jim Chanos.

Global Market Comments

April 4, 2023

Fiat Lux

Featured Trade:

(Trade Alert - (TLT) LEAPS – BUY)

(TLT)

CLICK HERE to download today's position sheet.

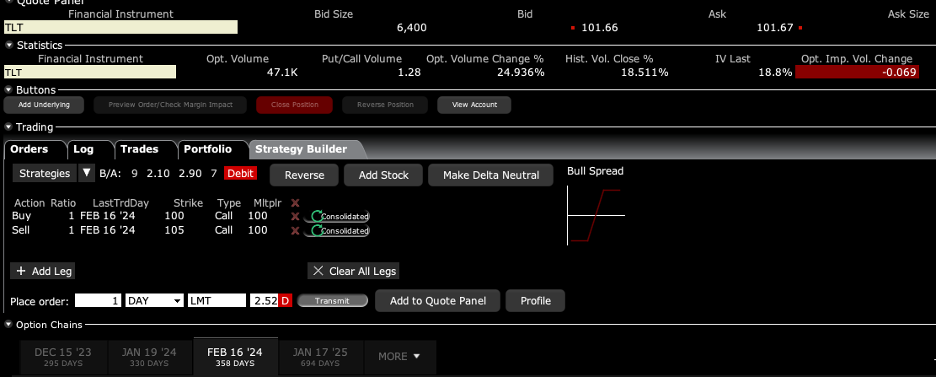

BUY the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call spread LEAPS at $2.50 or best

Opening Trade

4-4-2023

expiration date: February 16, 2024

Number of Contracts = 1 contract

A $10 selloff in the (TLT) is a great entry point for a LEAPS. This is a gift from the US House of Representatives which is threatening to throw the entire government bond market into default by summer.

If you are a trader, default threats are where you BUY bonds.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is a double in little more than a year. That is the probability that (TLT) shares will rise by only 3.32% over the next 12 months.

The logic behind this LEAPS is fairly simple.

After keeping interest rates too low for too long, then raising them too far too fast, what does the Fed do next? It then lowers interest rates too far too fast. In other words, a mistake-prone Jay Powell will keep on making mistakes. That’s what you get with a Fed chair who only has a degree in political science.

The rate of interest rate rises has been the most rapid in history and is certain to trigger a recession in 2023. When the recession hits, demand for money will dry up and interest rates will collapse. Yields on ten-year US Treasury bonds that bottomed at 0.32% in 2020 and reached a peak of 4.46% in October will easily fall back down to 2.50% by the time this LEAPS matures. That’s where we were last April and will take the (TLT) at least back up to $120.

I am using the very conservative $100-$105 strike price in case bonds continue bouncing along a bottom before turning in a few months. If a double in a year is not enough for you, perhaps you should consider another line of business.

I am therefore buying the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call spread LEAPS at $2.50 or best.

Don’t pay more than $3.00 or you’ll be chasing on a risk/reward basis.

I am going out to only a February 16, 2024 expiration because I think this trade will work fairly quickly with a 2023 recession, even a mild one.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call spread LEAPS at $2.50 or best are showing a bid/offer spread of $2.00-$3.00, which is typical. Enter an order for one contract at $2.00, another for $2.10, another for $2.20 and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if the (TLT) does NOT rise by 3.32% in 12 months, the value of your investment goes to zero. The way to play this is to buy LEAPS in ten different names. If one out of ten increases ten times, you break even. If two of ten work, you double your money, and if only three of ten work, you triple your money.

You never should have a position that is so big that you can’t sleep at night, or worse, need to call John Thomas asking if you should sell at a market bottom.

There is another way to cash in. Let’s say we get half of your double in the next three months which, from these low levels, is entirely possible. Then you could earn half of the maximum potential profit in months. You can decide whether to keep the threefold return or go for the full five bagger. It’s a nice problem to have.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 3.32% rise in (TLT) shares will generate a 100% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 30:1 across the $100-$105 space.

If you want to get more aggressive, you can buy the United States Treasury Bond Fund (TLT) February 2024 $115-$120 out-of-the-money vertical Bull Call spread LEAPS for $1.00, giving you a potential profit of 400%. I can do this trade and sleep at night. I’m not so sure about you.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that the (TLT) will not fall below $105 by the February 16, 2024 options expiration in 10 months.

Here are the specific trades you need to execute this position:

Buy 1 February 2024 (TLT) $100 calls at…………..………$7.00

Sell short 1 February 2024 (TLT) $105 calls at…..………$4.50

Net Cost:………………………….………..…..........……….….....$2.50

Potential Profit: $5.00 - $2.50 = $2.50

(1 X 100 X $2.50) = $250 or 100% in 10 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

“Our clients used to think in weeks and days. Today, it’s not even hours-- they think in minutes,” said John Schutz of Wells Fargo, the largest financial advisor in Minnesota, with $1.2 billion in assets.

Global Market Comments

April 3, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GOLDILOCKS IS BACK!)

(TSLA), (BAC), (C), (JPM), (IBKR), MS), (BRK/B), (FCX), (TLT)

CLICK HERE to download today's position sheet.